Georgia Contractor Form For Entry

Description

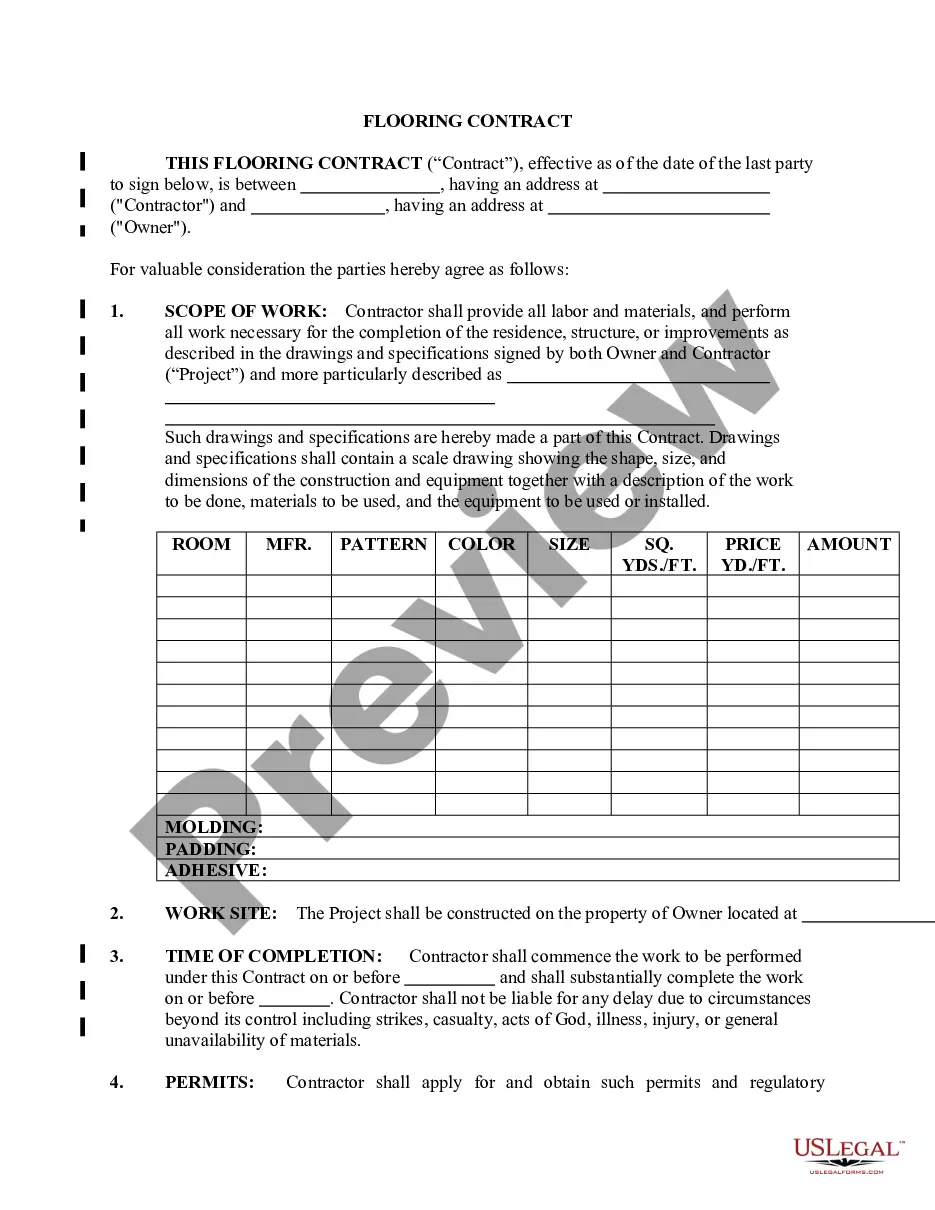

How to fill out Georgia Flooring Contract For Contractor?

When you need to file the Georgia Contractor Form For Entry that adheres to your local state's statutes and regulations, there can be numerous options available.

There's no need to scrutinize every form to ensure it fulfills all the legal requirements if you are a subscriber to US Legal Forms.

It is a reliable resource that can assist you in acquiring a reusable and current template on any subject.

Browse the suggested page and verify it aligns with your criteria. Utilize the Preview mode and review the form description if available. Search for another template through the Search bar in the header if needed. Click Buy Now once you identify the appropriate Georgia Contractor Form For Entry. Choose the most appropriate subscription plan, Log In to your account, or create a new one. Process payment for a subscription (options include PayPal and credit card). Download the template in your desired file format (PDF or DOCX). Print the document or fill it in electronically using an online editor. Obtaining professionally drafted official documents becomes effortless with US Legal Forms. Moreover, Premium users can also benefit from robust integrated tools for online PDF editing and signing. Try it out today!

- US Legal Forms is the most extensive online archive with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading the Georgia Contractor Form For Entry from our platform, you can be assured that you possess a valid and updated document.

- Retrieving the necessary sample from our site is exceptionally straightforward.

- If you already have an account, just Log In to the system, confirm your subscription is active, and save the chosen file.

- Later, you can access the My documents tab in your profile to retrieve the Georgia Contractor Form For Entry at any time.

- If this is your initial visit to our website, please follow the instructions below.

Form popularity

FAQ

To get a Georgia Contractor License, you must pass a two-part exam covering the license you are attempting to obtain; one in business and one in law. Applicants must also submit a license application and secure a Georgia Contractor Bond .

GA 500EZ Information Georgia form 500 EZ is designed for state residents for filing their income tax. Designed to streamline the filing process, form 500 EZ is for residents who have made less than $100,000 in a year and are not over the age of 65.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.