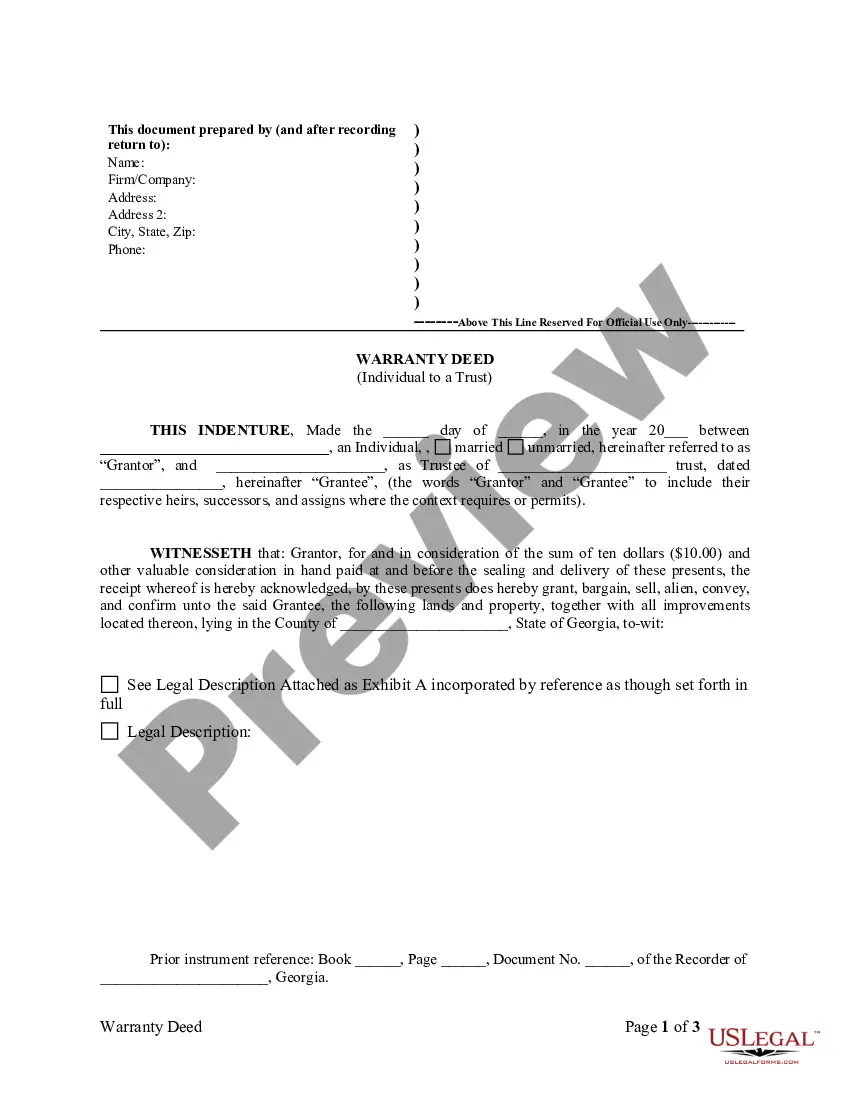

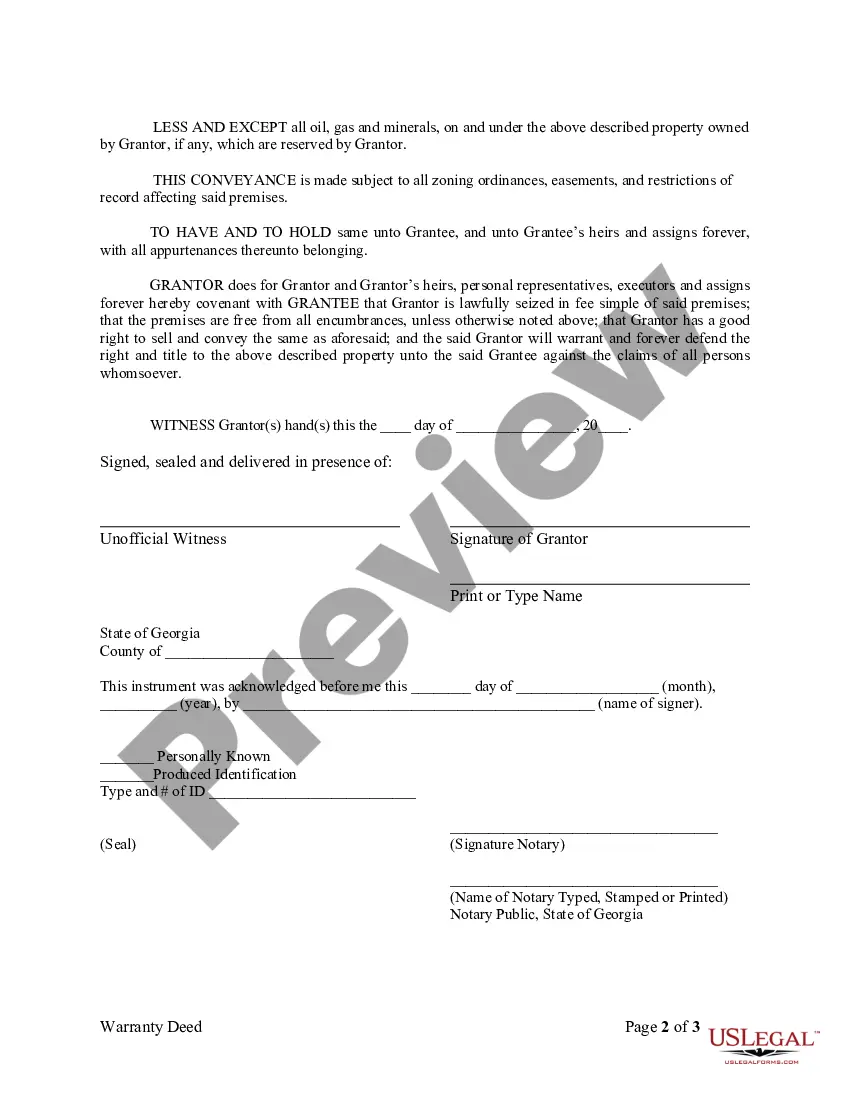

Trust Deed For Property

Description

How to fill out Georgia Warranty Deed From Individual To A Trust?

- Visit the US Legal Forms website and log in to your account if you're a returning user. Ensure your subscription remains active; renew it if necessary.

- For first-time users, browse the available forms, focusing on the trust deed for property. Check the Preview mode and the form description to ensure it matches your local requirements.

- If you don't find what you're looking for, utilize the Search tab to explore additional templates until you find the right one.

- Once you’ve selected your document, click the Buy Now button and choose a suitable subscription plan. You will need to create an account to access your forms.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After the transaction is done, download your form and save it to your device. You can also access it anytime from the My Forms section in your account.

Using US Legal Forms ensures that you have access to a vast repository of over 85,000 legal documents. This not only saves you time but also guarantees precision through expert assistance when needed.

Looking to secure your property with a trust deed? Start now with US Legal Forms for a hassle-free experience!

Form popularity

FAQ

Trust property includes any asset designated to be held in a trust, such as real estate, bank accounts, or investments. When you document a trust deed for property, these assets are legally transferred to a trustee for management. This structure ensures that your wealth is protected and distributed according to your wishes.

Three common types of trust include revocable trusts, irrevocable trusts, and living trusts. Each type serves different purposes; for example, a revocable trust allows you to maintain control over the assets while you are alive. Consider these options when creating a trust deed for property, as the choice will influence how your assets are managed.

Trust property refers to any asset held within a trust, and a primary example is residential real estate. For instance, if you place your home into a trust deed for property, that home becomes part of the trust. This means it will be managed and eventually distributed according to the stipulations laid out in the trust documents.

An example of a trust asset includes real estate such as homes or commercial buildings, which can be included in a trust deed for property. Other examples might include investments, bank accounts, or valuable personal possessions. Each of these assets can be managed according to the terms of the trust, ensuring they are used for the intended purpose.

While a trust deed for property can provide several benefits, there are also disadvantages to consider. First, you may incur additional costs like attorney fees to set up the trust. Additionally, transferring property into a trust may impact your eligibility for certain government benefits, as it can affect your assets.

The purpose of a trust deed is to provide clarity and security in financing a property. It establishes a legal agreement that outlines the terms between the lender, borrower, and trustee. This structure helps protect both parties and makes the lending process smoother. For those looking to leverage a trust deed for property, using platforms like US Legal Forms can simplify the process and ensure you have the right documents in place.

A significant disadvantage of a deed of trust is that it can lead to a non-judicial foreclosure process, which may occur without a court's involvement. This means that if the borrower defaults, the lender can sell the property quickly, leaving the borrower with limited recourse. Additionally, the borrower may not have as much time to rectify the situation compared to traditional mortgages. Thus, fully understanding the implications of a trust deed for property is essential before moving forward.

When a property is held in a trust, it means that a legal entity, known as a trustee, manages the property for the benefit of the beneficiaries. This arrangement allows for seamless transfer of property upon death and can help avoid probate. It also provides a layer of protection for the property against creditors. Using a trust deed for property can simplify estate planning and ensure your wishes are followed.

Using a trust deed for property carries some risks. If you fail to make payments, the lender can initiate foreclosure through the trustee, potentially leading to the loss of your home. Additionally, some borrowers may find the terms of a trust deed more rigid compared to traditional mortgages, limiting flexibility.

One significant mistake parents often make is failing to specify clear instructions for managing the trust fund. Without specific guidance, beneficiaries may misunderstand the purpose and usage of the trust, leading to potential disputes. Additionally, neglecting to review and update the trust as circumstances change can result in outdated provisions. Using a reliable platform like US Legal Forms can help parents create a solid trust deed for property that reflects their intentions.