Limited Limited

Description

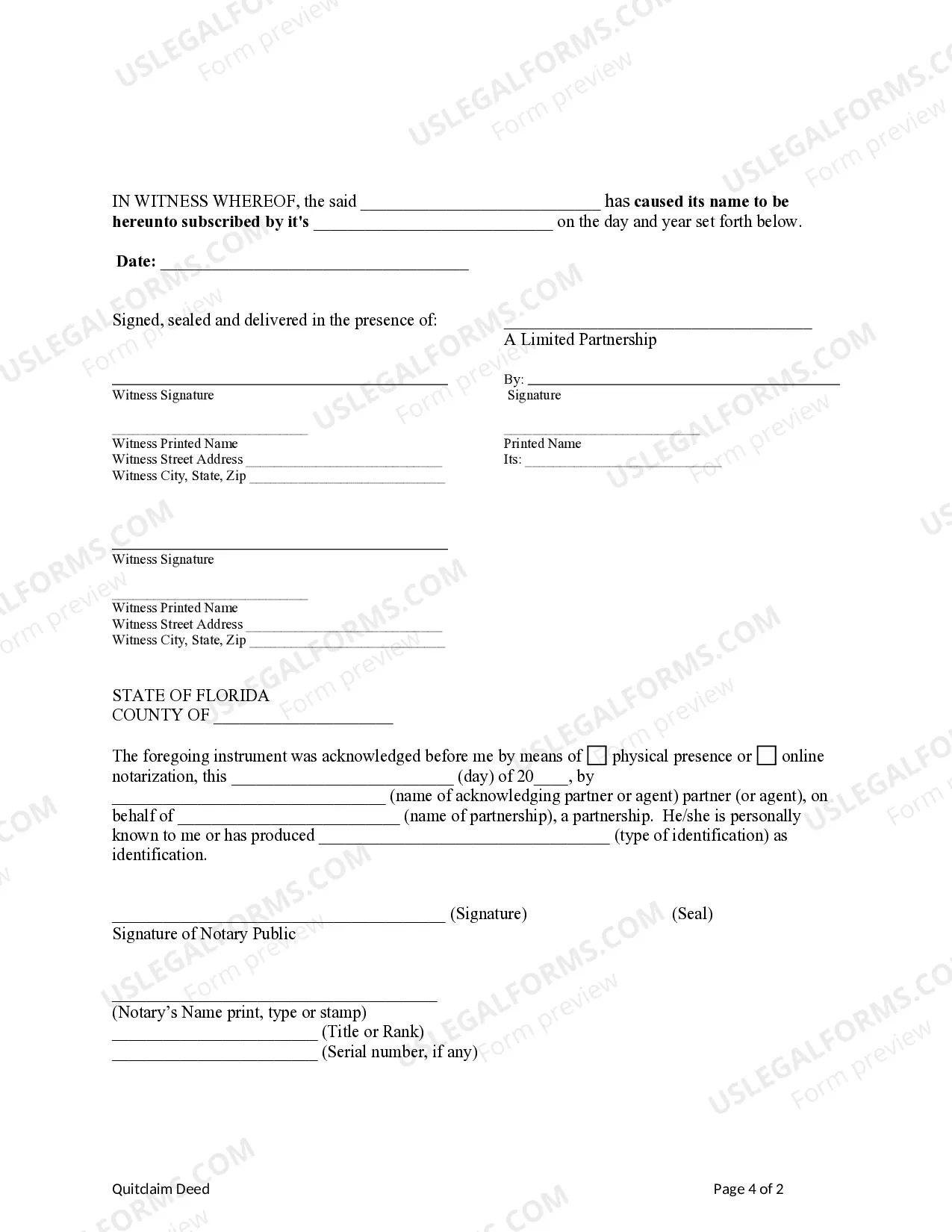

How to fill out Florida Quitclaim Deed From Limited Partnership To Limited Liability Company?

- If you are already a subscriber, log into your account and select the desired form. Ensure your subscription is current; if not, renew it to maintain access.

- For new users, start by browsing through the preview mode. Examine the form descriptions to find a template that fits your specific legal requirements and adheres to local jurisdiction guidelines.

- If you need a different template, utilize the search functionality above to find the correct form. Once you identify what you need, proceed to the next step.

- Purchase the chosen document. Click on the 'Buy Now' button, select a subscription plan that suits your needs, and create an account for library access.

- Complete your transaction by entering your payment details or by using your PayPal account for seamless processing.

- Download your selected form to your device. You can also revisit it later via the My Forms section of your profile.

In conclusion, US Legal Forms simplifies the process of creating legal documents, combining a wide array of forms with expert assistance for an efficient experience. Embrace the ease and effectiveness of legal documentation today!

Start crafting your legal documents now!

Form popularity

FAQ

An LLC is generally not limited to 100 members, as this limitation applies specifically to S corporations. LLCs can have an unlimited number of members, offering greater flexibility in ownership. This is one of the reasons many business owners choose LLCs for their ventures, as they support a limited limited structure while providing room for growth.

Completing a W9 with your LLC involves several key steps. After entering your LLC name, specify your tax classification as either 'C' or 'S' corporation. Then, be sure to provide your taxpayer identification number, which should be the LLC's EIN if you have one. This clear guidance can simplify your tax filing process while ensuring your limited limited status is correctly represented.

To fill out a limited power of attorney form, start by identifying the principal (the person granting the authority) and the agent (the trusted individual receiving the authority). Clearly outline the specific powers you are granting along with the duration of the authority. Lastly, ensure that both the principal and the agent sign and date the form. Following these steps will help you establish clear, limited limited authority.

Determining whether your LLC is an S or C Corporation depends on how you choose to classify your business tax-wise with the IRS. Generally, an LLC can be taxed as a sole proprietorship, partnership, S Corporation, or C Corporation, depending on your elections. To find out your classification, check with your tax advisor or review your previous tax filings. Understanding this distinction is key to managing your limited limited obligations.

When filling out a W-9 for an LLC, first, write your LLC name as it appears on official documents. Then, check the box for 'Limited Liability Company' and specify the tax classification, choosing either 'C' for a corporation or 'S' for an S Corporation. Provide your address and the taxpayer identification number associated with your LLC. This comprehensive approach ensures your W-9 reflects your LLC's limited limited status.

To fill out a W9 form correctly, start by providing your name and business name if applicable. Make sure to check the right box for your entity type, and include your address and taxpayer identification number. Finally, sign and date the form, confirming that the information is accurate. By completing these steps correctly, you contribute to a limited limited compliance with tax regulations.

The rarest Roblox limited items are often determined by their availability and demand among players. One example is the 'Dominus' series, which includes some of the most sought-after limiteds in the game. These items can command high prices in the marketplace, as collectors search for exclusive limited limited. To find out more about rare items, browse community discussions and dedicated Roblox marketplaces.

Yes, Roblox continues to release limited items, maintaining a vibrant marketplace for players. These limited items often come out during special events or as part of promotional campaigns. Players should be attentive to news from Roblox as well as community forums to stay updated on when new limiteds become available. Staying engaged will enhance your experience with Roblox's limited limited offerings.

The start-up costs for an LLC can include state filing fees, legal costs, and other setup expenses. Typically, you should budget for around $500 to $1,000 to cover these necessary fees. It's essential to account for ongoing costs as well, such as taxes and renewal fees. For complete guidance on initial and future expenses, uslegalforms offers resources to help you understand and manage these costs efficiently.

You can use 'limited' in some contexts, but it is essential to understand that they are not interchangeable. In the United States, the designation 'LLC' stands for 'Limited Liability Company', which provides specific legal protections and benefits. Limited limited companies may have different implications based on state laws and regulations. For accurate guidance, consider consulting with uslegalforms to ensure you choose the right entity for your needs.