Quitclaim Deed For Property

Description

How to fill out Florida Quitclaim Deed - One Individual To Two Individuals / Husband And Wife - With Life Estate In An Individual?

- If you're an existing US Legal Forms user, start by logging into your account. Ensure your subscription is active for uninterrupted access to forms.

- For new users, first, browse through the extensive preview mode and descriptions to ensure you select the correct quitclaim deed that meets local jurisdiction requirements.

- In case you need a different form, utilize the Search feature to locate the appropriate quitclaim deed template tailored to your needs.

- Once you’ve identified the right document, click 'Buy Now' and select your subscription plan. You'll need to create an account to use the library.

- Complete your purchase by entering your payment information—either through credit card or PayPal.

- After payment, download the quitclaim deed and save it for completion, or access it anytime from the 'My Forms' section of your account.

Utilizing US Legal Forms not only offers you access to a vast collection of templates but also connects you with premium experts who can assist with form completion.

Start your journey to streamline property transfers by taking advantage of our resources today!

Form popularity

FAQ

The main purpose of a quitclaim deed for property is to transfer interest in real estate without making promises about the property’s condition. This deed serves as an efficient way to relinquish ownership among family members or when settling a divorce. It allows the grantor to quickly transfer whatever rights they have, which can be beneficial in informal arrangements. However, it's crucial to ensure clarity and understanding of the transfer process, making resources like US Legal Forms invaluable.

The disadvantages of a quitclaim deed for property include potential risks related to ownership claims and title issues. Since the deed does not ensure a clear title, it puts the recipient in a vulnerable position. Furthermore, if the original owner has unresolved debts or disputes regarding the property, the new owner might face legal challenges. It’s vital to assess these risks and, if necessary, seek solutions, such as using US Legal Forms to simplify the process.

Yes, you can complete a quitclaim deed for property on your own, especially if you have a simple situation. It's advisable to use reliable templates or resources that guide you through the process. However, be mindful of specific state requirements that must be met for the deed to be valid. Leveraging platforms like USLegalForms can ensure you have the correct documentation and help you avoid common mistakes.

The typical reason for using a quitclaim deed for property is to transfer ownership without warranties or guarantees. People often opt for this type of deed in family situations, such as when parents want to transfer their home to their children. The simplicity and speed of this process are appealing, but it’s essential to ensure everyone understands the potential risks involved. When in doubt, platforms like USLegalForms can provide proper guidance and forms.

Quitclaim deeds for property are most frequently used for transfers between family members or to clear up property disputes. They help simplify the process when there are no disputes about ownership or when the parties involved trust one another. This type of deed is especially practical in situations like inheritance or when one party leaves a home. Being aware of the implications is crucial, so consulting experts can be beneficial.

Many people choose quitclaim deeds for property during transfers among family members, such as gifting property or settling estate issues. They are quick and easy to execute, making them a popular choice for informal asset transfers. Additionally, quitclaim deeds are often used in divorce settlements, allowing one spouse to relinquish their claim to a property. However, always consider legal advice to ensure proper handling.

Quitclaim deeds for property are often viewed with caution due to their lack of guarantees. Unlike warranty deeds, a quitclaim deed does not assure that the title is clear of liens or encumbrances. This can pose risks to the grantee, as they may inherit debts linked to the property. Thus, it's wise to conduct thorough title research or seek professional guidance before proceeding.

Yes, you can create your own quitclaim deed for property in Michigan. However, it's important to ensure that the document meets all legal requirements in the state. While online resources and templates can assist you, consulting a legal expert can help avoid potential issues. Using platforms like USLegalForms can provide you with accurate forms that comply with Michigan laws.

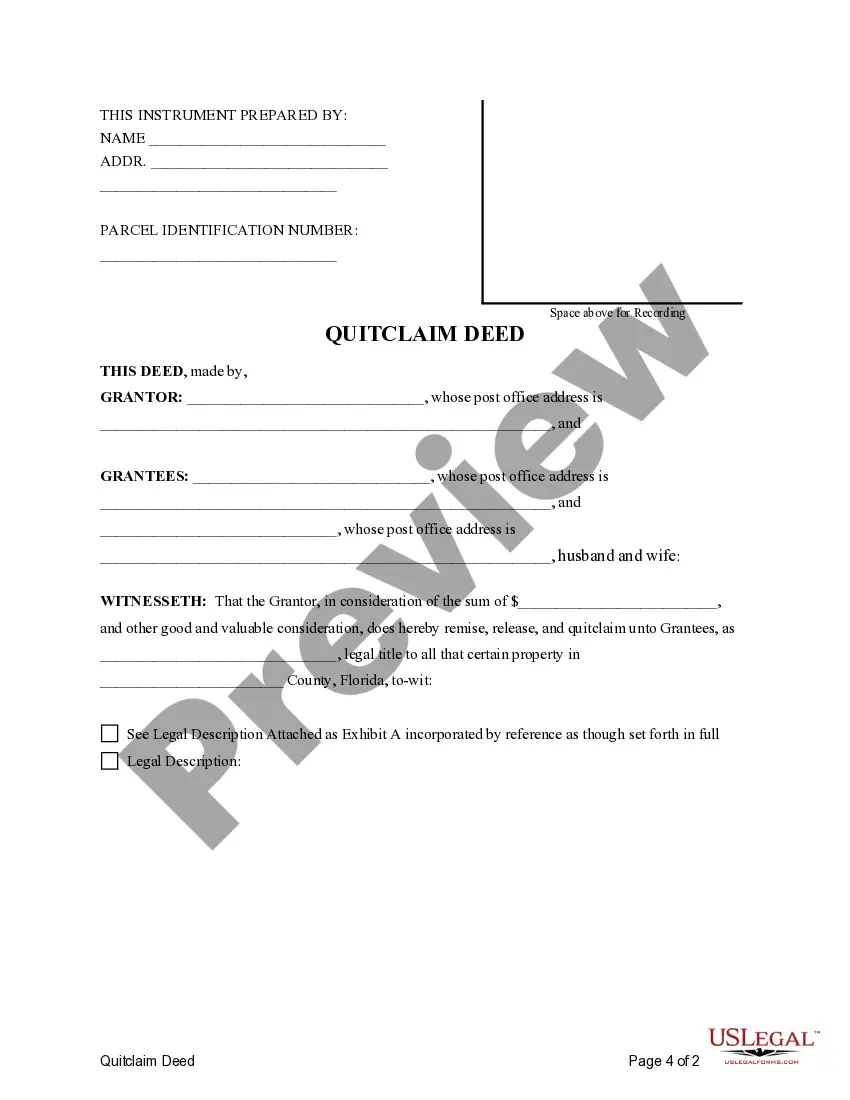

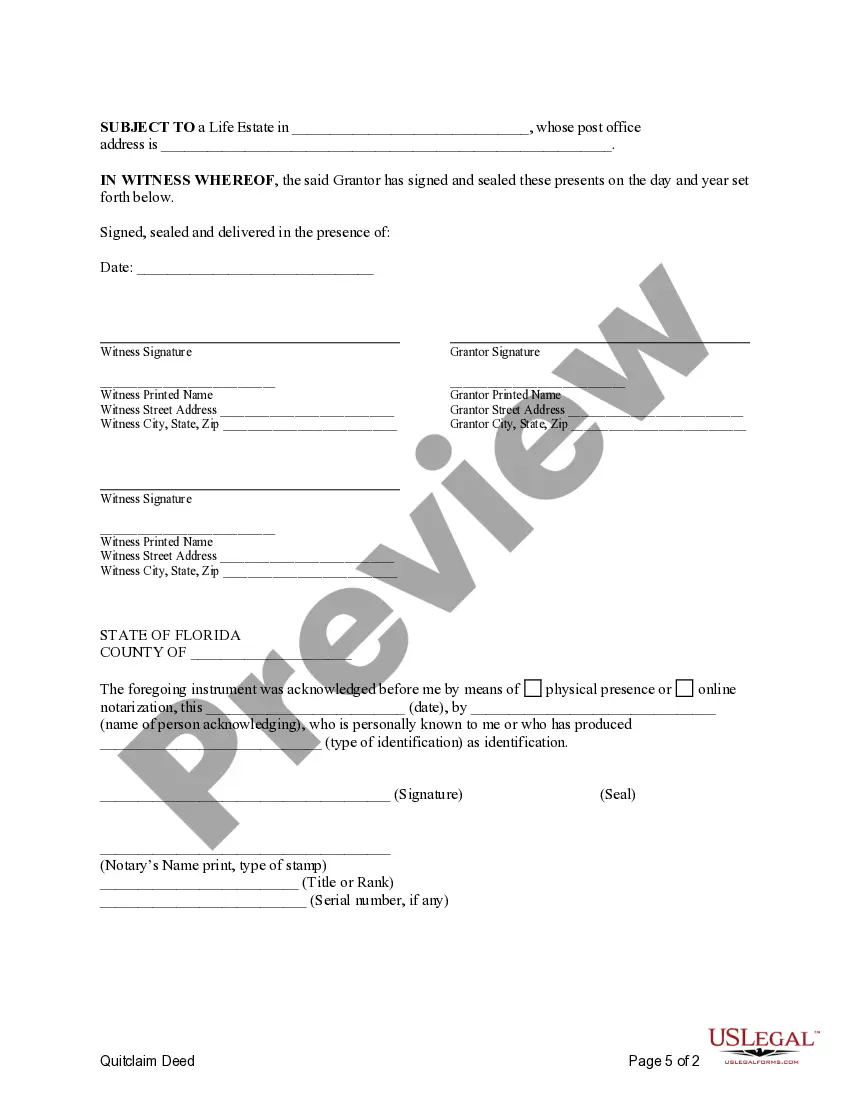

To properly fill out a quitclaim deed for property, start by gathering necessary information about the parties involved and the property description. Clearly indicate the names of the grantor and grantee, along with the legal description of the property. Ensure you provide space for both signatures and verify any additional requirements based on your state’s regulations. Consider using platforms like US Legal Forms to access templates and guidance, making the process smoother.

A quitclaim deed for property can have drawbacks, primarily due to its lack of guarantees. It does not offer the buyer any security regarding unknown claims or encumbrances on the property. This absence of legal assurances means that buyers might unknowingly inherit risks associated with the property's title. Therefore, understanding these risks is crucial when considering the use of a quitclaim deed.