Attorney Powers Power With Irs

Description

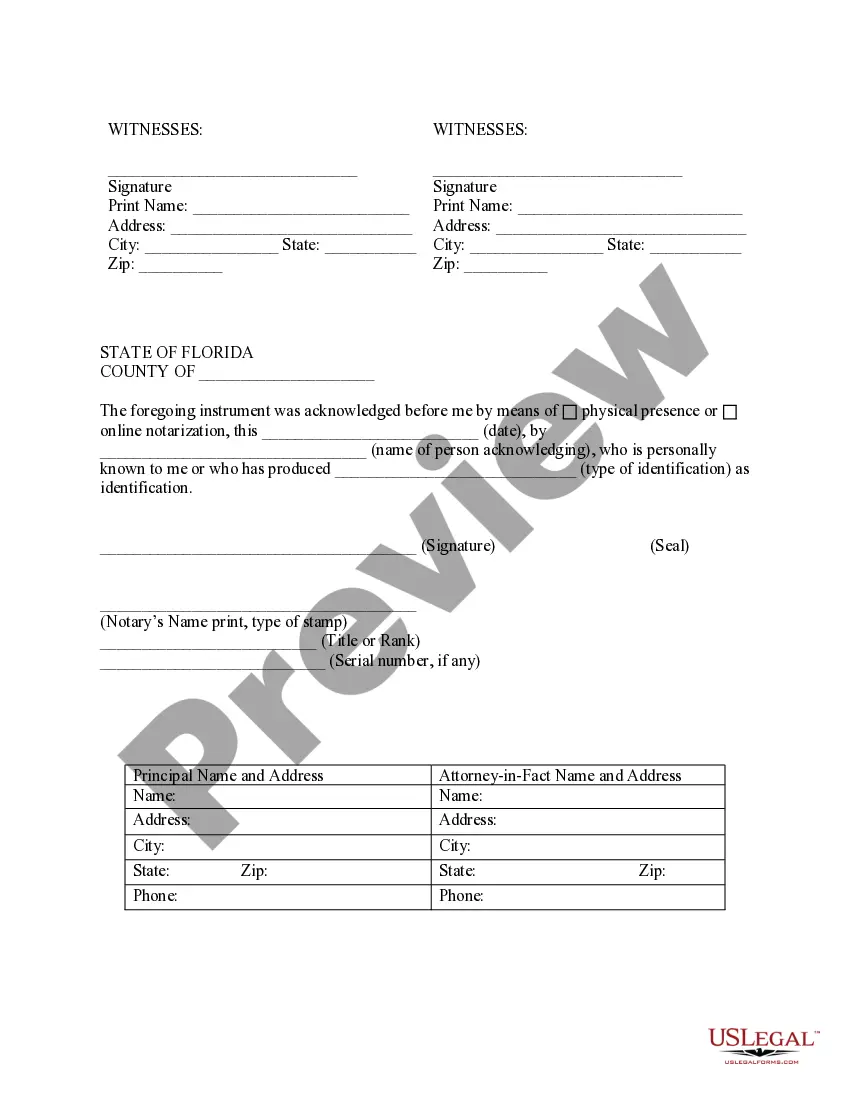

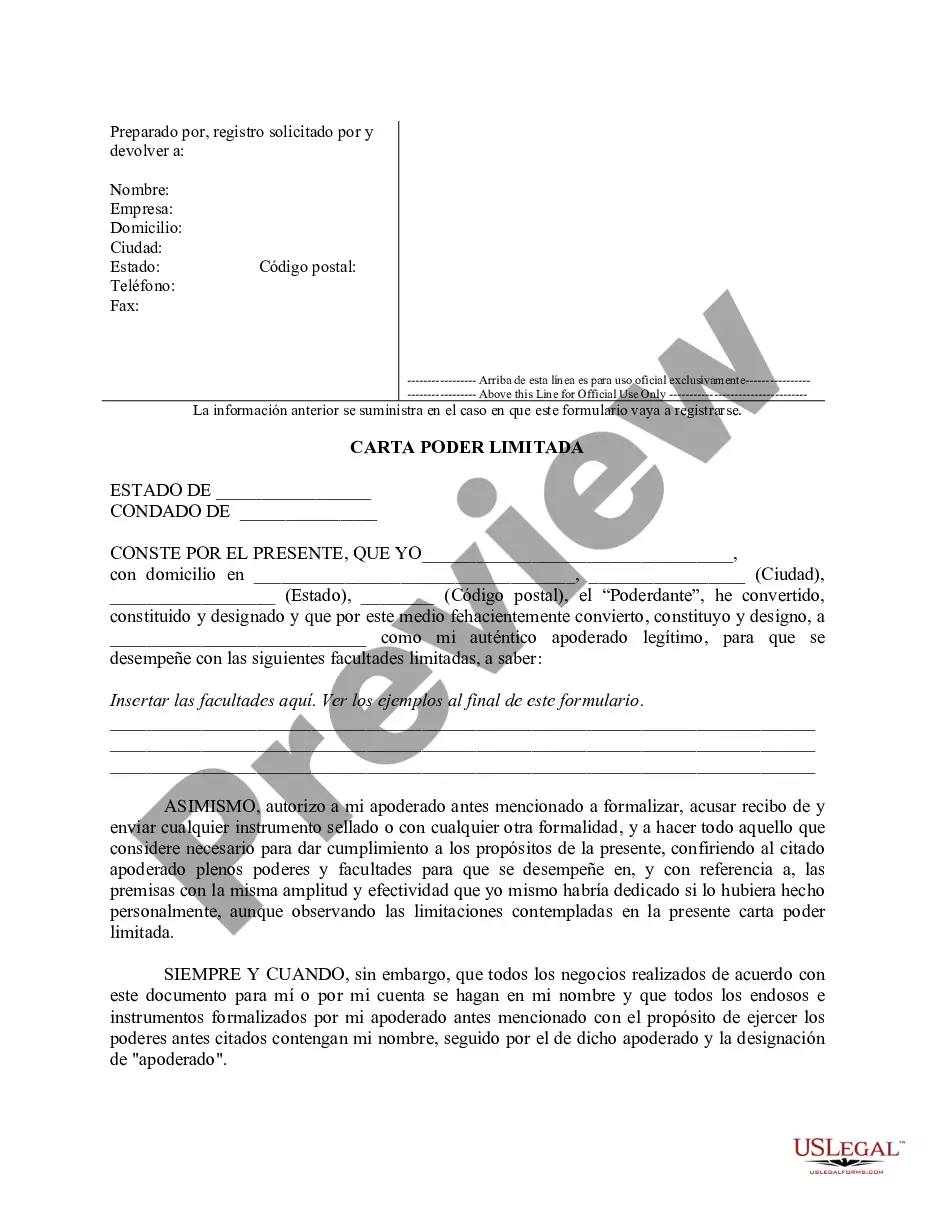

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Legal administration can be daunting, even for experienced professionals.

When you seek an Attorney Powers Power With IRS and lack the time to spend searching for the right and current version, the processes can be overwhelming.

US Legal Forms accommodates any requirements you may have, from personal to business documents, all in one location.

Utilize cutting-edge tools to complete and manage your Attorney Powers Power With IRS.

Here are the steps to follow after downloading the required form: Verify this is the correct form by previewing it and reviewing its details.

- Access a valuable resource repository of articles, guides, and manuals related to your situation and requirements.

- Save time and energy searching for the documents you need, and make use of US Legal Forms’ advanced search and Review feature to find Attorney Powers Power With IRS and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to review the documents you've previously saved and manage your folders as you prefer.

- If it's your first time with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- A comprehensive online form library can be a game changer for anyone looking to manage these matters efficiently.

- US Legal Forms is a market leader in online legal forms, providing over 85,000 state-specific legal templates available whenever you need them.

- With US Legal Forms, you can access state- or county-specific legal and business documents.

Form popularity

FAQ

Yes, the IRS does accept power of attorney documents, specifically Form 2848. This form allows your designated representative to act on your behalf regarding tax matters. By filing it correctly, you can give them the authority they need, streamlining communication with the IRS and resolving your tax issues effectively.

To get a power of attorney on file with the IRS, you must complete and submit Form 2848. It is vital to provide accurate details about your chosen representative and define the scope of their authority. By using USLegalForms, you can efficiently manage this process and ensure compliance with IRS regulations.

To streamline obtaining a power of attorney, consider using an online legal template service. Platforms like USLegalForms allow you to customize documents tailored to your needs, removing the guesswork. This method saves time and ensures you have a legal document that meets all requirements.

The easiest way to get a power of attorney is to use a reliable online service, such as USLegalForms. They offer user-friendly templates that guide you through the necessary steps, making the entire process straightforward. Additionally, these services can help you understand the specific requirements for your state, minimizing confusion.

Filing a power of attorney with the IRS requires submitting Form 2848, the Power of Attorney and Declaration of Representative. You need to provide your personal information, the representative's details, and the specific tax matters they will handle. Using platforms like USLegalForms can simplify this process, ensuring you fill out and file the form correctly and efficiently.

Yes, the IRS recognizes powers of attorney when properly executed and filed using Form 2848. Your attorney powers power with IRS allows a designated representative to act on your behalf in tax matters, including filing returns and communicating with the agency. It is vital to complete the form accurately and submit it as required. For expert assistance, US Legal Forms can help you navigate the process smoothly.

The primary IRS form for establishing a power of attorney is Form 2848. This form allows you to designate a representative who holds your attorney powers power with IRS for tax purposes. It is essential to fill out this form correctly to ensure your representative can act on your behalf effectively. Consider using US Legal Forms to access this form and ensure compliance with IRS requirements.

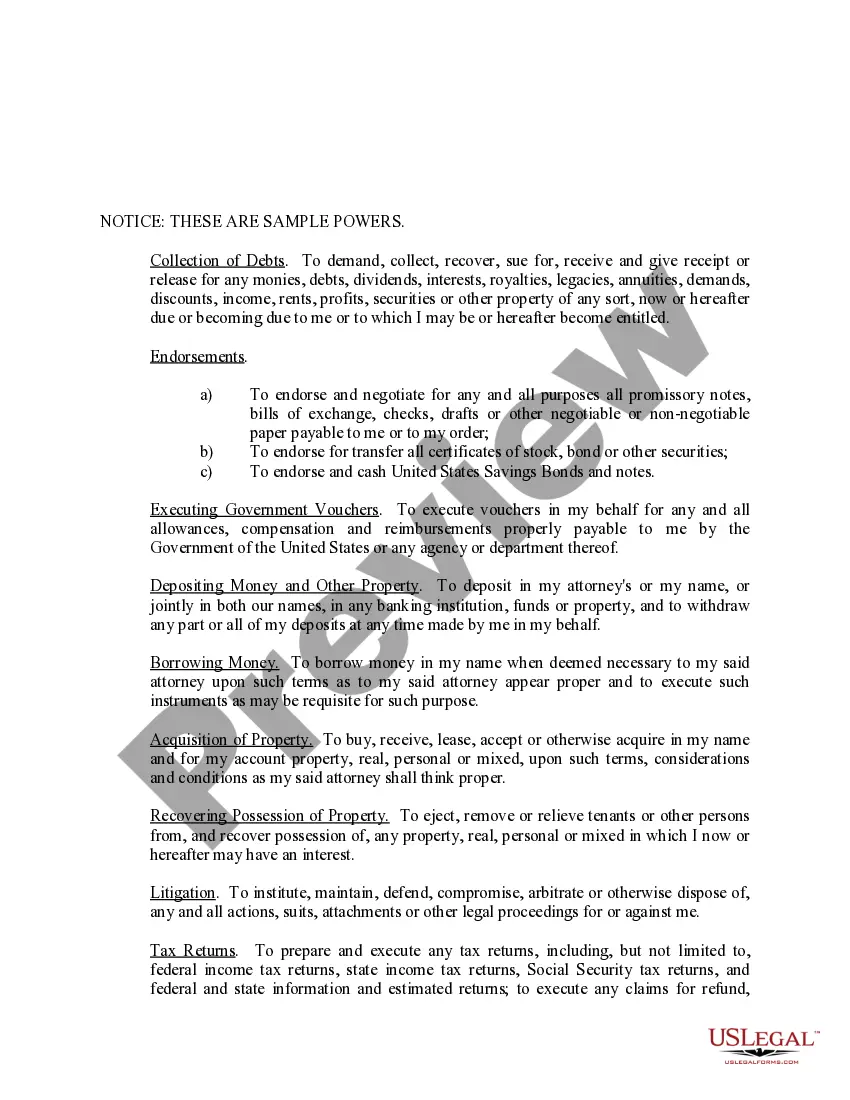

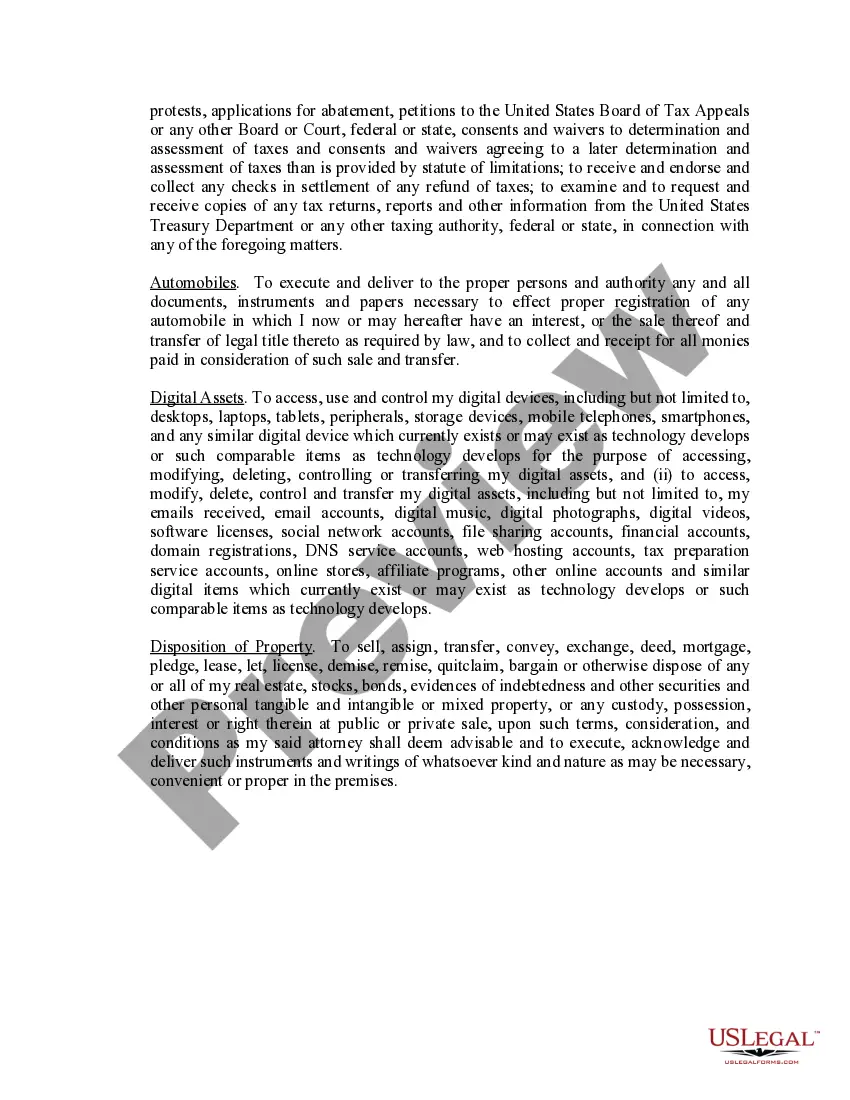

Filling out a power of attorney involves several steps, such as identifying yourself and the person you are granting authority to. You must also specify the powers you wish to grant and any limitations. Your attorney powers power with IRS means detailing their ability to handle tax matters explicitly. Using US Legal Forms can guide you through the process and help ensure all necessary sections are accurately completed.

An IRS power of attorney may cover multiple years, depending on the specific needs outlined in the document. Your attorney powers power with IRS ensures you have appropriate representation for the tax years you specify. Typically, it is advisable to provide a clear scope of years in the POA to avoid any misunderstandings with the IRS. For assistance, platforms like US Legal Forms can help you create a customized document.

To submit a power of attorney to the IRS, you should complete Form 2848, which clearly indicates the individuals you authorize to act on your behalf. Your attorney powers power with IRS can simplify interactions with the agency. Once completed, you can fax or mail the form to the IRS office listed in the instructions. Using resources like US Legal Forms can help you ensure your submission is correct and complete.