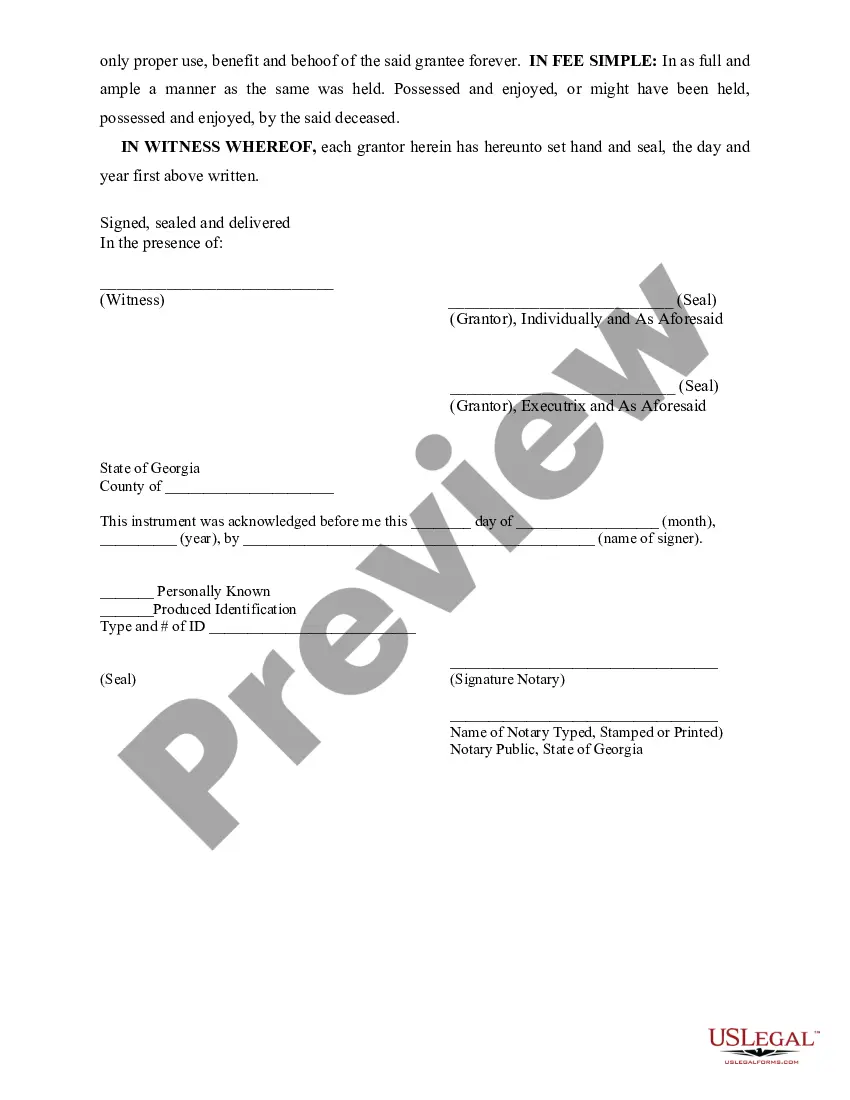

Georgia Deed Ga Withholding

Description

How to fill out Georgia Executor's Deed?

It’s clear that you cannot transform into a legal specialist instantly, nor can you swiftly learn how to draft the Georgia Deed Ga Withholding without possessing a specific skill set.

Assembling legal documents is a lengthy endeavor that necessitates particular training and abilities. So why not entrust the generation of the Georgia Deed Ga Withholding to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover anything from court documents to templates for internal communication.

If you need any additional form, restart your search.

Create a free account and select a subscription plan to buy the template. Click Buy now. Once the payment is processed, you can obtain the Georgia Deed Ga Withholding, complete it, print it, and send or mail it to the designated recipients or organizations.

- We recognize the significance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all templates are geographically specific and current.

- Here’s how to start with our platform and acquire the document you need in just minutes.

- Locate the form you require using the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to determine if Georgia Deed Ga Withholding is what you seek.

Form popularity

FAQ

You can find your Georgia state tax number on any correspondence you received from the Georgia Department of Revenue, including tax returns and notices. If you cannot find it, consider reaching out to their office for help. Knowing your state tax number is vital for navigating tax responsibilities, particularly for Georgia deed ga withholding. Make sure to have your business details ready when you inquire.

To get a Georgia withholding number, you must register online through the Georgia Department of Revenue. Fill out the necessary forms, and ensure all information is accurate to expedite the process. This number will help you manage your tax withholdings effectively, including any obligations related to Georgia deed ga withholding. Keeping this number handy will simplify your tax reporting.

To find your state withholding account number, check the documentation you received when you registered your business with the Georgia Department of Revenue. If you cannot locate it, you can contact their office directly for assistance. Having this number is vital for managing your taxes, especially those related to Georgia deed ga withholding. Always keep your records organized for easy access.

You can obtain a Georgia withholding number by registering your business with the Georgia Department of Revenue. This registration can be done online, which makes the process quick and efficient. Having a Georgia withholding number is essential for handling your tax obligations, particularly in relation to Georgia deed ga withholding. Ensure you gather all necessary documentation before starting the application.

To get a withholding certificate in Georgia, you must complete Form G-4 and submit it to your employer. This form informs your employer how much tax to withhold from your paychecks. It is crucial for managing your tax liabilities, including those related to Georgia deed ga withholding. You can find the form on the Georgia Department of Revenue's website.

To obtain a tax ID number in Georgia, you will need to apply through the Georgia Department of Revenue. You can complete the application online, by mail, or in person. This number is essential for various tax-related processes, including Georgia deed ga withholding. Make sure to have your business information ready to ensure a smooth application.

Form 500 UET is the Georgia Individual Income Tax Return form, used for reporting individual income tax. This form is important for individuals who need to settle their tax obligations, including any Georgia deed ga withholding amounts. You can find Form 500 UET on the Georgia Department of Revenue's website for your convenience.

To set up your tax withholding, begin by filling out the appropriate withholding forms for your state. For Georgia, you will need to complete the Georgia Employee's Withholding Allowance Certificate. This document helps you determine the correct amount of Georgia deed ga withholding to apply to your employees’ wages.

A G2 form is a Georgia withholding tax form used by employers to report the state income tax withheld from employees' wages. This form helps ensure that employers comply with their Georgia deed ga withholding obligations. You can obtain the G2 form from the Georgia Department of Revenue's website.

To apply for a Georgia Department of Labor (DOL) account number, you must complete the online application available on the GA DOL website. This account number is crucial for managing unemployment insurance taxes and other related obligations. Once you have your account number, you can easily handle your Georgia deed ga withholding responsibilities.