Limited Company Meaning

Description

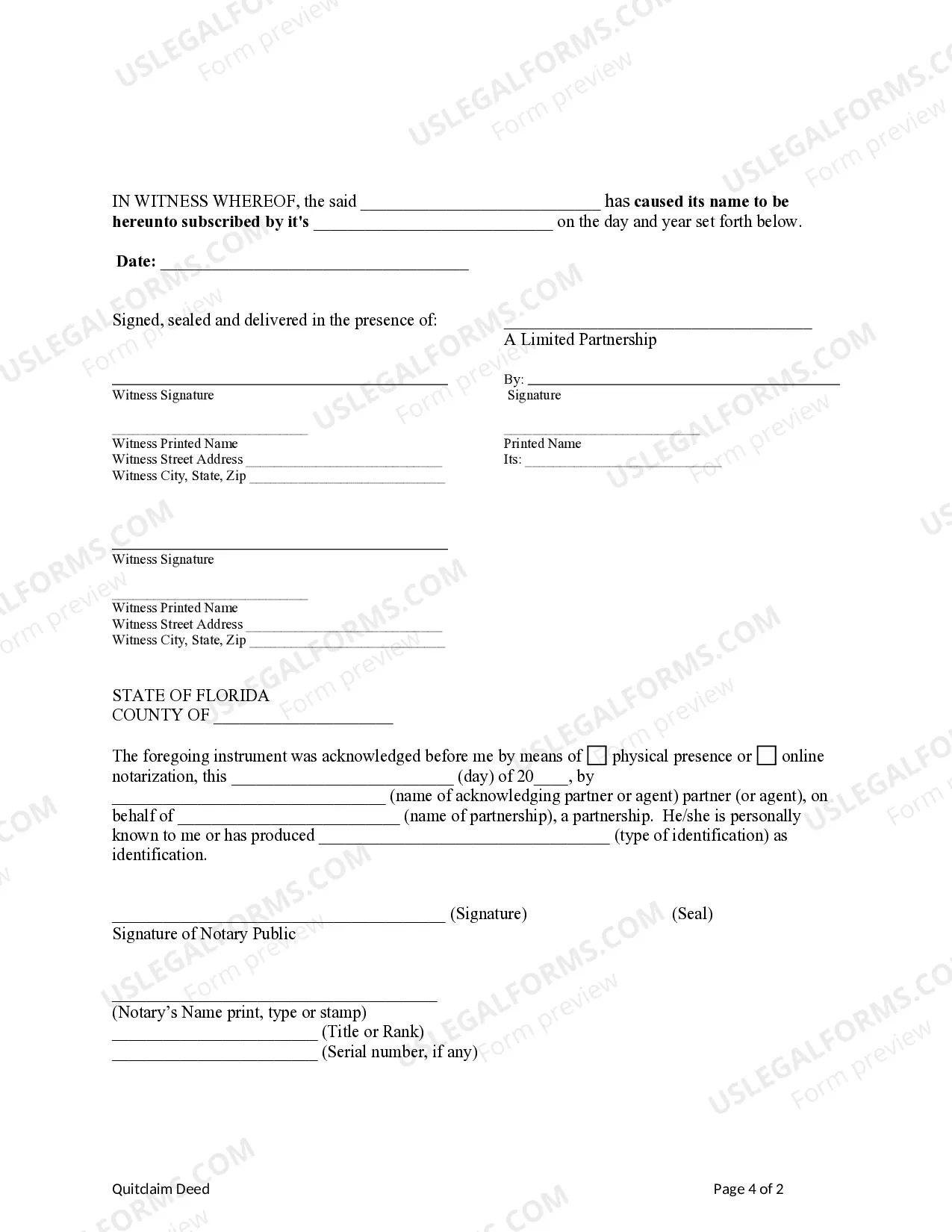

How to fill out Florida Quitclaim Deed From Limited Partnership To Limited Liability Company?

- Visit the US Legal Forms website and log in to your account if you are an existing user. Ensure your subscription is valid for seamless access.

- For new users, browse through the extensive database of over 85,000 legal templates. Use the Preview mode to verify that the selected form meets your local jurisdiction requirements.

- If you do not find the right form, utilize the Search tab to explore additional templates until you locate one that fits your needs.

- Once you've found the desired document, click on the 'Buy Now' button to select your subscription plan. Create an account for full access to the legal library.

- Complete your purchase by entering your payment details, either through a credit card or PayPal, to finalize your subscription.

- After your payment is processed, download the form directly to your device. You can access it anytime through the 'My Forms' section of your profile.

Utilizing US Legal Forms not only simplifies the document acquisition process but also guides you through the legal complexities involved in establishing a limited company.

Start your journey towards forming a limited company today by visiting US Legal Forms and accessing a wealth of resources at your fingertips!

Form popularity

FAQ

A limited company needs to file several important documents to remain compliant with the law. This typically includes annual accounts, confirmation statements, and corporation tax returns. Ensuring timely submission of these documents is crucial to maintain the company's status. Grasping the limited company meaning can inform you about these essential filing requirements.

One significant disadvantage of a limited company is the complexity involved in its operation. Unlike sole proprietorships, limited companies must adhere to stricter regulations and filing requirements. This means additional paperwork and legal obligations, which can be time-consuming and costly. Understanding the limited company meaning helps clarify these challenges.

The objective of a limited company is to generate profits while protecting shareholders from risks associated with the business operations. This structure encourages growth and investment, driven by clear objectives and regulated liabilities. Familiarizing yourself with the limited company meaning can help guide your strategic planning and risk management efforts.

You become a limited company when you register your business with the appropriate government authorities, specifying that it is a separate legal entity. This registration process typically includes choosing a unique company name and filing necessary paperwork. Knowing the limited company meaning is crucial to ensure compliance with ongoing legal obligations, like annual reporting.

The main purpose of a limited company is to offer a legal distinction between the business and its owners, minimizing personal liability. This setup not only arms business owners with legal protection but also elevates the business's professional image. To fully grasp the limited company meaning, you should consider how it facilitates investment and financing options.

While a limited company has significant advantages, there are also some drawbacks. It can involve more paperwork and regulatory requirements compared to sole proprietorships. Additionally, understanding the limited company meaning is essential because profits may be subject to corporation tax before being distributed to shareholders.

The purpose of a limited company is to provide a clear structure for business operations while protecting the owners' personal assets. This means that in the event of debts or legal issues, your personal property remains secure. Understanding the limited company meaning can help you navigate tax advantages and enhance credibility in your business dealings.

A limited company is a type of business entity where the owners' liability is limited to the amount they invested in the company. This structure protects personal assets from business debts, making it an attractive choice for many entrepreneurs. In simple terms, a limited company offers a legal framework that balances risk and reward. Understanding this structure enhances your grasp of the limited company meaning.

If a business is classified as a limited company, it signifies that the owners have limited personal liability for debts and obligations of the company. As a result, their personal assets are generally protected from business liabilities. This structure is advantageous as it encourages entrepreneurship while offering a safety net. Thus, the limited company meaning encompasses these protective features.

While both a limited company and an LLC provide liability protection, the key difference lies in their formation and management. A limited company is a broader term that can encompass different types of companies that limit the owners' liability, including corporations. An LLC, however, is specifically designed to provide more flexibility in management and tax benefits. Knowing these differences clarifies the limited company meaning in relation to your business.