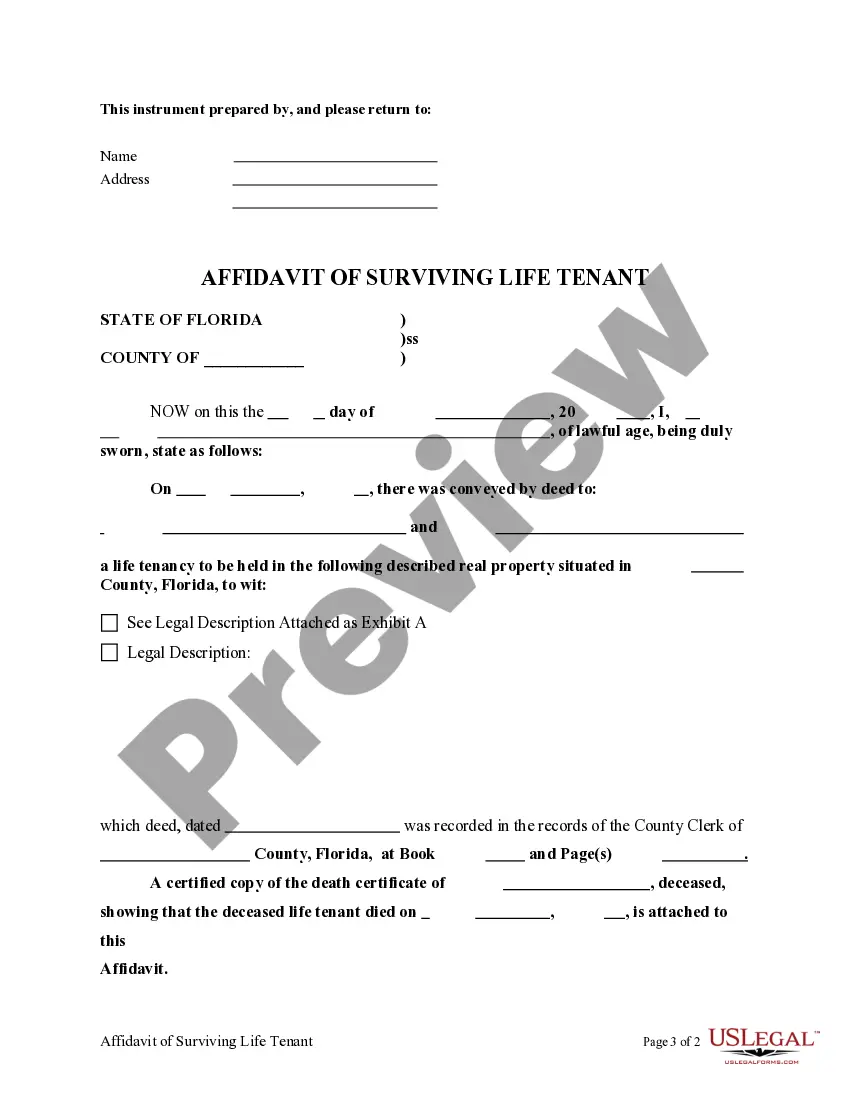

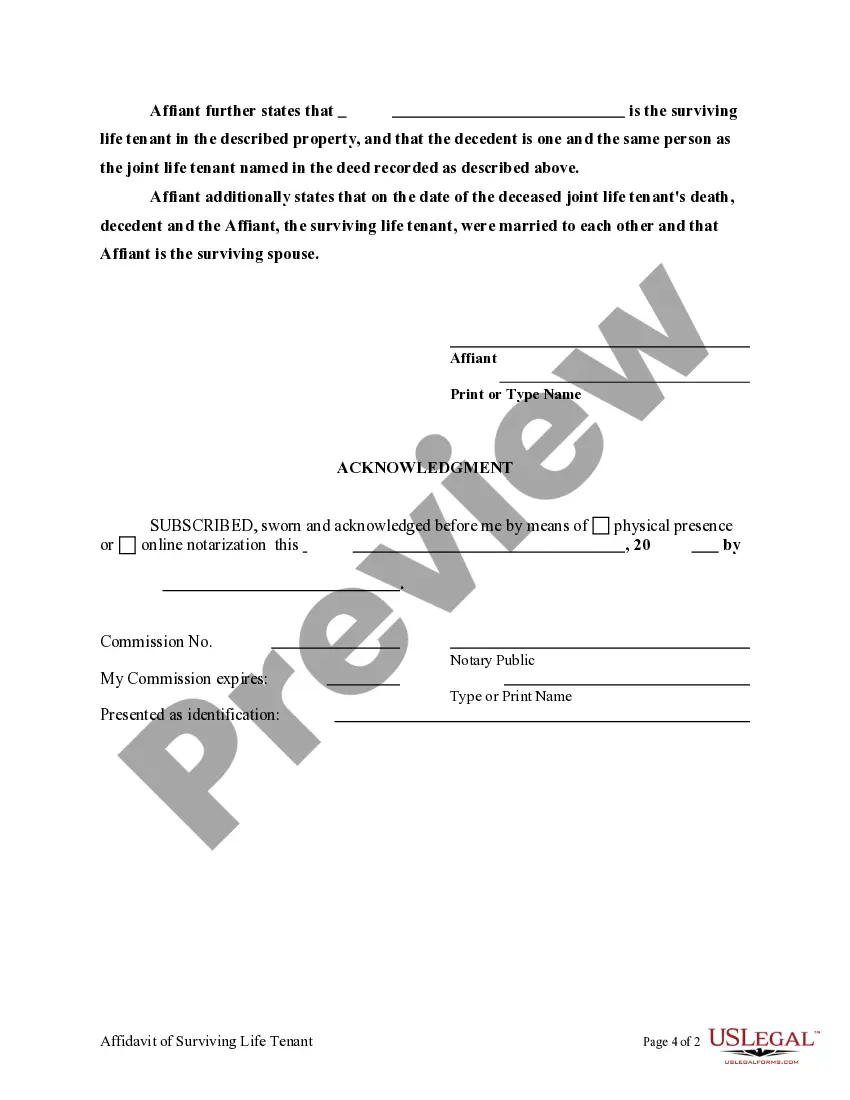

This form is an Affidavit by the Surviving Life Tenant regarding the death of Joint Life Tenant.

Life Tenant Of A Will Trust

Description

How to fill out Florida Affidavit Of Surviving Life Tenant?

Identifying a reliable source to obtain the latest and pertinent legal templates is a significant part of navigating bureaucracy. Locating the appropriate legal document necessitates precision and meticulousness, which is why it is crucial to source samples of Life Tenant Of A Will Trust exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and hinder your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all details regarding the document’s applicability and significance for your situation and within your jurisdiction.

Follow these steps to complete your Life Tenant Of A Will Trust.

Once you have the form on your device, you may modify it using the editor or print it and complete it manually. Eliminate the stress associated with your legal documentation. Navigate the extensive US Legal Forms library to discover legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the library navigation or search bar to find your template.

- Examine the form’s details to determine if it meets your state and county requirements.

- Check the form preview, if available, to confirm that the template is the one you need.

- Return to the search and find the correct document if the Life Tenant Of A Will Trust does not fulfill your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing option that suits your needs.

- Proceed with the registration to complete your purchase.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading Life Tenant Of A Will Trust.

Form popularity

FAQ

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

Example: John's will creates a life interest in the farmland he owned to his partner Molly, with the farm to go to their child Lex on Molly's death. John's will states 'I give a life interest in the farmland to my partner Molly, and the remainder interest in the farmland to my child Lex'.

Transferring large assets, such as a home, into a life estate or irrevocable trust can help an individual qualify for Medicaid, although this can depend on state law. Life estates split ownership between the giver and receiver. An irrevocable trust allows an individual to give away part of an asset.

An irrevocable trust is a separate legal entity that takes ownership of your assets and manages them on behalf of beneficiaries. A life estate is simply a deed of ownership that lets you retain partial ownership of a property during your lifetime before passing the property on to another after you pass.

Plain English translation: A lifetime trust is a trust created during a person's lifetime as opposed to a trust created through the person's will, which is referred to as a testamentary trust. A lifetime trust directs the distribution of property during both the grantor's lifetime and after death.