Quitclaim Deed For Arkansas

Description

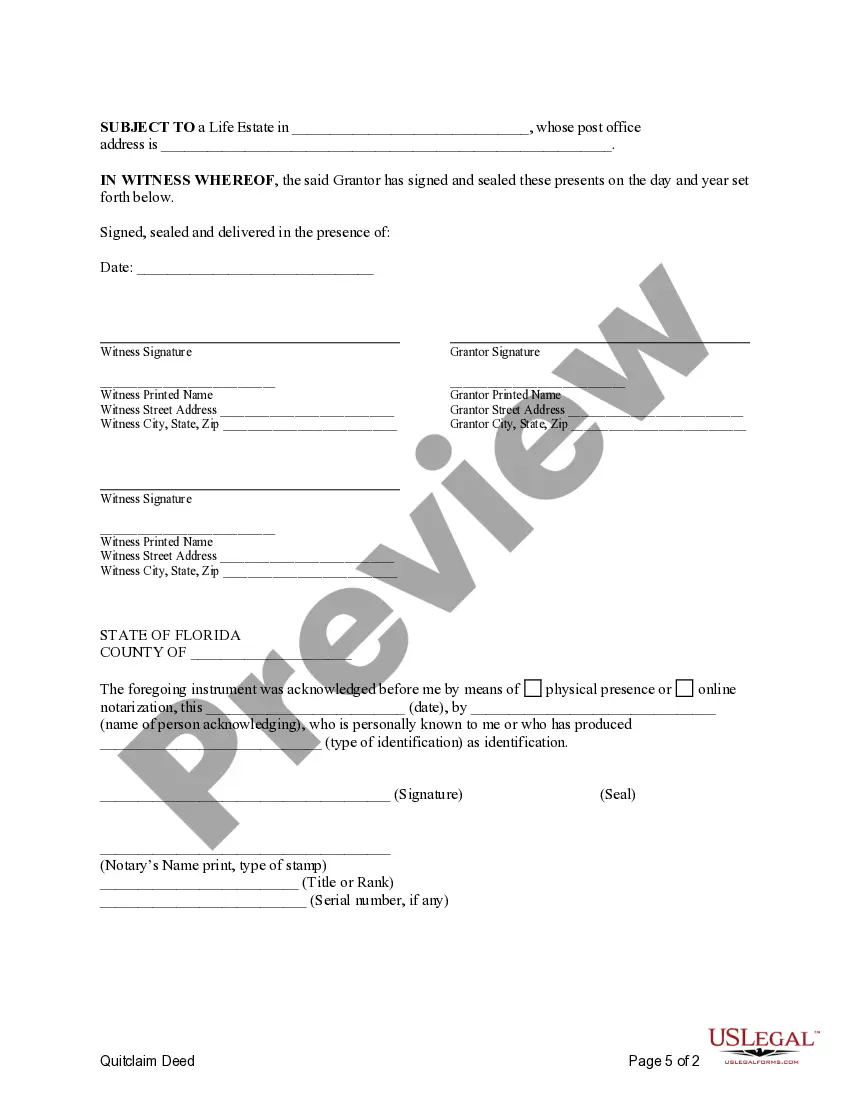

How to fill out Florida Quitclaim Deed - One Individual To Two Individuals / Husband And Wife - With Life Estate In An Individual?

- Log in to your US Legal Forms account if you're already a member. Make sure your subscription is active to access the forms you need.

- If this is your first visit, start by checking the preview and description of the quitclaim deed template. Confirm that it complies with Arkansas regulations.

- Search for alternative templates if necessary. Use the Search tab to ensure you have the correct form that meets your requirements.

- Proceed to purchase the document by clicking on the Buy Now button. You’ll need to select a subscription plan that fits your needs.

- Complete your payment by entering your credit card information or using your PayPal account to finalize the purchase.

- Download the quitclaim deed template to your device. It will also be accessible anytime in the My Forms section of your profile.

By leveraging US Legal Forms, you gain access to a vast library of over 85,000 legal documents, ensuring that you have the most relevant forms at your fingertips. This service not only saves you time but also provides an opportunity to consult with legal experts for enhanced accuracy in your documents.

In conclusion, obtaining a quitclaim deed for Arkansas is made simpler with US Legal Forms. Start your process today and ensure your property transfer is seamless and legally sound!

Form popularity

FAQ

Yes, you can prepare a quitclaim deed for yourself in Arkansas, but it's essential to understand the process and requirements involved. While forms are available online, utilizing a resource like US Legal Forms can help you avoid common mistakes. This platform offers ready-to-use templates and guides, ensuring that your quitclaim deed meets all legal standards for a smooth transaction.

Not all notaries can notarize a quitclaim deed for Arkansas. The notary must be commissioned in the state of Arkansas and authorized to perform notarial acts. It's crucial to verify that the notary understands the requirements for notarizing property documents to ensure the deed is valid.

Several factors can void a quitclaim deed for Arkansas. If the deed contains fraudulent information or was signed under duress, it may be considered invalid. Additionally, if the grantor did not have the legal capacity to transfer the property or the deed was not properly notarized and recorded, it may not hold up in court.

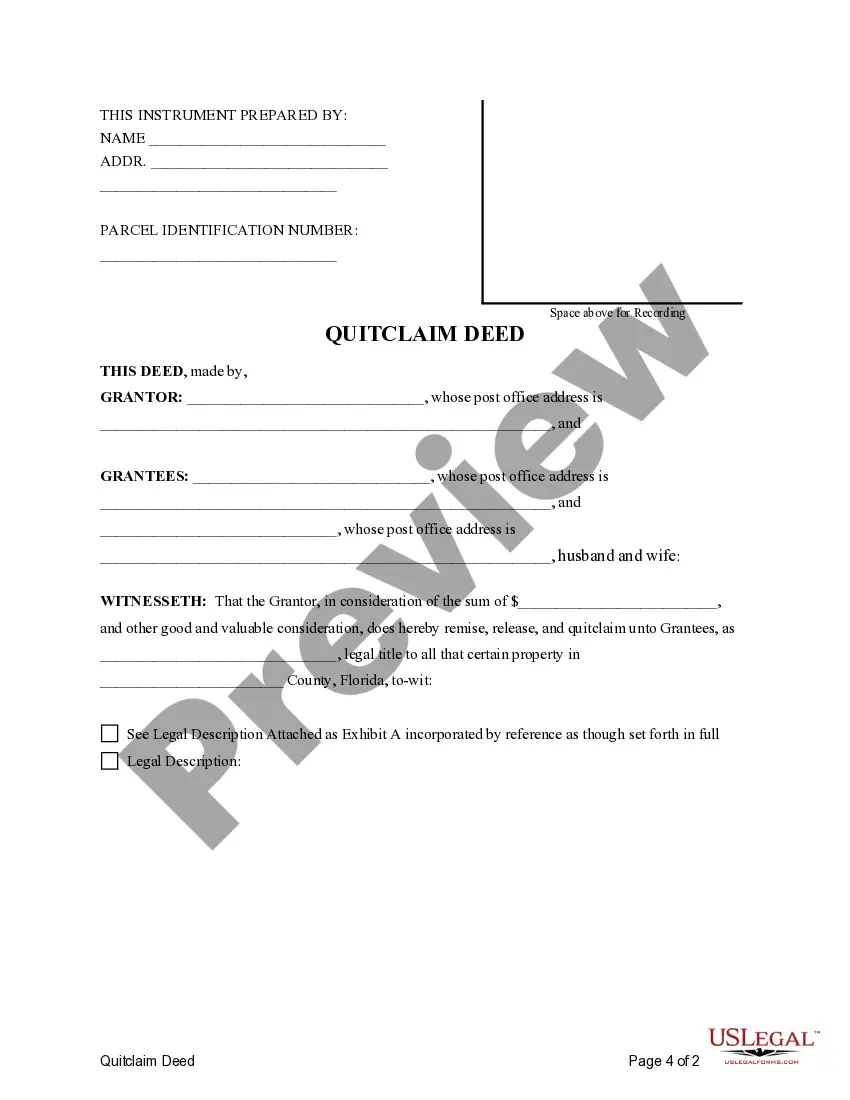

To file a quitclaim deed for Arkansas, you must first complete the deed with the required information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Once completed, you need to sign the deed in front of a notary public. After notarization, submit the deed to the county clerk's office where the property is located to ensure it is recorded properly.

Quitclaim deeds are often viewed with caution due to the potential risks involved. Unlike warranty deeds, quitclaims do not guarantee that the grantor holds clear title to the property, which can lead to disputes later. People may worry about the lack of assurances regarding existing liens or encumbrances. However, when used correctly, a quitclaim deed for Arkansas can serve specific needs, such as transferring property between family members or quickly clearing title issues.

Yes, a quitclaim deed must be notarized in Arkansas to be legally valid. This process ensures that both parties have agreed to the terms and are signing willingly. Notarization provides an extra layer of protection and verification for property transactions. When using a quitclaim deed for Arkansas, you can trust that having it notarized will help confirm the authenticity of the document.

Certainly, you can do a quit claim deed yourself if you feel comfortable with the process. To do this for Arkansas, gather the required documents and fill out the quitclaim deed form carefully. After completing it, file the deed in the local clerk's office. For those seeking ease and security, using platforms like US Legal Forms can provide helpful resources to make the process smoother.

Yes, you can complete a quitclaim deed on your own in Arkansas, provided you follow the necessary steps. It involves drafting the deed, ensuring it meets Arkansas's legal requirements, and filing it with your local clerk’s office. However, for added assurance, you might want to check resources from US Legal Forms that offer guided templates, as they can simplify the process and ensure accuracy.

To effectively get a quitclaim deed for Arkansas, you can visit your local county clerk's office or use an online platform like US Legal Forms. Simply fill out the necessary forms, ensuring all information is accurate and complete. Once completed, submit them to the appropriate office along with any required fees. This process facilitates a smooth transfer of ownership without unnecessary delays.

While a quitclaim deed for Arkansas is generally simple, it carries risks, particularly regarding title issues. Since this deed does not guarantee that the title is clear, the grantee may inherit undisclosed liens or claims. Additionally, this form of deed offers no warranty, meaning if legal issues arise, the grantor typically bears no responsibility. Therefore, it is crucial to understand these potential drawbacks before proceeding.