Bond For Deed Real Estate

Description

How to fill out Georgia Administrator's Deed?

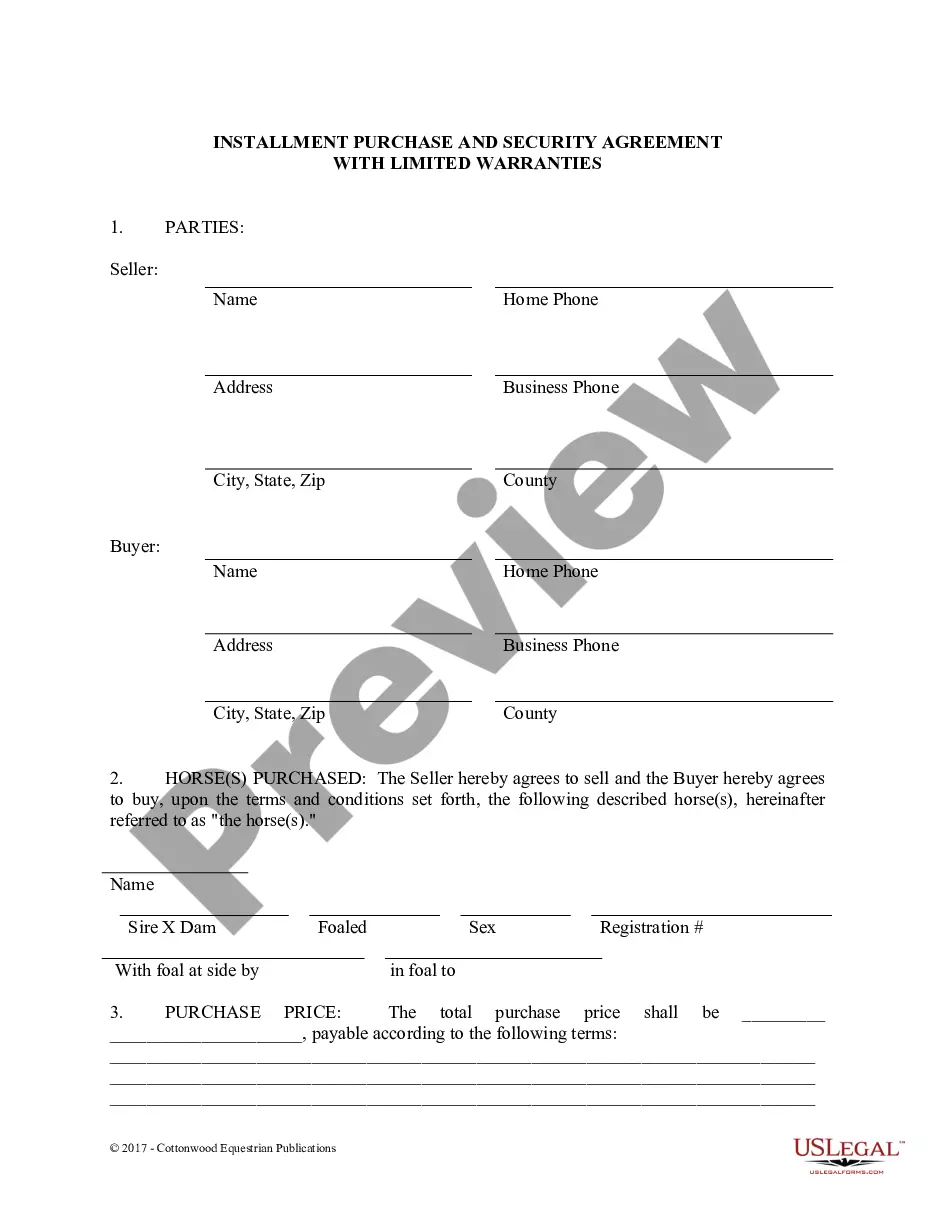

- Log in to your US Legal Forms account if you are already a member. Ensure your subscription remains active and download the required template by clicking the Download button.

- For first-time users, start by checking the Preview mode and form description to confirm you’ve selected the correct Bond for Deed template that fits your jurisdiction's requirements.

- If you find that the template does not meet your needs, utilize the Search function to discover additional options that better align with your legal requirements.

- Once you have identified the correct document, proceed to purchase it by selecting the Buy Now button and choosing a suitable subscription plan.

- Complete your purchase securely using your credit card details or PayPal account to finalize your transaction.

- After your purchase, download the form to your device and access it anytime through the My Forms section in your profile.

US Legal Forms provides individuals and attorneys with a robust library of over 85,000 customizable legal documents, ensuring both ease and accuracy. With more forms available at competitive pricing, users can feel confident in their choice.

In conclusion, obtaining a Bond for Deed real estate form through US Legal Forms is a hassle-free experience. With their extensive resources and expert assistance, you can ensure your legal documents are prepared correctly. Start your journey today!

Form popularity

FAQ

One disadvantage of a bond for deed real estate transaction is that the seller retains legal title until the terms are fulfilled. This can leave the buyer vulnerable if the seller defaults or faces financial issues. Additionally, the buyer is responsible for maintenance, which can lead to unforeseen expenses.

If your name appears on the deed, the property is not solely owned by the other party. Without your consent, the other party typically cannot sell the house. In bond for deed real estate transactions, both parties have defined rights and responsibilities, ensuring fair dealings.

While both bond for deed and owner financing serve as alternatives to traditional mortgages, the key distinction lies in the retention of the deed. In bond for deed real estate transactions, the deed remains with the seller until all payments are made, while in owner financing, responsibilities and deed retention can vary. Understanding these differences allows buyers and sellers to select the option best suited for their circumstances.

One potential downside of owner financing is the risk for the seller if the buyer fails to make payments, leading to potential foreclosure. This situation can be complex and may require legal proceedings. Additionally, without extensive regulations, terms can vary significantly, making it vital for both parties to have a clear and fair agreement in place.

A bond for deed can indeed be a beneficial option for buyers who may struggle with traditional financing. It allows them to acquire a property while making payments over time, often with less stringent requirements. However, it's essential to understand the terms clearly and ensure both parties are comfortable with the arrangements before proceeding.

Typically, the seller or their agent drafts a contract for deed. However, it is a good idea for both parties to review the contract with a lawyer to ensure it meets legal standards. If you prefer, you can use services that specialize in contract drafting, such as USLegalForms, particularly for bond for deed real estate agreements.

Yes, you can prepare your own deed, but it requires careful attention to detail. Make sure you understand the legal requirements for your state and that all necessary information is included accurately. Using a resource like USLegalForms can help streamline the process, especially for bond for deed real estate transactions where clarity is crucial.

To write a simple deed, start by identifying the parties involved and describing the property clearly. Include a statement of conveyance that demonstrates the grantor’s intention to transfer ownership. A simple deed should be concise but thorough, and in bond for deed real estate, it is essential to ensure that all legal standards are met.

A bond for deed in real estate is a financing arrangement in which the buyer takes possession of the property while making payments to the seller. The seller retains legal title until the buyer fulfills payment terms. This method is beneficial in situations where traditional mortgages may not be available, making homeownership more accessible.

Completing a deed involves several key steps. First, you will need to identify the grantor and grantee, along with the property details. Ensure you include the consideration amount and that the deed is signed and notarized. This becomes particularly important in bond for deed real estate transactions, where clear documentation is necessary.