Custodia Niños Withdrawal

Description

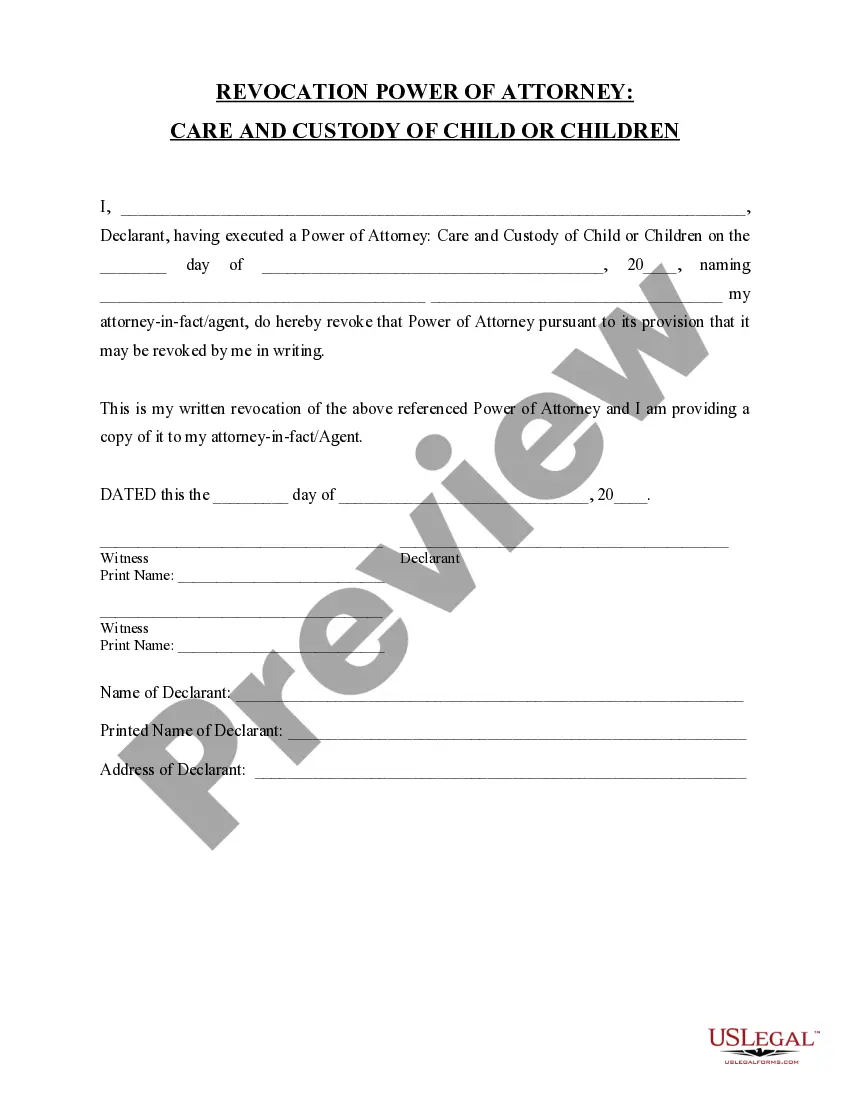

How to fill out Florida Revocation Of Power Of Attorney For Care And Custody Of Child Or Children?

Drafting legal documents from scratch can often be daunting. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more cost-effective way of preparing Custodia Niños Withdrawal or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly locate and download the Custodia Niños Withdrawal. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and explore the catalog. But before jumping directly to downloading Custodia Niños Withdrawal, follow these recommendations:

- Check the document preview and descriptions to make sure you have found the document you are searching for.

- Make sure the form you choose complies with the requirements of your state and county.

- Choose the right subscription option to buy the Custodia Niños Withdrawal.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

Gifts are irrevocable: Contributions to a custodial account are considered irrevocable?meaning you can't get that money back?and funds can be withdrawn by the custodian only to pay for expenses that would directly benefit the child before the age of majority.

As the custodian, you can withdraw money from a custodial account if you need to use it to pay for something that will benefit the minor. You can't take the money back yourself, or give it to someone else.

The moment it gets deposited into a children's long-term savings accounts, it also becomes your child's property. Therefore, any withdrawals you make can only be withdrawn and used for things that benefit the child (e.g., school expenses, college tuition, etc.).

Advantages of Custodial Accounts Also, there are no withdrawal penalties. While all withdrawn funds are restricted to being used "for the benefit of the minor," this requirement is vague and is not limited to educational costs, as with college savings plans.

How is an UTMA account taxed? UTMA accounts have a few tax implications. While there are no taxes on withdrawals (since contributions are made with after-tax dollars), there may be taxes on any unearned income. Unearned income includes taxable interest, dividends, and capital gains on any assets in the account.