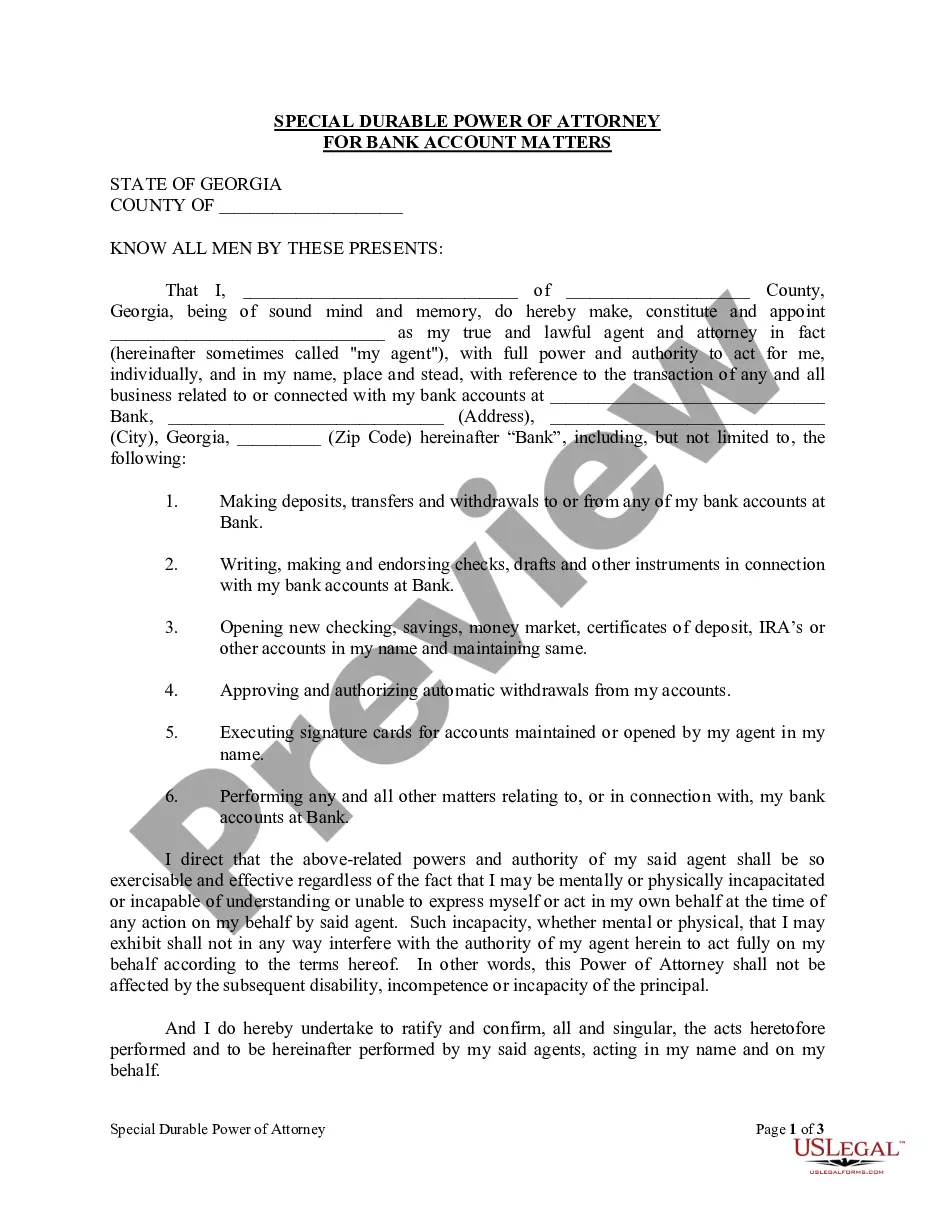

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Form Poa-1

Description

How to fill out Georgia Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your existing US Legal Forms account if you’ve used the service before, making sure your subscription is active. Click the Download button to save the form poa-1 on your device.

- For new users, start by browsing the form descriptions and preview options. Verify that the form poa-1 meets your specific requirements and complies with local laws.

- If you need a different document, use the search bar to locate any other relevant forms that may fulfill your requirements.

- Purchase the necessary document by clicking the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to access the full library.

- Finalize your payment using either credit card details or your PayPal account.

- Download the form poa-1 to your device so you can complete it. It will also be accessible anytime in the My Forms section of your profile.

In conclusion, US Legal Forms not only offers an extensive array of legal forms but also provides access to premium experts for assistance, ensuring that your documents are completed correctly. Whether you're a novice or experienced user, the process is simple and efficient.

Begin your document journey today with US Legal Forms and streamline your legal processes!

Form popularity

FAQ

In Indiana, signing the power of attorney document requires the principal's signature, along with the signature of the agent. While not mandatory, it's beneficial to have the Form poa-1 notarized to strengthen its legality. Additionally, witnesses may be required depending on the specific powers granted, so reviewing the form carefully is vital. Completing these steps ensures your document is recognized by financial and legal institutions.

The easiest way to establish a power of attorney is to use an online legal service like US Legal Forms. Here, you can find Form poa-1 and fill it out swiftly with clear guidance. Make sure to choose an agent whom you trust, and follow the state-specific requirements for signing and notarizing the form. This straightforward approach simplifies the entire process while ensuring legal compliance.

You can obtain a power of attorney form, such as the Form poa-1, through various sources. One reliable option is US Legal Forms, which offers a user-friendly platform to access essential legal documents. With just a few clicks, you can download the necessary form tailored for Indiana. This ensures you have the correct and most up-to-date version.

In Indiana, creating a power of attorney requires a completed Form poa-1, signed by you and your chosen agent. You must be of sound mind when signing the document. Additionally, having the document notarized adds an extra layer of security to ensure its acceptance. It’s crucial that the form clearly outlines the powers granted to the agent.

To give someone power of attorney in Indiana, you need to complete a Form poa-1. This form designates an agent who can act on your behalf regarding financial or legal matters. Both you and your agent must sign the form, and it is recommended to have a notary present to ensure its validity. Once completed, keep this document in a safe place or provide copies to relevant parties.

To file Form 2848 with the IRS, ensure that you have completed the form accurately and signed it. The completed form can be submitted by mail or fax to the appropriate IRS office depending on your location and the type of tax issues involved. For a smoother process, you can also use resources from uslegalforms, which guide you in completing and filing essential forms like Form 2848.

The best person to serve as your power of attorney is someone you trust deeply and who understands your values and preferences. This person should be responsible, reliable, and capable of making decisions on your behalf. Often, individuals choose close family members or friends, but it’s wise to consider their ability to handle financial or medical responsibilities.

Filling out power of attorney paperwork, such as Form POA-1, involves crafting a clear and concise statement that outlines your intentions. Begin by providing the necessary details about yourself and the agent you wish to appoint. It is crucial to sign the document in front of a witness and to keep copies for your records.

Form 2848, known as the Power of Attorney for Tax Matters, is generally required for someone to represent you before the IRS. If you want to delegate authority for tax-related matters, completing Form POA-1 or Form 2848 is essential. However, it is only necessary if you want to formalize representation for tax purposes.

To establish a power of attorney in New Jersey, you need to complete a document that specifies your intentions, often using Form POA-1. This form must be signed by you, the principal, and witnessed by at least one person. Additionally, you may want to consider consulting with a legal expert to ensure everything meets state requirements.