Georgia Executors Ga Withholding

Description

How to fill out Georgia Executor's Deed?

Accessing legal documents that adhere to federal and state regulations is vital, and the web provides a plethora of choices to choose from.

However, what’s the use of spending time searching for the correct Georgia Executors Ga Withholding template online if the US Legal Forms library has already compiled such documents in one location.

US Legal Forms is the largest online legal resource with over 85,000 fillable templates created by lawyers for any business and personal situation. They are straightforward to navigate, with all documents categorized by state and intended use.

Explore for an alternative template using the search tool located at the top of the page if needed.

- Our experts keep up with legal updates, ensuring that your form is current and compliant when you acquire a Georgia Executors Ga Withholding from our site.

- Acquiring a Georgia Executors Ga Withholding is quick and easy for both existing and new users.

- If you already have an account with an active subscription, Log In and download the template you require in your desired format.

- If you are new to our portal, follow the steps outlined below.

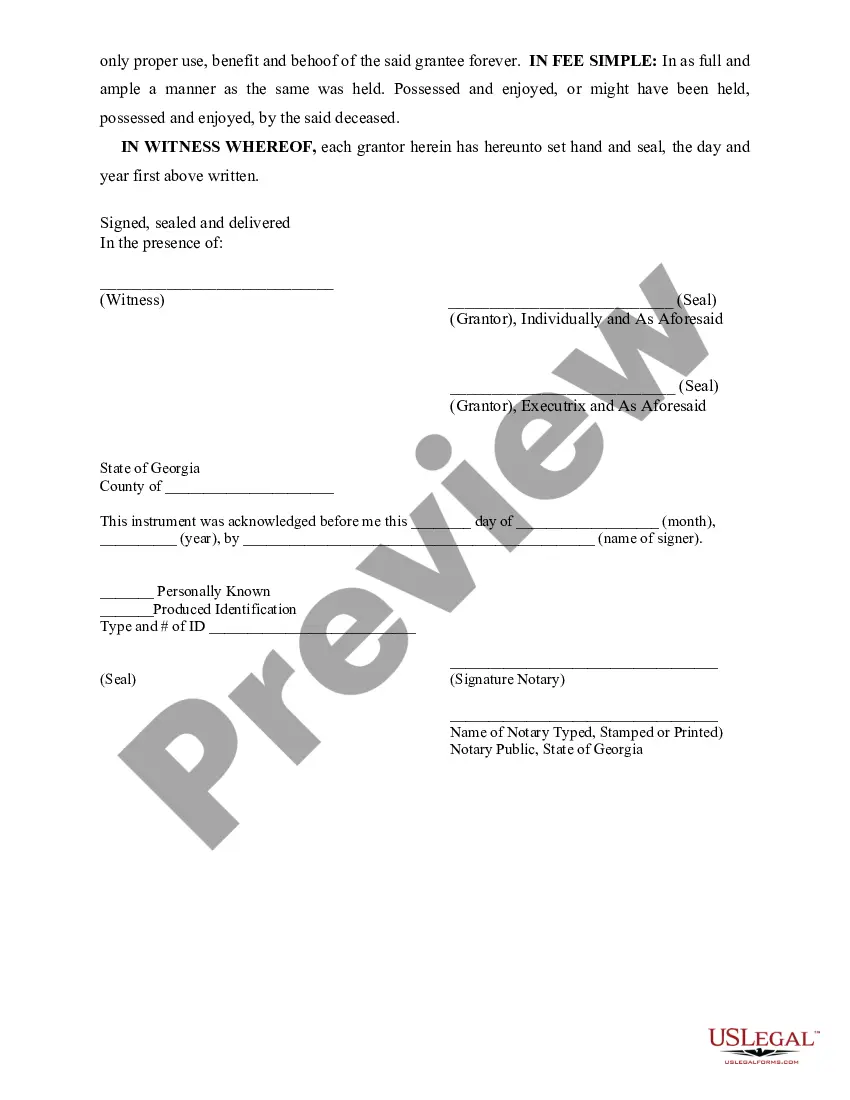

- Check the template using the Preview feature or via the text description to ensure it fits your requirements.

Form popularity

FAQ

The Georgia withholding number consists of a series of digits assigned by the Georgia Department of Revenue. Typically, it is formatted as a nine-digit number. Keeping this information handy is essential for proper Georgia executors GA withholding, especially when submitting tax forms.

To fill out a W4 in Georgia, begin with your name, address, and Social Security number. Next, choose your filing status and indicate the number of allowances. This process is crucial for ensuring accurate Georgia executors GA withholding, and you may find helpful templates on US Legal Forms for a smoother experience.

When filling out your tax withholding form, start by entering your personal details, including your filing status. Next, accurately calculate the number of allowances based on your situation. Using resources like US Legal Forms can help you navigate the process of Georgia executors GA withholding more effectively.

The number of allowances you claim in Georgia should reflect your personal and financial situation. For instance, you can claim one allowance for yourself and additional allowances for dependents. It's important to review your circumstances regularly to ensure your Georgia executors GA withholding aligns with your tax liabilities.

The amount you should withhold for Georgia state taxes depends on your income, filing status, and number of allowances claimed. Generally, refer to the Georgia Withholding Tax Table for guidance. Remember, keeping accurate records will help you remain compliant with Georgia executors GA withholding requirements.

To fill out the Georgia state tax withholding form, start by providing your personal information, including your name and Social Security number. Next, indicate your filing status and the number of allowances you wish to claim. Ensure that all information is accurate to avoid issues with Georgia executors GA withholding, and consider using US Legal Forms for templates that simplify the process.

You can obtain your Georgia withholding tax number by registering your business with the Georgia Department of Revenue. This registration can be completed online, providing you with a quick and efficient way to set up your withholding obligations. This number is vital for managing Georgia executors GA withholding and ensuring that you meet state tax requirements.

Yes, Georgia provides a state withholding form known as the Georgia Employee’s Withholding Allowance Certificate (G-4). Employers must have their employees complete this form to calculate the correct amount of state income tax to withhold. This form is key for ensuring compliance with Georgia executors GA withholding regulations.

Obtaining a GA tax ID number is straightforward. You can apply through the Georgia Department of Revenue's online portal, where you will fill out the necessary forms. Remember, having a tax ID is crucial for any business, especially for managing Georgia executors GA withholding effectively.

To get a Georgia withholding number, you need to register your business with the Georgia Department of Revenue. You can complete this process online through the Georgia Tax Center. Once registered, you will receive your withholding number, which is essential for managing Georgia executors GA withholding for your employees.