Personal Services Contract Florida Withholding Tax

Description

How to fill out Florida Summons - Personal Service On An Individual?

How to obtain professional legal documents that adhere to your state's regulations and prepare the Personal Services Contract Florida Withholding Tax without consulting an attorney.

Numerous online services offer templates to address various legal scenarios and formalities.

However, it may require time to determine which of the provided samples satisfy both your needs and legal criteria.

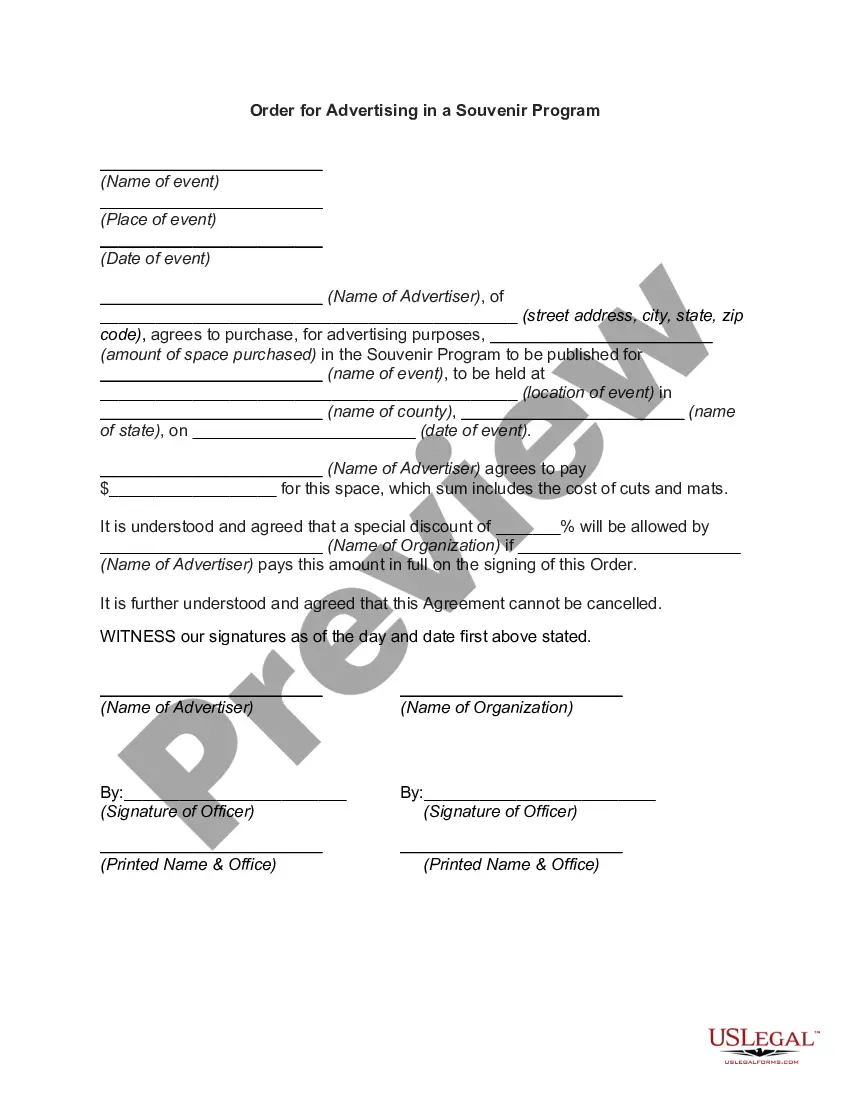

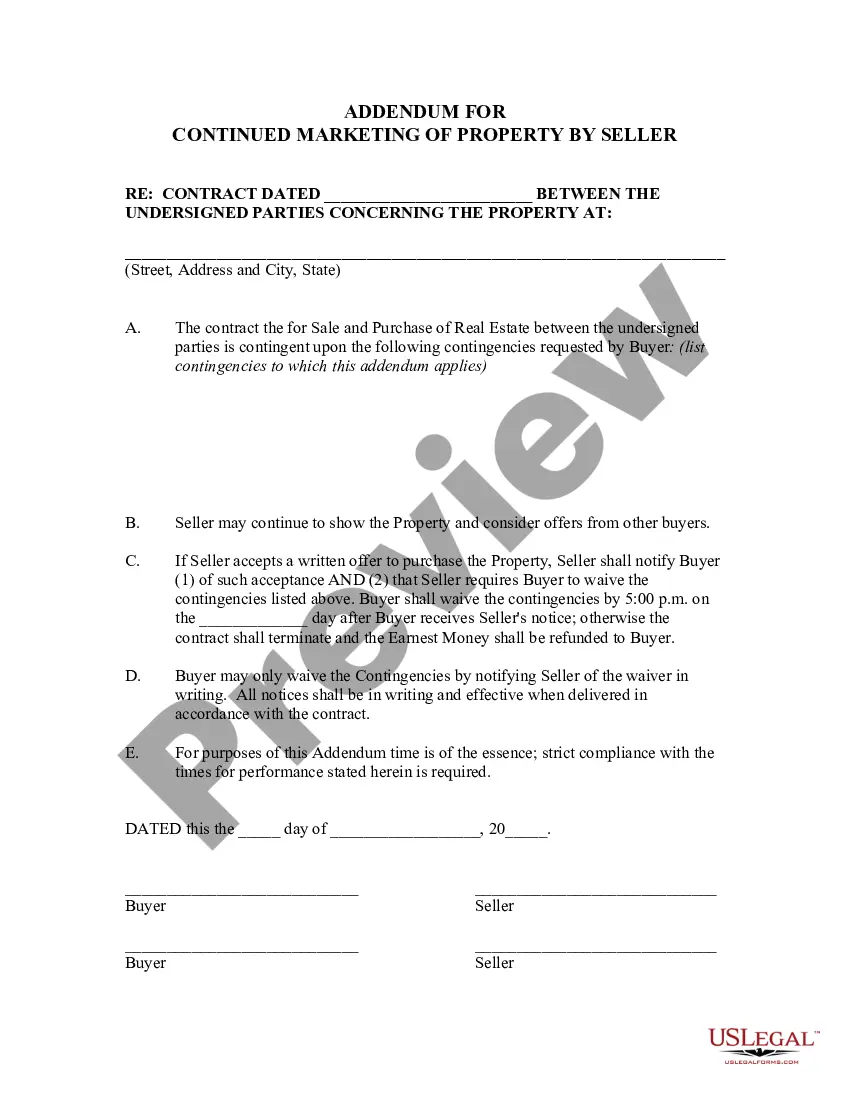

If you already possess an account, Log In to confirm your subscription is active. Download the Personal Services Contract Florida Withholding Tax using the corresponding button beside the file name. If you do not have an account with US Legal Forms, follow the instructions below: Review the web page you opened and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. If needed, search for another sample in the header that corresponds to your state. Click the Buy Now button when you locate the appropriate document. Choose the most fitting pricing plan, and then either Log In or pre-register for an account. Opt for the payment method (by credit card or via PayPal). Change the file format for your Personal Services Contract Florida Withholding Tax and click Download. The acquired documents remain in your ownership: you can always return to them in the My documents tab of your profile. Join our platform and create legal documents independently as if you were an experienced legal professional!

- US Legal Forms is a trustworthy service that assists you in locating official documents crafted according to the latest updates in state law and helps you save on legal fees.

- US Legal Forms is not an ordinary online catalog.

- It is a repository of over 85,000 verified templates for different business and personal situations.

- All documents are organized by region and state to streamline your search process.

- Additionally, it integrates with efficient solutions for PDF editing and electronic signatures.

- This allows users with a Premium subscription to conveniently complete their documentation online.

- It requires minimal effort and time to acquire the necessary paperwork.

Form popularity

FAQ

Personal services include any activity performed in the fields of accounting, actuarial science, architecture, consulting, engineering, health (including veterinary services), law, and the performing arts. 2. They own stock in the corporation at any time during the testing period.

The Personal Services Contract is a formal, written contract. The two parties to the contract are: (1) The person who plans to apply for Medicaid benefits, usually a parent. (2) A trusted person who will provide that person with caregiving services, usually an adult child.

If the caregiver is an independent contractor, the employer must file a Form 1099-MISC and be concerned with potential liability for a work-related injury.

A personal service activity means any business enterprise whose primary purpose is the administration of personal services. For instance, services rendered in the fields of architecture, health, law, engineering, accounting and similar other fields are personal service activities.

(a) A personal services contract is characterized by the employer-employee relationship it creates between the Government and the contractor's personnel. The Government is normally required to obtain its employees by direct hire under competitive appointment or other procedures required by the civil service laws.