Assignment Of Lease To New Owner Form Withholding Tax

Description

How to fill out Florida Assignment Of Lease From Lessor With Notice Of Assignment?

Managing legal documents can be perplexing, even for seasoned professionals.

When searching for an Assignment Of Lease To New Owner Form Withholding Tax and lacking the time to find the correct and updated version, the tasks can be overwhelming.

Access a useful library of articles, guides, handbooks, and resources relevant to your situation.

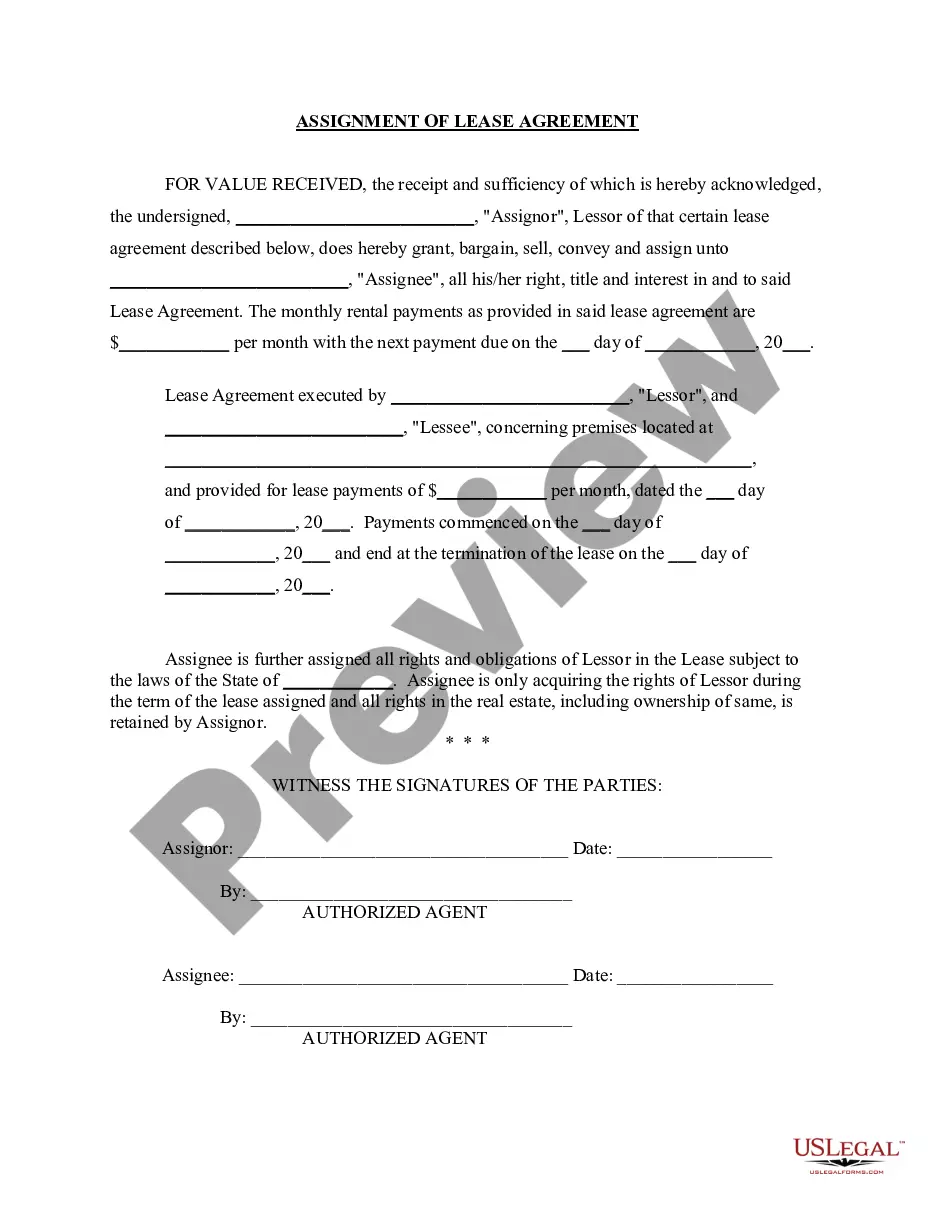

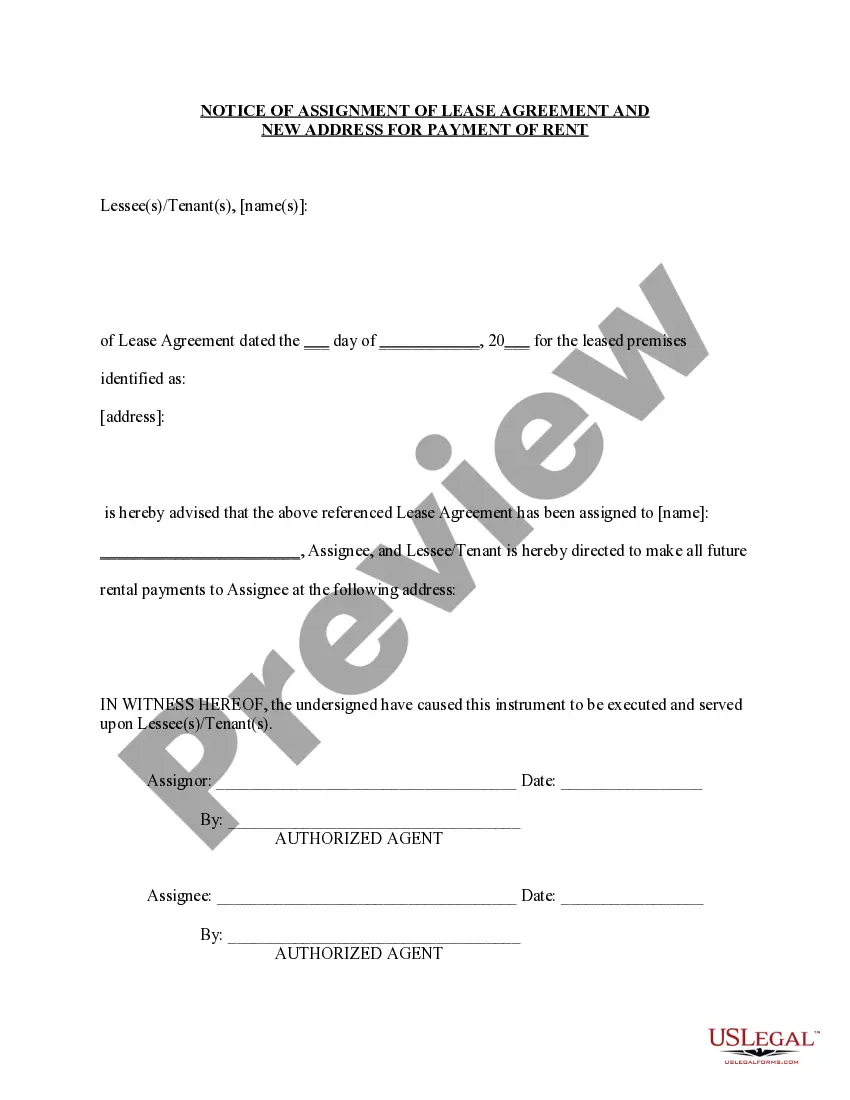

Save time and effort searching for the documents you need, and utilize US Legal Forms’ advanced search and Preview feature to locate the Assignment Of Lease To New Owner Form Withholding Tax and obtain it.

Ensure the sample is accepted in your state or county. Select Buy Now once you are prepared. Choose a monthly subscription plan, select your preferred file format, and Download, complete, eSign, print, and send your documents. Optimize your daily document management into a streamlined and user-friendly process today with the US Legal Forms web library, backed by 25 years of expertise and trust.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check the My documents tab to discover previously saved documents and manage your folders.

- If you are new to US Legal Forms, create a free account for unlimited access to all platform benefits.

- Follow these steps to get your desired form.

- Confirm it is the correct form by previewing it and reviewing its description.

- Access state- or county-specific legal and organizational forms.

- US Legal Forms fulfills all your needs, from personal to business documents, in one place.

- Utilize advanced tools to complete and manage your Assignment Of Lease To New Owner Form Withholding Tax.

Form popularity

FAQ

If you plan to purchase property from a foreign person or corporation and want to avoid FIRPTA withholding taxes, you can apply for a withholding certificate from the IRS. The IRS only grants withholding certificates in certain situations, and applying for a certificate does not guarantee you will be granted one.

To ensure collection of the FIRPTA tax, any transferee or buyer acquiring a U.S. property interest must deduct and withhold a tax equal to 15 percent of the amount realized on the disposition.

FIRPTA Rates and Withholding For example, let's say that a foreign corporation sells property for $10 million. At the closing, the purchaser would withhold 15 percent of the sale price, which in this case would be $1.5 million (15 percent of $10 million).

FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate. Under FIRPTA, if you buy U.S. real estate from a foreign person, you may be required to withhold 10% of the amount realized from the sale. The amount realized is normally the purchase price.

If you are classified as a foreign individual, the rate of FIRPTA withholding is 15% of the purchase price. Withhold this particular withholding tax when you close on your property deal. The rate of FIRPTA withholding for a foreign corporation is equal to 21% of the gain.