Transfer Deed For Trust

Description

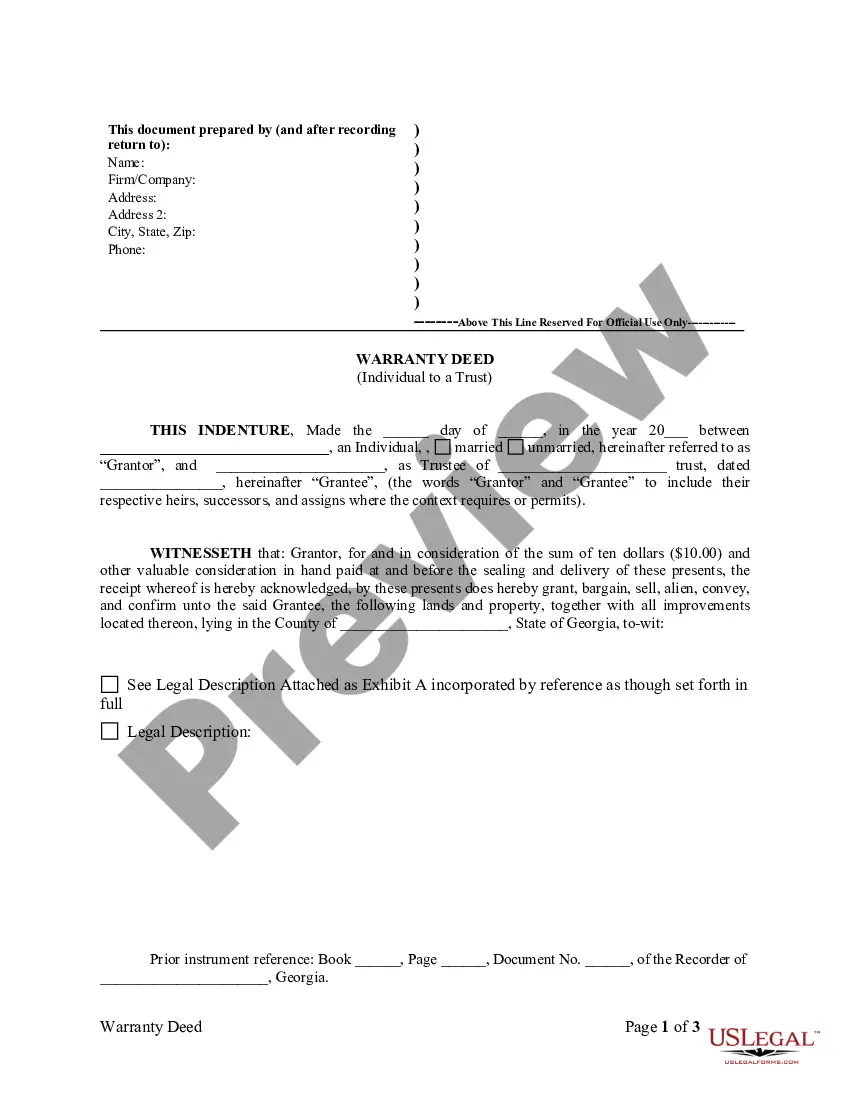

How to fill out Georgia Warranty Deed From Individual To A Trust?

- If you are a returning user, log in to your account and download your desired form template by clicking the Download button. Ensure your subscription is active, or renew it if necessary.

- Preview the form and read its description to confirm it meets your specific requirements and complies with local jurisdiction rules.

- If the form isn’t right, utilize the Search tab to find another template that better fits your needs.

- To acquire the document, click the Buy Now button and select your subscription plan. Don’t forget to create an account for full access to the library.

- Complete your purchase using your credit card or PayPal information.

- Download the completed form to your device, ensuring you can easily access it later from the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the transfer deed for trust process with its extensive collection of legal documents and easy-to-use interface. Whether you are a seasoned user or a newcomer, this platform provides the tools necessary for legally sound documentation.

Start your journey today and experience the convenience of US Legal Forms!

Form popularity

FAQ

Getting a deed of trust is important for a variety of reasons, including facilitating asset management and estate planning. It helps to ensure that your assets are distributed according to your wishes, thereby avoiding potential disputes among beneficiaries. Using a trusted service like USLegalForms can help you easily create a clear and effective transfer deed for trust.

The trust deed is usually created by the trustor, who establishes the trust and outlines its terms. While you can draft it yourself, enlisting the help of professionals or utilizing a platform like USLegalForms can ensure that your transfer deed for trust is legally sound and comprehensive. This way, you can have peace of mind knowing that your trust deed meets all legal requirements.

Yes, you can definitely obtain a trust deed if you own property you wish to place in a trust for estate planning purposes. It is essential to understand the specifics of your situation, and services like USLegalForms provide guidance to help you draft the right transfer deed for trust. This approach ensures that your property is managed and distributed according to your wishes.

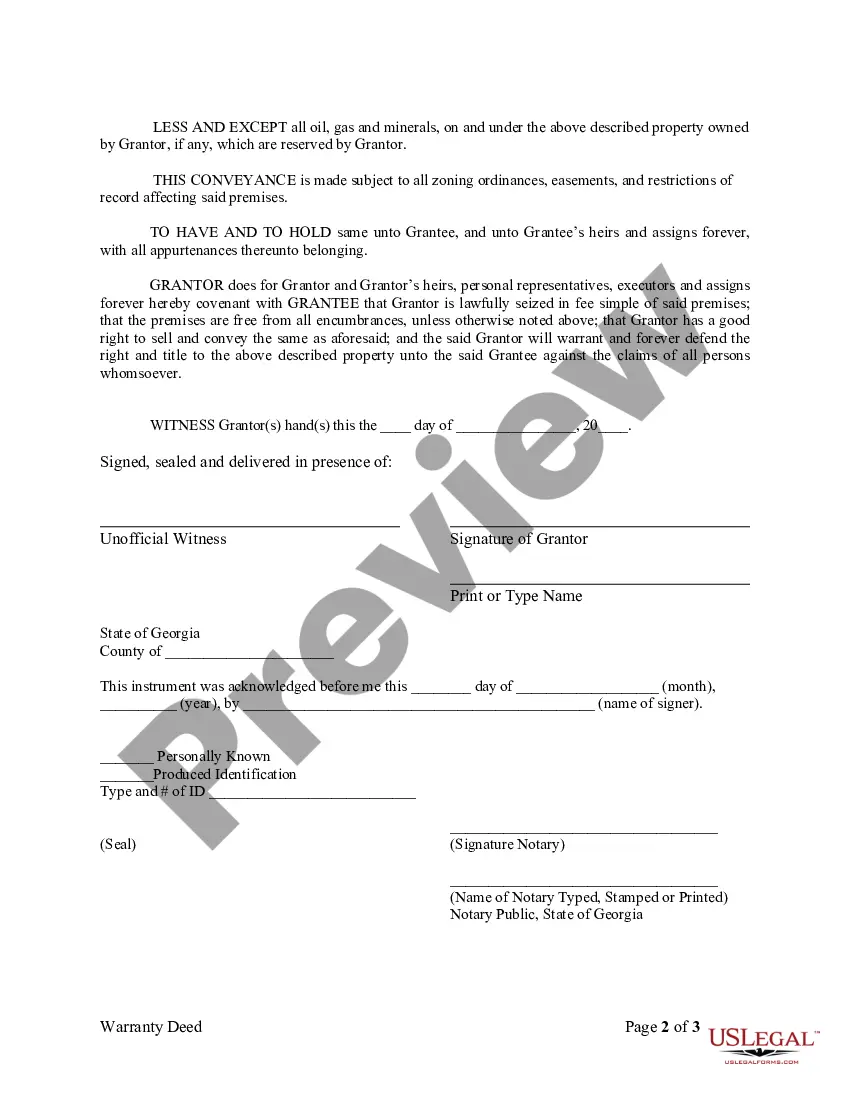

To get a trust deed, you typically start by deciding on the terms of the trust and identifying the assets you wish to transfer. You can create this deed using a reliable online platform like USLegalForms, which offers templates tailored for your needs. After drafting the transfer deed for trust, you’ll need to sign it and have it notarized to make it valid.

Yes, a home with a mortgage can often be transferred to a trust through a transfer deed for trust. However, you should first check with your mortgage lender to confirm any requirements or potential complications. Maintaining mortgage payments is crucial, as the lender still holds a claim to the property. This transfer can help protect the asset, but professional guidance is advisable.

Whether to gift a house or put it in a trust depends on your goals. Gifting may provide immediate benefits but could expose your child to inheritance taxes later. On the other hand, a transfer deed for trust offers control over the property and tax advantages. Consider your long-term objectives and consult a legal advisor to determine the best approach.

Transferring property from one trust to another involves creating a new transfer deed for trust that details the asset being moved. You must follow legal procedures to ensure that the transfer is valid and recognized. It often requires documentation and, in some cases, re-evaluating the trust's terms. Consulting a legal expert can greatly assist you in navigating this process smoothly.

A trust deed transfer is the process of moving property ownership into a trust. This involves preparing a document that specifies the details of the transfer and the trust itself. Using a transfer deed for trust can simplify the management of your assets and ensure your wishes are followed after your passing. This legal mechanism helps in protecting your property for future generations.

While putting your house in a trust offers benefits like avoiding probate, there are some disadvantages to consider. You may incur additional setup costs and ongoing management fees. Furthermore, a transfer deed for trust may limit your access to the property, depending on how the trust is structured. It's important to weigh these factors against the benefits when making your decision.

One effective method to leave a house to your child is through a transfer deed for trust. This legal document allows you to transfer ownership while avoiding probate. By placing the house in a trust, you ensure your child receives it smoothly and efficiently. Always consult a legal expert to explore the best options for your specific situation.