Leaseforless

Description

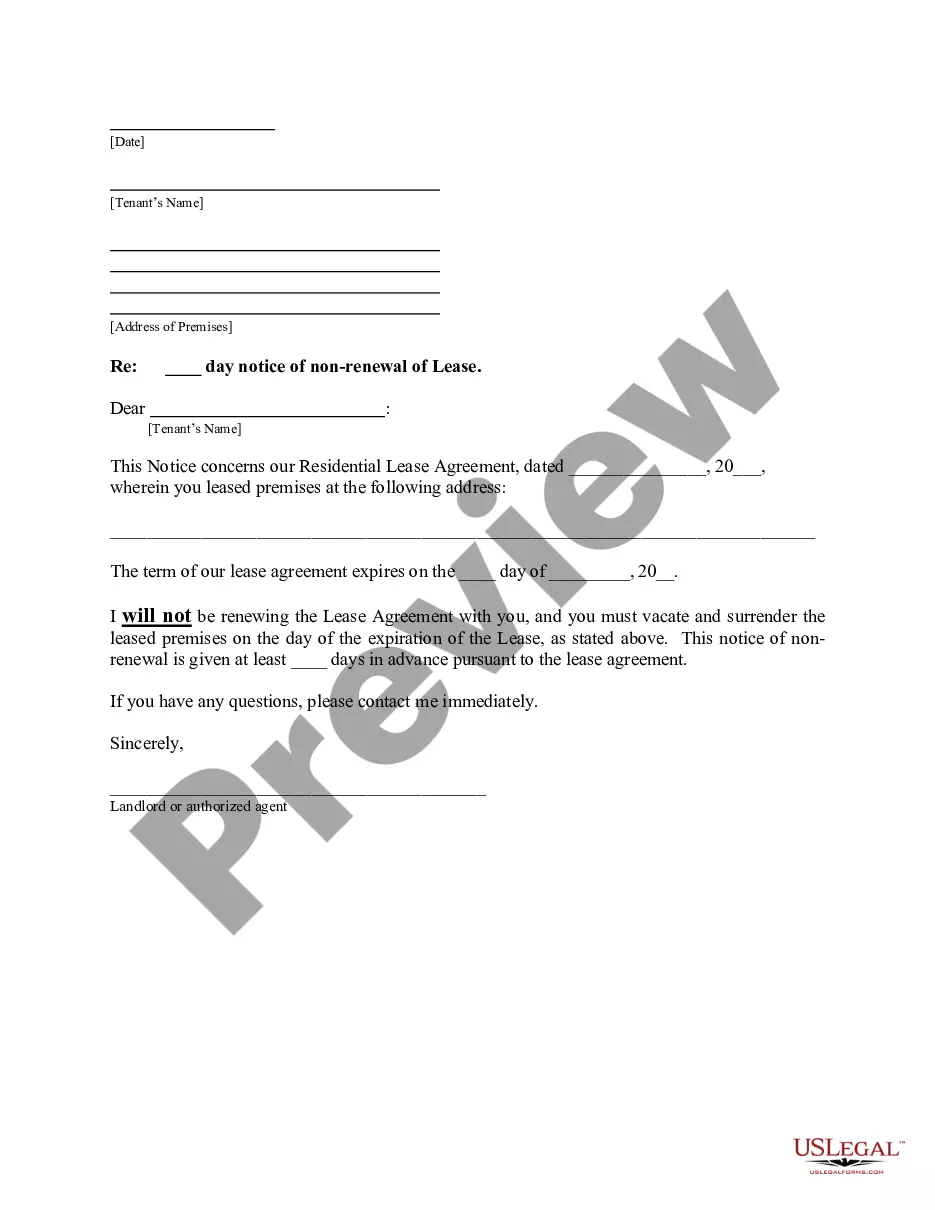

How to fill out Florida Letter From Landlord To Tenant With 30 Day Notice Of Expiration Of Lease And Nonrenewal By Landlord - Vacate By Expiration?

- If you're a returning user, log in to your account and ensure your subscription is in good standing. Click the Download button to save the necessary form template.

- For new users, start by exploring the Preview mode and form descriptions to select the form that fits your legal needs and complies with your local jurisdiction.

- If your chosen form has discrepancies, use the Search tab for alternative templates that better suit your requirements.

- Select the document you need and click on the Buy Now button. Choose your preferred subscription plan and create an account to access the forms library.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download your completed form and save it to your device. You can access it anytime through the My Forms section in your profile.

With US Legal Forms, you can ensure that every document you create is legally sound and precisely tailored to your needs. This resource not only streamlines the document preparation process but also provides access to experts for assistance.

Ready to simplify your legal documentation? Start your journey with US Legal Forms today and experience the convenience of Leaseforless!

Form popularity

FAQ

Dave Ramsey advises against leasing a car because he believes it leads to a cycle of continuous payments without ownership. Leasing can often result in higher costs in the long run, compared to buying a vehicle outright. His perspective encourages individuals to consider long-term savings and investments instead. Utilizing platforms like USLegalForms may provide the necessary information to make smarter financial decisions, allowing you to Leaseforless effectively.

The 1% rule for leasing suggests that your monthly lease payment should not exceed 1% of the vehicle's total MSRP. This guideline helps you ensure that you are not overpaying for your lease. By following this rule, you can better manage your budget and find options to Leaseforless. It's an effective way to evaluate deals and make informed decisions.

You need to file Form 4684 if you are claiming a loss from theft, disaster, or certain other events. This form helps you detail the loss and calculate any applicable deductions. If you are unsure whether your situation requires filing, consulting resources like Leaseforless can help clarify your requirements and provide guidance.

Yes, an LLC can write off a car lease as a business expense, provided that the vehicle is used for business purposes. To maximize deductions, keep accurate records of business use versus personal use. This can lead to significant tax savings for your LLC. Using Leaseforless can help you understand how to best manage these deductions.

Leasing a car for $100 a month can be possible, but it often depends on the make and model of the car, as well as any special promotions from dealerships. Be sure to thoroughly review the lease agreement for any additional fees or requirements. Researching options through Leaseforless could provide you with great leasing strategies that fit your budget.

Yes, you need to report investment losses on your tax return, as they can offset your capital gains and lower your taxable income. This is typically done on Schedule D and Form 8949. By reporting your losses, you can minimize your tax liability and make the most of your investments. Leaseforless offers insightful resources to help you through the reporting process.

To claim a disaster loss on your taxes, you typically file Form 4684 with your return. This form outlines your losses and any compensation received from insurance. It’s important to gather documentation of the disaster, like photos and repair bills, to substantiate your claim. If you need assistance navigating this process, Leaseforless provides resources that can simplify the procedure.

You can claim a totaled car on your taxes if you have suffered a loss from an accident. The loss can be reported on your tax return as a casualty loss, which may help reduce your taxable income. Keep in mind that if you received insurance compensation, the amount you can claim might be impacted. To better understand your options, consider using Leaseforless for straightforward tax solutions.

Several factors can disqualify you from leasing a car, primarily related to your financial health. Poor credit history, high debt-to-income ratio, or a lack of employment history can be major red flags. With Leaseforless, you can easily identify these issues and work toward a viable solution. Remember, knowing what disqualifies you allows you to improve your chances for future applications.

Yes, it's possible to be denied for a car lease, but understanding the reasons can help you improve your chances. Factors such as low credit scores or insufficient income play a significant role. Leaseforless provides insights into what might lead to a denial, so you can take proactive steps to enhance your application. If you encounter a denial, don't be discouraged; you can always re-evaluate your options.