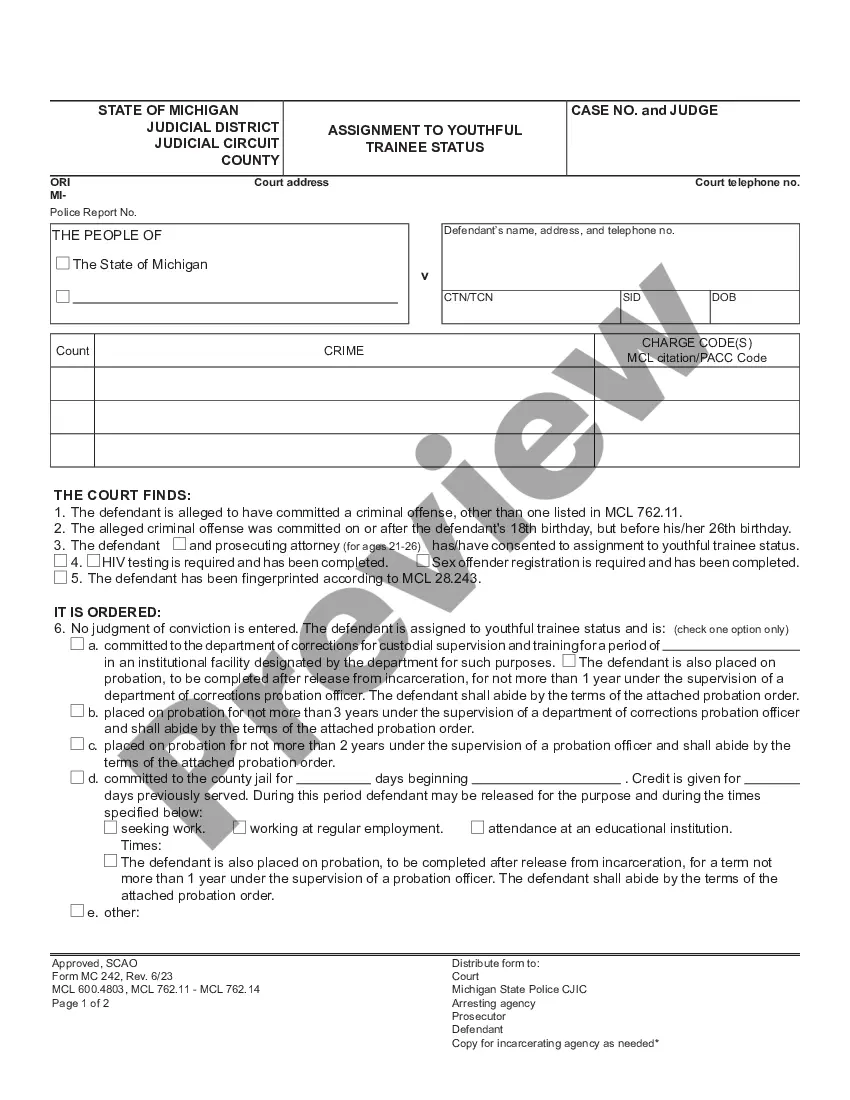

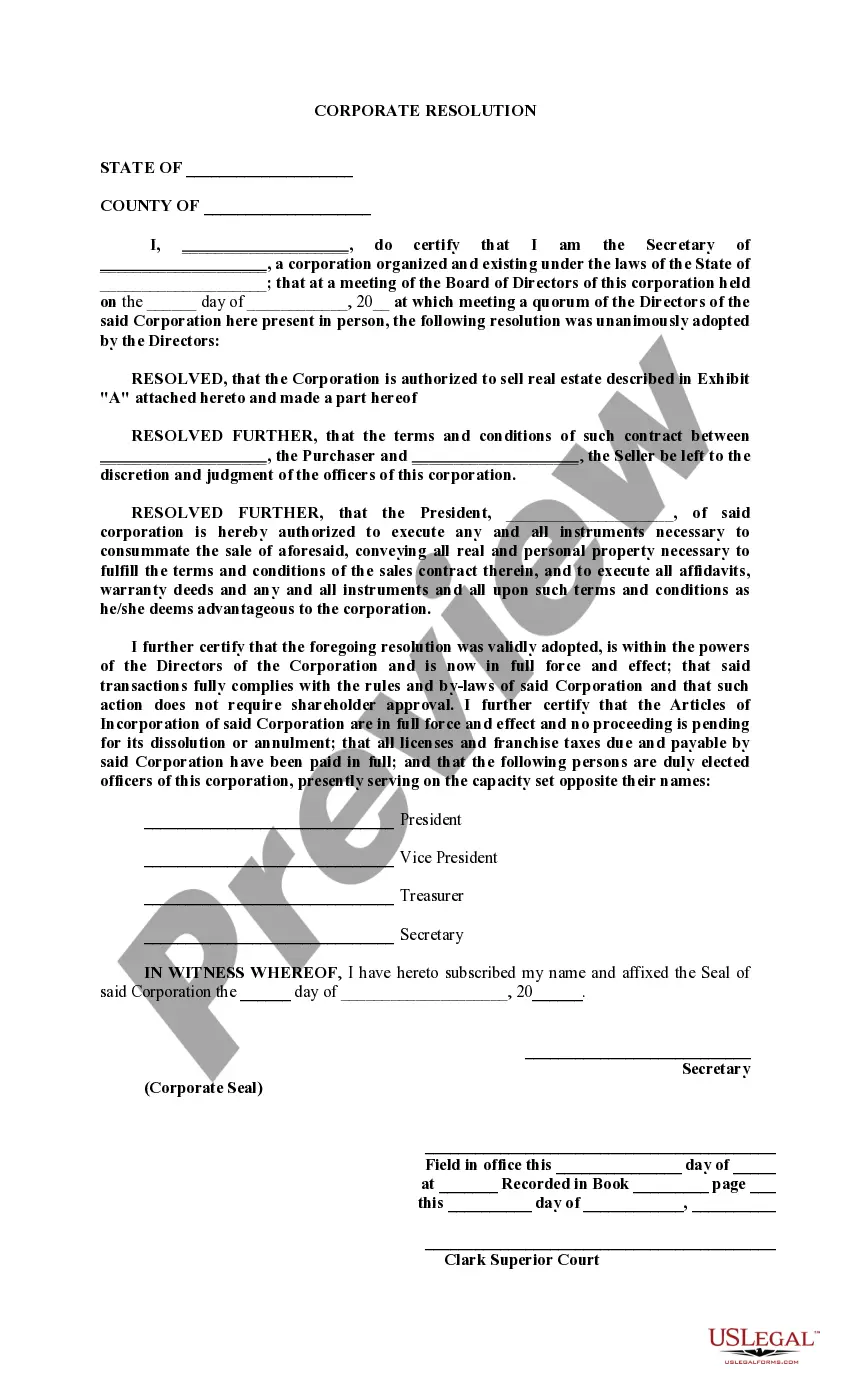

Corporate Resolution Form Georgia With Signature Required

Description

How to fill out Georgia Corporate Resolution?

Establishing a reliable source for the most up-to-date and suitable legal templates is part of the challenge of navigating bureaucracy.

Identifying the appropriate legal document necessitates precision and careful consideration, which is why it is crucial to acquire samples of the Corporate Resolution Form Georgia With Signature Required solely from trustworthy sources, such as US Legal Forms. A flawed template can consume your time and prolong your situation. With US Legal Forms, there is minimal reason for concern. You can access and review all information pertaining to the document's applicability and importance for your case and your jurisdiction.

Eliminate the difficulties associated with your legal documentation. Explore the comprehensive US Legal Forms catalog to discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Review the form’s description to determine if it meets the stipulations of your state and locale.

- Access the form preview, if available, to verify that the form aligns with your expectations.

- Return to the search to find an alternative document if the Corporate Resolution Form Georgia With Signature Required does not meet your needs.

- Once you are confident in the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that suits your requirements.

- Continue to the registration to complete your transaction.

- Conclude your purchase by opting for a payment method (credit card or PayPal).

- Select the file format for downloading the Corporate Resolution Form Georgia With Signature Required.

- Once the form is on your device, you can edit it using the editor or print it to fill out by hand.

Form popularity

FAQ

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

The Executor (or Administrator) of an estate will be supplied with a Fiduciary Probate Certificate (called PC-450), a document from the Probate Court that will evidence that the Executor/Administrator is appointed as such for the estate.

Rule 5 - Self-representation; Representation by Attorney and Appearance Section 5.1 Representation before court (a) A party who is an individual may represent himself or herself without an attorney.

Ing to Title 45a-283, the executor must apply for probate of the deceased person's will within 30 days after the person's death.

1) A proposed fiduciary who resides outside the State of Connecticut or an appointed fiduciary who is moving out of Connecticut uses this form to appoint the probate judge as agent for service of process.

File an application with the appropriate probate court, together with a certified death certificate and the original Will and codicils. The application will list basic information about the decedent, including the beneficiaries under any Will or codicil and all heirs at law.

If the decedent's solely-owned assets include no real property and are valued at less than $40,000 ? which meets Connecticut's ?small estates limit? ? then the assets and property of the estate can be settled without full probate, under a much shorter and easier process.