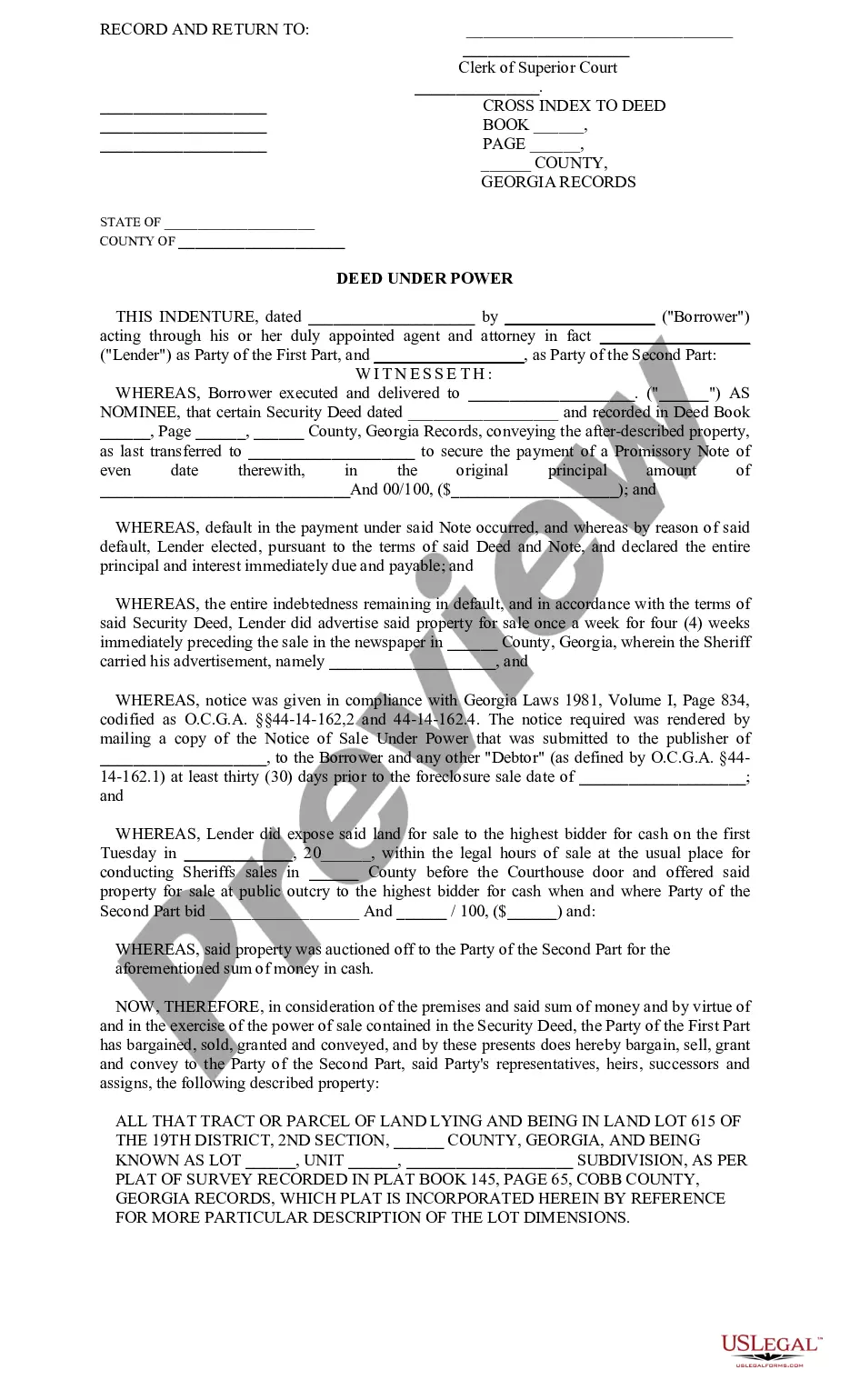

Deed Under Power With A Mortgage

Description

How to fill out Georgia Deed Under Power?

The Deed Under Power With A Mortgage displayed on this page is a versatile legal template crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with more than 85,000 verified, state-specific forms for any business and personal need.

Pick the format you prefer for your Deed Under Power With A Mortgage (PDF, DOCX, RTF) and download the example to your device.

- Search for the document you require and review it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your requirements. If it does not, use the search feature to find the suitable one. Click Buy Now when you have located the template you need.

- Register and Log In.

- Select the subscription plan that fits you and set up an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

A deed under power refers to a legal document that allows a lender to transfer property title if the borrower defaults on their mortgage. This deed provides a means for lenders to recover debts without going through lengthy court processes. Understanding this concept is essential, especially for homeowners dealing with a deed under power with a mortgage.

You must file an Affidavit for Collection of Small Estate with the probate clerk of the circuit court in the county where the deceased last lived.

In Arkansas, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

Arkansas's probate code requires estates to go through probate if the decedent owned property, had minor-aged children, or bequeathed valuable assets to beneficiaries, whether or not they died without a will.

If any of these conditions apply, an estate might be able to avoid probate: Total estate value is less than $100,000 (and all debts, claims and any judgments have been paid) No Personal Representative has already been appointed. There is no petition for an appointment that is pending.

Some ways to avoid probate proceedings in Arkansas include: Using a living trust, Qualify for Arkansas small estate laws, or. Transfer on death designations.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

How to File (4 steps) Complete the Small Estate Affidavit. File at the Local Court. Publish in the Local Newspaper. Submit the Deed of Distribution.