Limited Lliability

Description

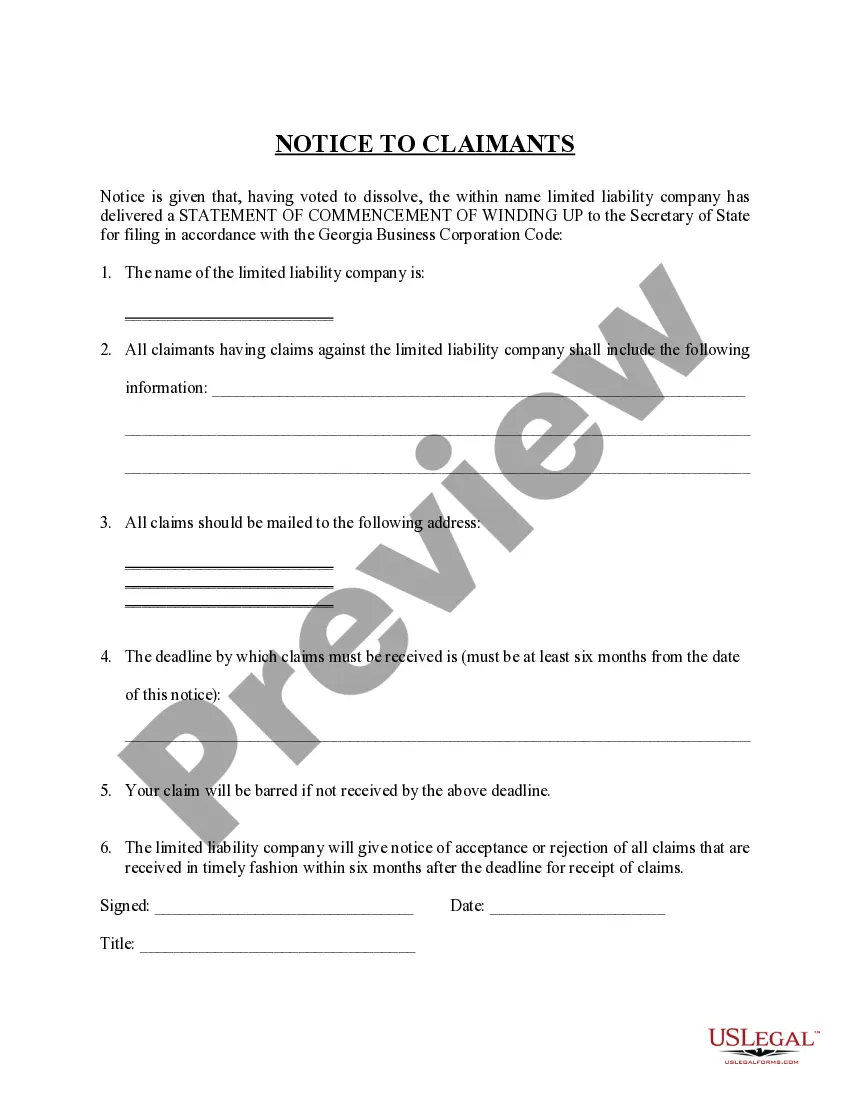

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- Start by previewing the relevant form. Verify its description to ensure it matches your legal needs and adheres to local jurisdiction regulations.

- If adjustments are needed, utilize the search feature to find the appropriate template. Double-check for completeness before proceeding.

- Purchase your selected document. Click the 'Buy Now' button and select a subscription plan that meets your requirements. You will need to create an account to access all features.

- Complete your payment. Enter your credit card details or use your PayPal account to finalize your subscription and access the forms.

- Download the form. Save the template on your device for completion and keep it for future use under the 'My Forms' section of your account.

Acquiring legal documents doesn't have to be cumbersome. With US Legal Forms, you can navigate the process easily, ensuring all documents are comprehensive and error-free.

Start your journey with US Legal Forms today and empower yourself with the legal resources you need for successful documentation.

Form popularity

FAQ

Writing a limited liability company involves several key steps. Begin with a unique business name that includes 'LLC' to indicate its structure. Next, draft the articles of organization, which outline the company’s purpose, management, and compliance requirements. Being detailed in these documents sets a strong foundation for your limited liability company.

Filling out an LLC requires you to gather specific information. Begin with your LLC's name and address, followed by the names of the members or managers. Make sure to complete any required sections per your state’s guidelines, including the management structure and purpose of the limited liability company;

To write an LLC example, start by outlining the essential components. First, include the name of your limited liability company, ensuring it complies with state regulations. Next, specify the purpose of the LLC and the registered agent's details. This structure not only clarifies your intentions but also standardizes the process of forming a limited liability company.

The filing method depends on the structure of your limited liability company. If it’s a single-member LLC, you typically file personal and LLC taxes together. Multi-member LLCs must file separately, as each member reports their share of the profits. Familiarizing yourself with these rules is crucial to avoid mistakes, and Uslegalforms can provide the necessary tools to simplify the process.

If your LLC has multiple members, it needs to file taxes as a partnership, requiring a separate tax return. For a single-member LLC, however, you can report it directly with your personal taxes. It's essential to understand this distinction to ensure proper compliance and avoid penalties. Seek out resources like Uslegalforms to aid in navigating these requirements.

member LLC files taxes by treating the business as a disregarded entity. This means all income and expenses get reported on Schedule C attached to your personal tax return. This streamlined process simplifies your tax obligations and provides a clear picture of your earnings. Using Uslegalforms can assist in managing your filing needs efficiently.

Even if your limited liability company does not generate income, you may still need to file taxes. Generally, any LLC that receives income or has expenses should file a tax return. Understanding the thresholds and requirements ensures you remain compliant with tax laws. Uslegalforms can help clarify the financial duties associated with maintaining an LLC.

Whether you should file personal and business taxes together depends on your LLC structure. Single-member LLCs typically combine business income with personal tax returns, while partnerships file separate returns. This distinction affects your tax obligations and potential deductions. It’s beneficial to seek expert advice to make informed decisions and optimize your tax situation.

Generally, if you operate a single-member LLC, you report your LLC income on your personal tax return. However, for multi-member LLCs, the partnership return is separate from personal taxes. It's essential to understand these tax structures to avoid confusion during tax season. Uslegalforms can provide guidance on filing requirements for your specific situation.

A limited liability company typically files Form 1065, which is the return for a partnership. If the LLC has only one owner, it files the income on Schedule C as part of the owner's personal tax return. This simplified approach makes tax time easier for many individuals. Always consult with a tax professional to ensure compliance with tax laws.