Limited Liability Company With The Ability To Establish Series

Description

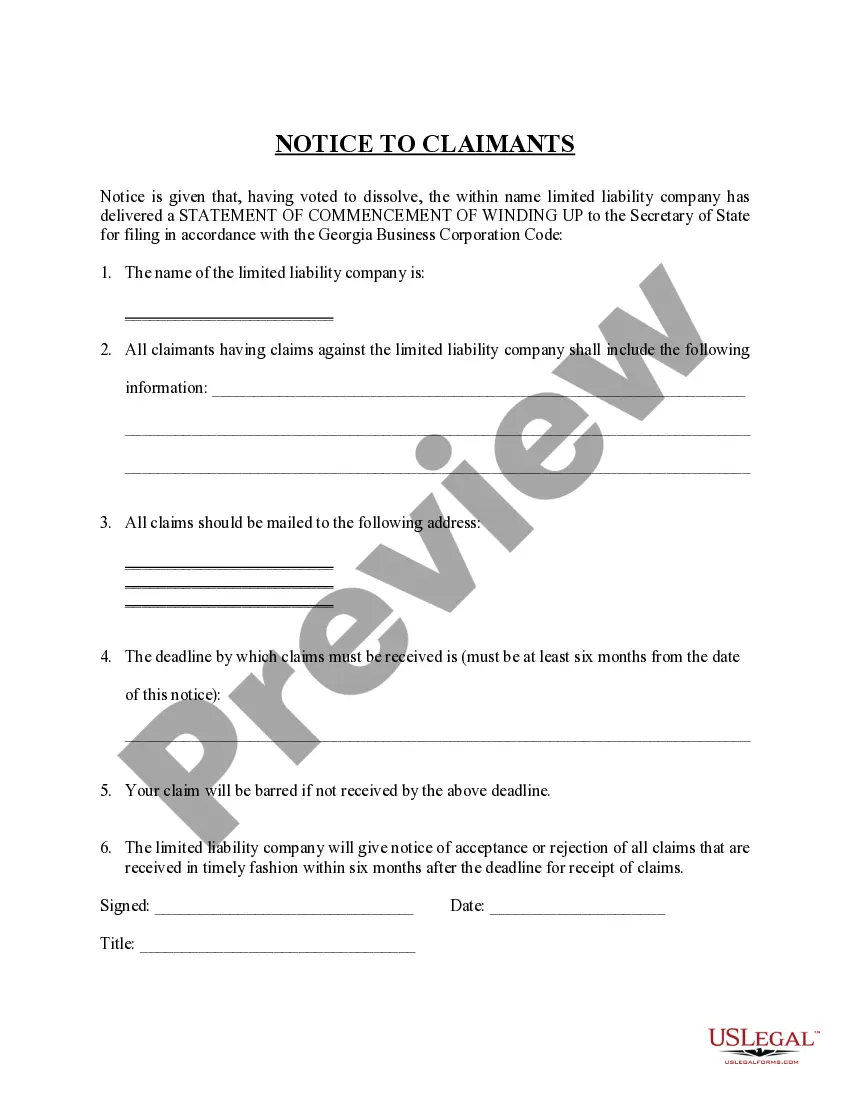

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- Start by checking the library for the correct form. Review the Preview mode and form description, ensuring it aligns with your jurisdiction's requirements.

- If no suitable form is found, utilize the Search feature to locate an appropriate template that meets your specific needs.

- Proceed to purchase the document by clicking the 'Buy Now' button and selecting your desired subscription plan.

- Create an account to gain access to all resources within the library. This step is essential for both new and returning users.

- Complete your purchase by entering the required payment details using either a credit card or PayPal.

- Finally, download the form to your device and store it securely. You can access it anytime via the 'My Forms' section of your account.

In conclusion, US Legal Forms offers a comprehensive way to manage your legal document needs effectively. With over 85,000 forms available and access to premium expert assistance, you're ensured a smooth experience and legally sound documents.

Get started today and simplify your legal process with US Legal Forms!

Form popularity

FAQ

Yes, you can change your existing LLC to a limited liability company with the ability to establish series. This change typically requires you to update your Articles of Organization and possibly the operating agreement to reflect the series structure. Each state has its own regulations, so check local rules to ensure compliance. Utilizing US Legal Forms can help you navigate this transformation effectively.

Converting your conventional LLC to a limited liability company with the ability to establish series involves filing specific documents with your state. Generally, you must amend your original Articles of Organization to include provisions for a Series LLC. Additionally, it is important to comply with any state-specific requirements. To ensure a smooth transition, consider using US Legal Forms for accurate legal documents and guidance.

To obtain an Employer Identification Number (EIN) for your limited liability company with the ability to establish series, you can apply directly through the IRS website. The process is straightforward; just select the option for an LLC and indicate that it is a Series LLC. Ensure you have all necessary information ready, including your entity's name and structure. If you need assistance, US Legal Forms offers resources to simplify this process.

A Series LLC can be an excellent choice for many businesses, especially those looking to manage multiple ventures without establishing multiple entities. By using a limited liability company with the ability to establish series, you can simplify management and reduce costs related to compliance and administration. This structure helps in isolating risks, making it a practical option for real estate, investments, or various business activities.

A limited liability company with the ability to establish series is a unique business structure that allows a single LLC to create multiple series, each acting like its own entity. This means that each series can have its own assets, members, and operations, while still being part of the main LLC. It provides an efficient way to manage risk and protect assets across different operations or investment ventures.

Yes, a single member LLC can absolutely be structured as a Series LLC. This allows you to create multiple divisions under one main company, each with its own protection from liabilities. By leveraging the benefits of a limited liability company with the ability to establish series, you can streamline your business operations while maintaining legal and financial separation between your series.

A limited liability company with the ability to establish series is a unique business structure that allows an LLC to create multiple series, each with its own assets, liabilities, and operational responsibilities. This structure helps protect each series from the liabilities of others, thus offering better risk management. Additionally, it can simplify administration and save costs, making it an attractive option for many entrepreneurs.

If you operate multiple LLCs, each limited liability company with the ability to establish series generally requires its own EIN. This requirement ensures proper tax reporting and legal compliance for each entity. If you are unsure about your situation, consulting a legal expert or using platforms like US Legal Forms can guide you through the process effectively.

It is advisable for each series within a limited liability company with the ability to establish series to maintain separate bank accounts. This practice helps keep finances organized and ensures easier tracking of income and expenses for each series. Moreover, having separate accounts can strengthen the liability protection provided by the LLC structure.

Generally, a limited liability company with the ability to establish series does not require each series to obtain its own EIN unless they are treated as separate entities for tax purposes. Depending on your specific business needs and structure, you may find it beneficial to have a distinct EIN for each series. We recommend consulting with a tax advisor to determine the best approach for your situation.