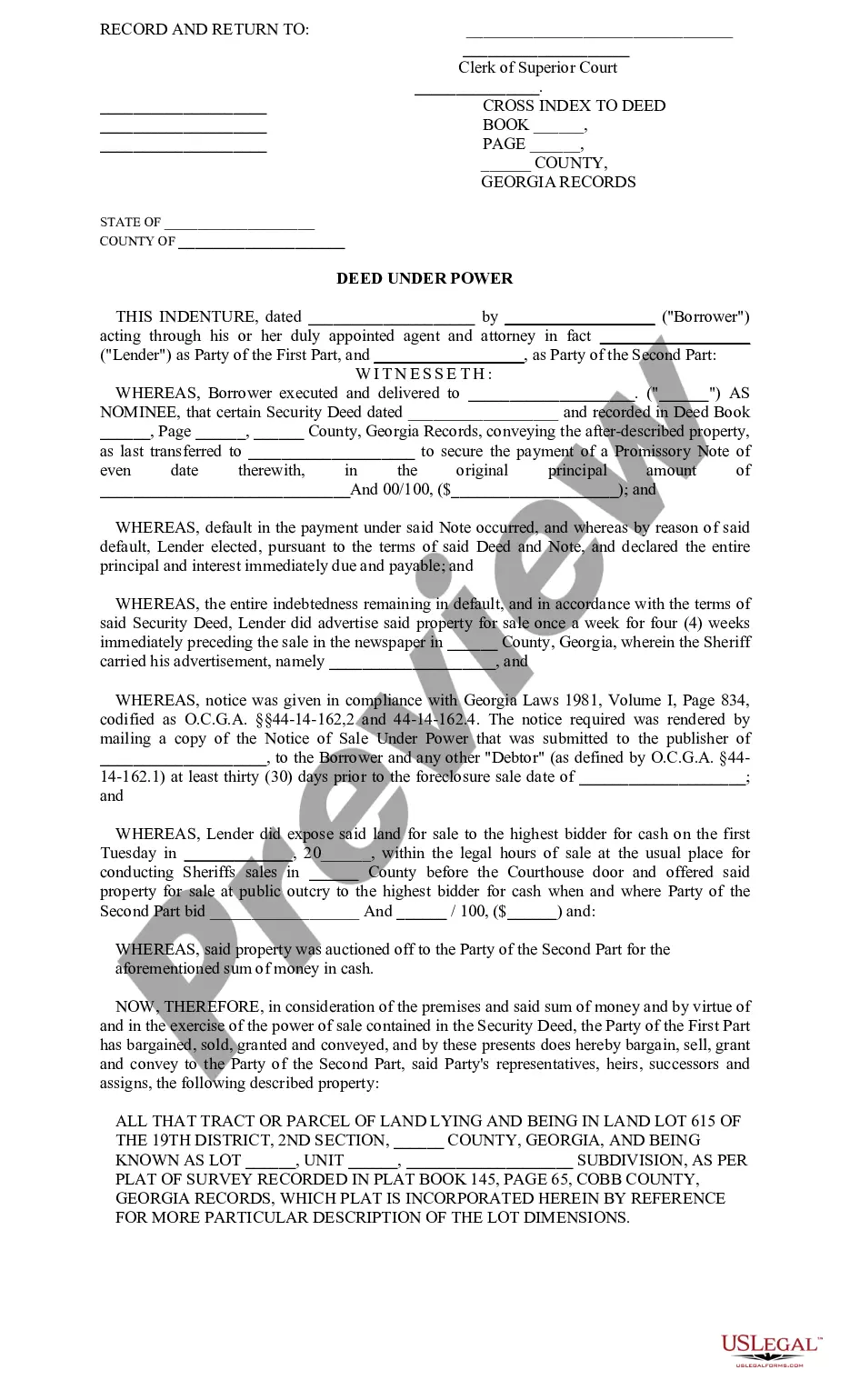

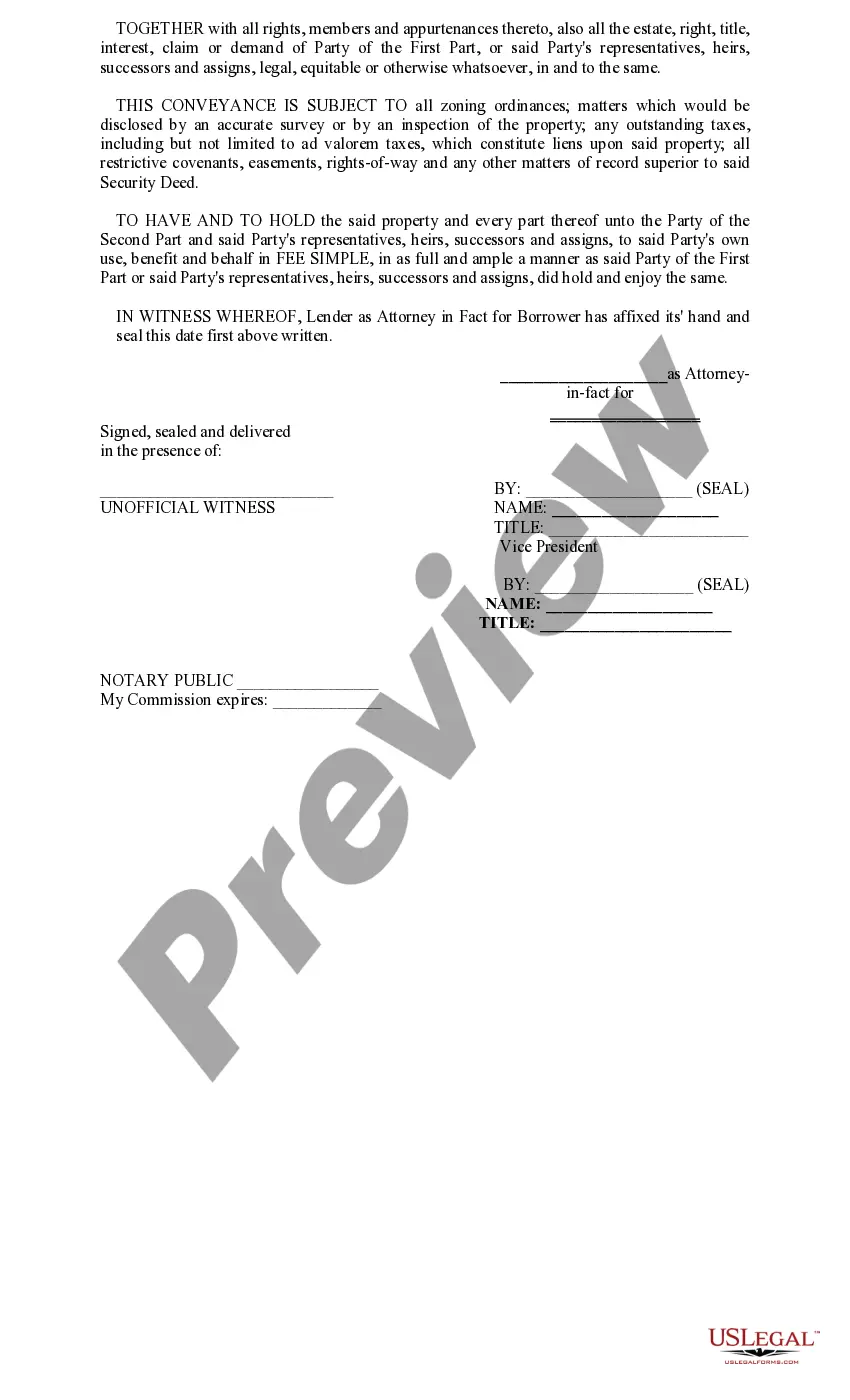

Deed Under Power Of Sale Definition

Description

How to fill out Georgia Deed Under Power?

Obtaining legal document samples that comply with federal and state regulations is essential, and the web provides many choices to select from.

However, why spend time searching for the correct Deed Under Power Of Sale Definition sample online when the US Legal Forms online resource has such documents conveniently gathered in one location.

US Legal Forms boasts the largest digital legal repository with more than 85,000 editable templates created by attorneys for various professional and personal situations. Navigating through the forms is straightforward with all documents organized by state and intended use. Our experts stay informed about legal changes, ensuring that your documents are consistently current and compliant when obtaining a Deed Under Power Of Sale Definition from our platform.

- Evaluate the template using the Preview option or through the text description to confirm it meets your requirements.

- Search for an alternative sample using the search functionality at the top of the page if necessary.

- Select Buy Now once you find the suitable form and choose a subscription plan.

- Create an account or Log In and proceed with payment via PayPal or a credit card.

- Select the appropriate format for your Deed Under Power Of Sale Definition and download it.

Form popularity

FAQ

The term 'deed under power' refers to a type of deed that grants the lender the authority to sell the property without needing court intervention. This legal arrangement typically arises from defaults where the borrower misses payments. It serves as a practical alternative to traditional foreclosures. To gain a complete understanding, familiarize yourself with the deed under power of sale definition on our platform.

There are three common types of businesses?sole proprietorship, partnership, and corporation?and each comes with its own set of advantages and disadvantages. Here's a rundown of what you need to know about each one.

Persons desiring to organize a business entity such as a corporation or partnership in Arkansas must apply to the Arkansas Secretary of State for authority to conduct business or other activities.

Steps to Getting Your Arkansas Business License A business name. An EIN (Employer Identification Number) or SSN (if you're a sole proprietor) A business entity type (LLC, partnership, corporation, etc.) A business address and phone number. A business plan that includes anticipated revenue and expenses.

An overview of the four basic legal forms of organization: Sole Proprietorship; Partnerships; Corporations and Limited Liability Company follows.

4 Types of Legal Structures for Business: Sole Proprietorship. General Partnership. Limited Liability Company (LLC) Corporations (C-Corp and S-Corp)

The three major forms of business in the United States are sole proprietorships, partnerships, and corporations. Each form has implications for how individuals are taxed and resources are managed and deployed.

There are five basic forms of business entities: Sole Proprietorship. Partnership. Corporation. S Corporation. Limited Liability Company?LLC.

The sole proprietorship is the most common form of business organization. One person conducts business for him or herself. A sole proprietorship is not a legal entity. It has no life of its own separate and apart from the owner of the business.