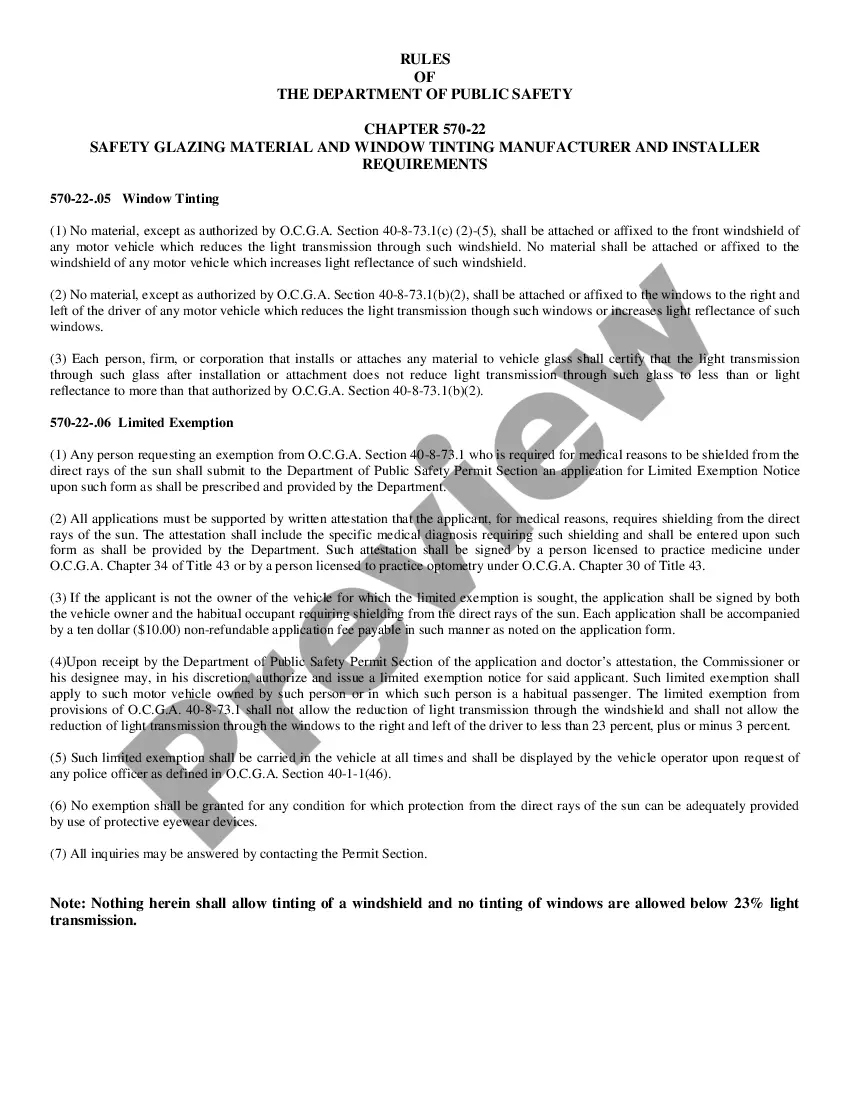

Georgia Tint Laws

Description

How to fill out Georgia Application For Exemption To The Window Tint Law?

The Georgia Tint Regulations you see on this page is a reusable official template created by experienced attorneys in accordance with federal and local laws and guidelines.

For over 25 years, US Legal Forms has provided individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal scenario. It’s the fastest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures bank-level data protection and anti-virus security.

Re-download your documentation as needed. Access the My documents tab in your profile to retrieve any previously downloaded forms. Subscribe to US Legal Forms to have authenticated legal templates for all of life’s situations readily available.

- Examine the document you require and assess it.

- Review the sample you searched for and either preview it or check the document description to confirm it meets your needs. If it doesn’t, use the search feature to locate the right one. Click Buy Now when you’ve identified the template you want.

- Register and sign in.

- Choose the pricing plan that fits you and set up an account. Use PayPal or a credit card for a fast payment. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

They are useful in a variety of very specific circumstances, but as discussed below, in Pennsylvania, Revocable Living Trusts are unnecessary in most cases. A Revocable Living Trust is a Trust that a person, called the Grantor, creates, funds, and retains control over during his lifetime.

If you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

The Register of Wills keeps records of wills, estate inventories, and related documents. To request copies of probate records, you'll need to know: The person's complete name at the time they died. The date of the person's death.

Rule 10.6. This is a report, due within two years of date of death, and if administration has not been completed, annually thereafter until administration of the estate is complete. The Status Report Under Pa. O. C.

The cost of setting up a trust in Pennsylvania varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, ing to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) ? enough to make a major, lasting impact.

The fiduciary of a resident estate or trust uses the PA-41, Fiduciary Income Tax Return, to report: ? The income, deductions, gains, losses, etc., of the. estate or trust; ? The income that is either accumulated or held for future.

A will or a living trust are two valuable tools used for estate planning. A will is important to avoid having your estate distributed in ance with Pennsylvania's laws. A living trust can essentially operate as a vault to hold several types of assets that you transfer into it.