Sample Petition To Probate Will In Solemn Form Georgia Without A Lawyer

Description

How to fill out Georgia Petition To Probate Will In Solemn Form?

Finding a reliable source to obtain the latest and most suitable legal templates is a significant part of managing bureaucracy.

Identifying the appropriate legal paperwork requires accuracy and meticulousness, which is why it's crucial to source documents like the Sample Petition To Probate Will In Solemn Form Georgia Without A Lawyer only from reputable outlets, such as US Legal Forms. An incorrect template can waste your time and delay the matter at hand.

Once the form is on your device, you can edit it using the provided editor or print it and fill it out manually. Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms catalog to find legal samples, assess their relevance to your situation, and download them right away.

- Utilize the library navigation or search bar to find your template.

- Review the form's details to ensure it meets the criteria of your state and area.

- Check the form preview, if available, to confirm it is the correct document.

- Return to the search to find the suitable document if the Sample Petition To Probate Will In Solemn Form Georgia Without A Lawyer does not fit your needs.

- If you are confident about the form's suitability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the pricing option that meets your requirements.

- Proceed with the sign-up to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Sample Petition To Probate Will In Solemn Form Georgia Without A Lawyer.

Form popularity

FAQ

The petition to probate will in solemn form is used when the deceased has a will and it is the most common probate petition. This probate petition's sole purpose is to ask the probate court for a determination of whether or not the will filed by the petitioner is the last will and testament of the deceased.

The petition to probate in common form will not be binding for four years after it has been completed. Executors appointed through a solemn form probate can petition to be discharged from their liability and responsibilities six (6) months after their appointment.

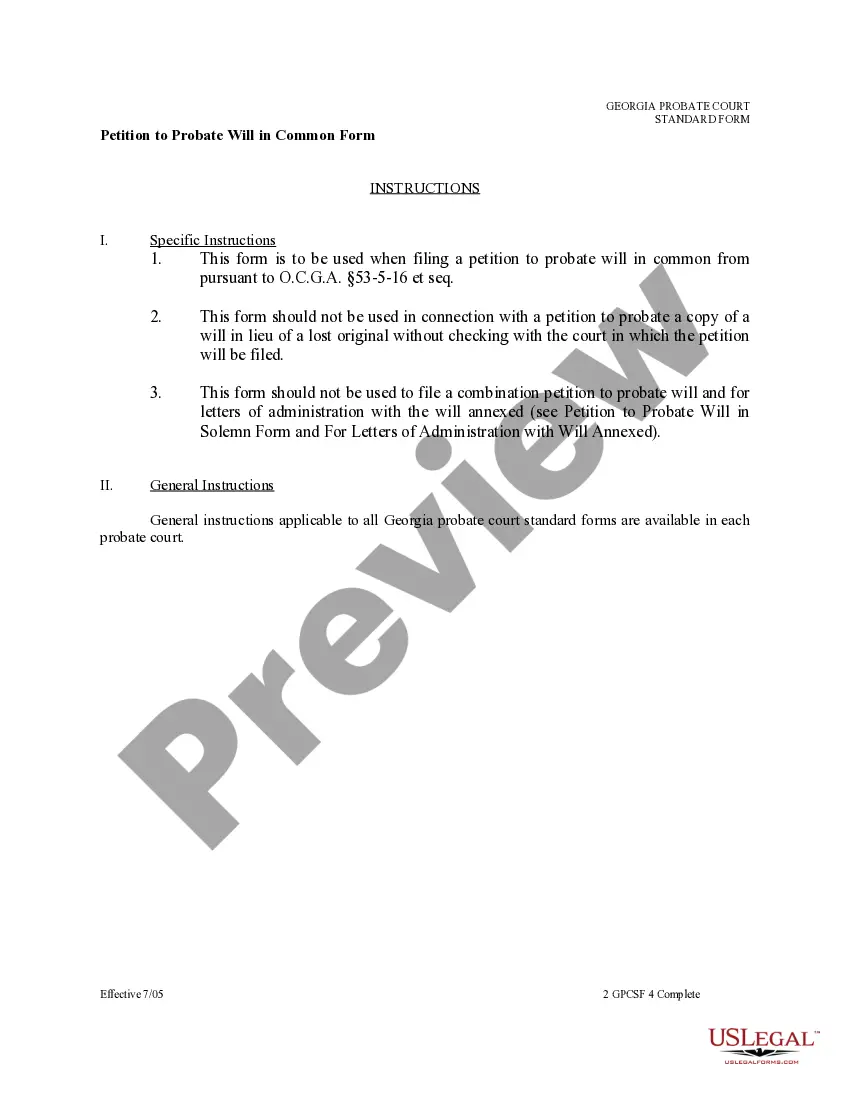

In order to probate the will, the executor should file the original signed will and, in most cases, Georgia Probate Court Standard Form #5 - Petition to Probate Will in Solemn Form. The Standard Forms are available at the courthouse or online at the official statewide Probate Court website.

The petition to probate in common form will not be binding for four years after it has been completed. Executors appointed through a solemn form probate can petition to be discharged from their liability and responsibilities six (6) months after their appointment.

How to File Probate Without a Lawyer - A Step-by-Step Guide Petition the court. The probate process won't begin automatically. ... Notify heirs, beneficiaries, and other interested parties. ... Change the legal name of the assets. ... Pay creditors and tax payments first. ... Pay funds to heirs. ... Report back to the court and close the estate.