Quit Claim Deed Form For Florida

Description

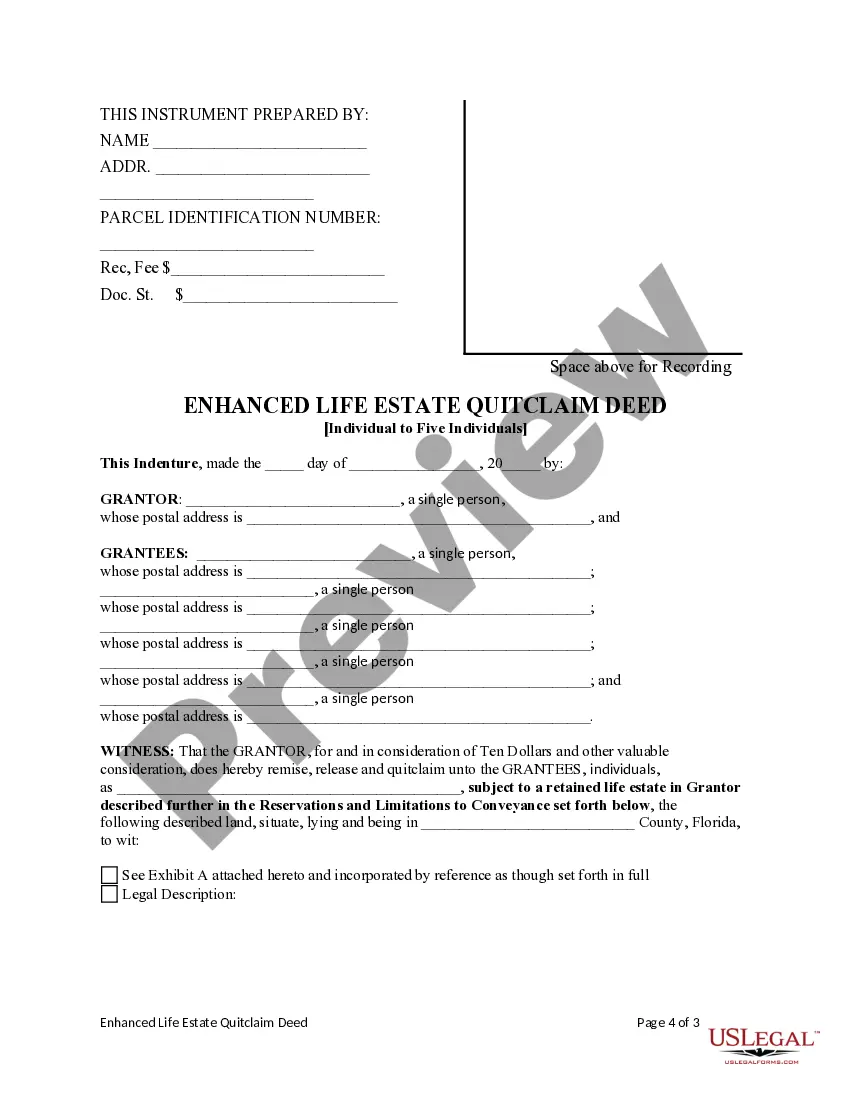

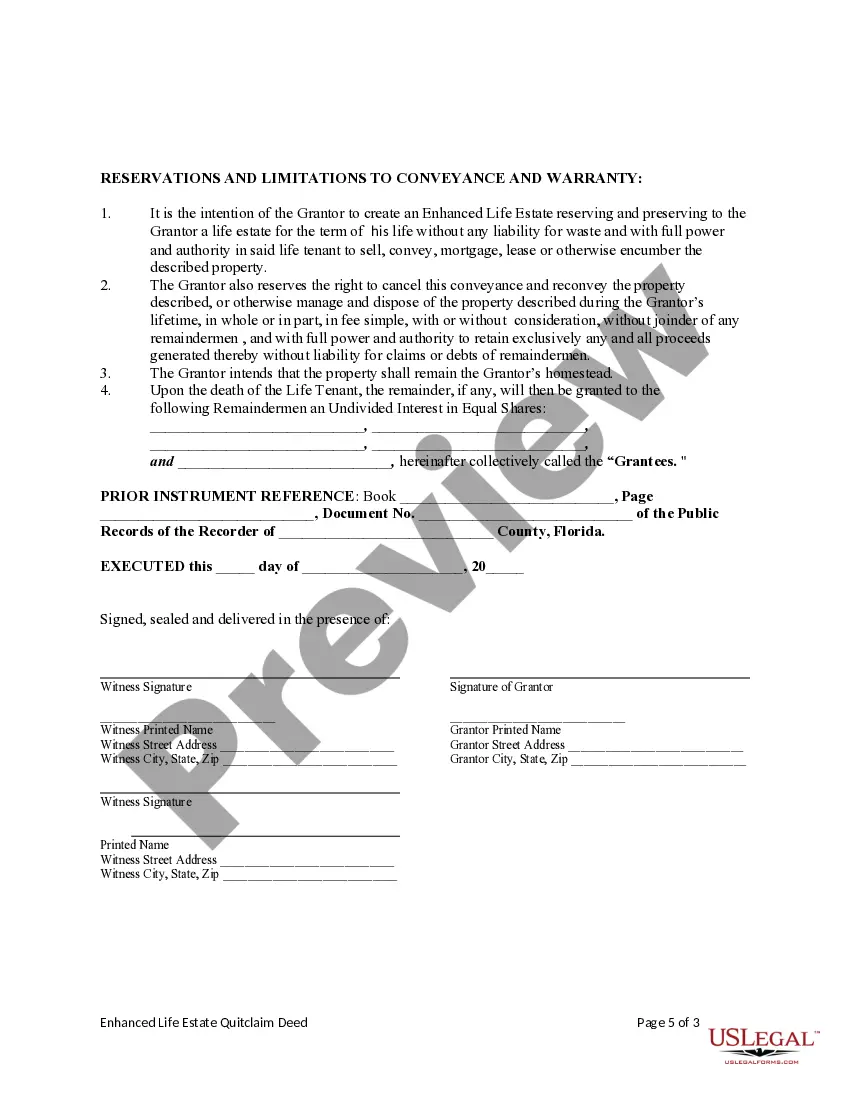

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Individual To Five Individuals?

Obtaining a reliable source for the most up-to-date and pertinent legal templates is a major part of navigating bureaucracy.

Finding the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to gather samples of Quit Claim Deed Form For Florida exclusively from trustworthy providers, such as US Legal Forms. A faulty template will squander your time and postpone your current situation. With US Legal Forms, you have minimal concerns.

After obtaining the form on your device, you can modify it using the editor or print it out and complete it manually. Eliminate the stress associated with your legal documentation. Browse the comprehensive US Legal Forms library to discover legal templates, verify their applicability to your situation, and download them immediately.

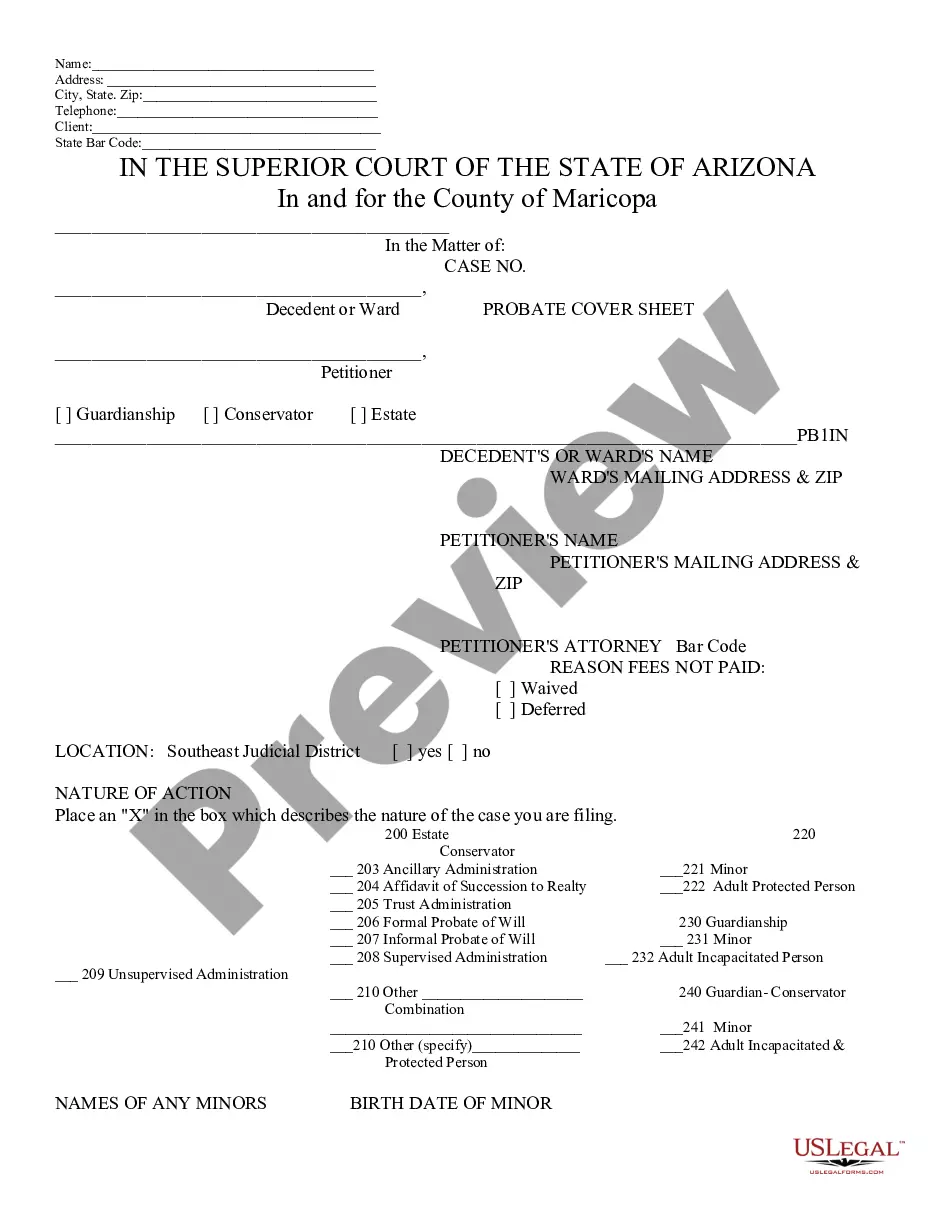

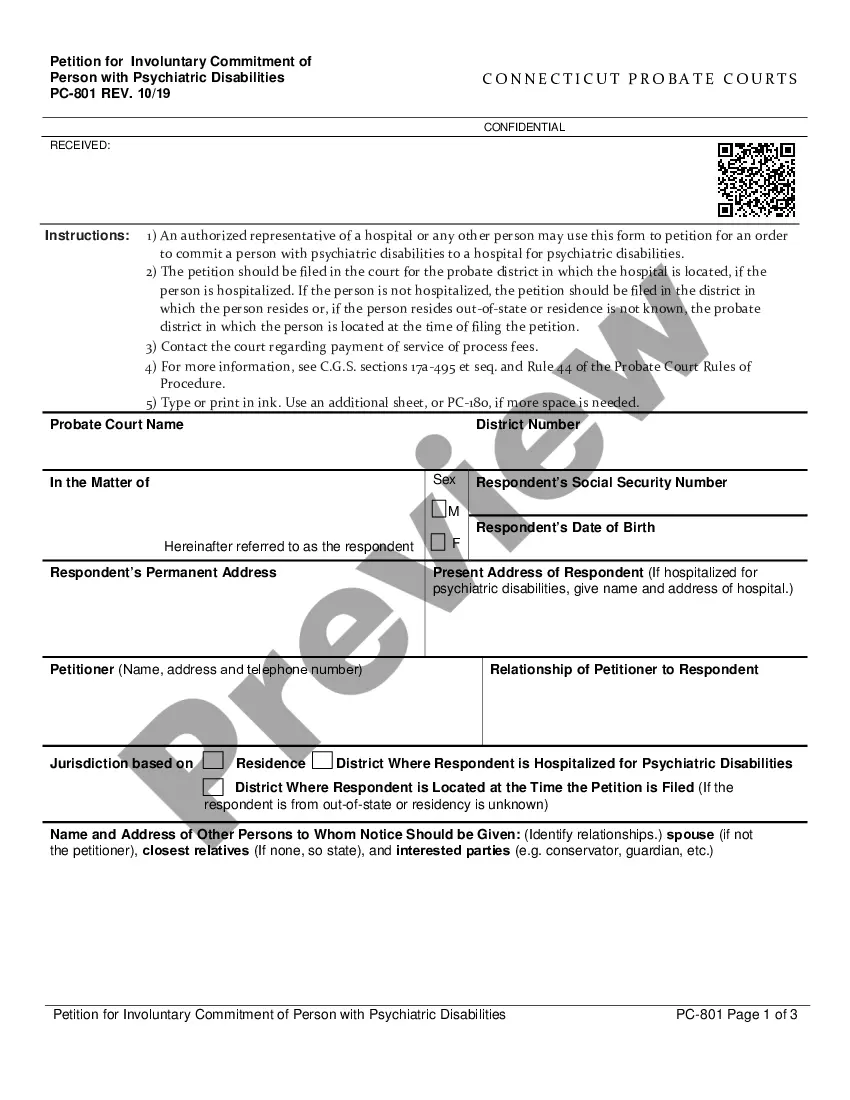

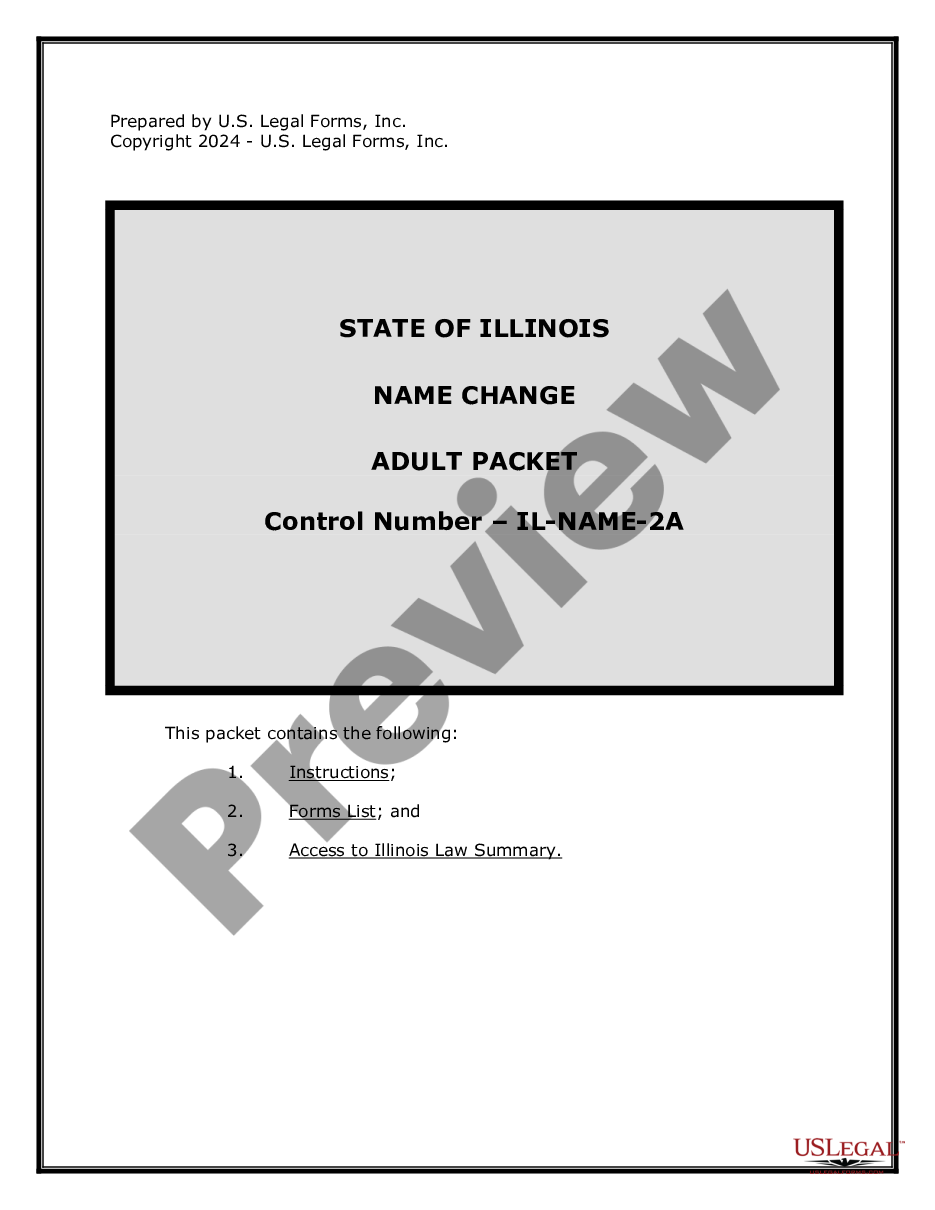

- Utilize the catalog navigation or search box to find your template.

- Examine the form’s details to ensure it meets the criteria for your state and locality.

- View the form preview, if accessible, to confirm that the template is what you need.

- Continue searching and locate the suitable template if the Quit Claim Deed Form For Florida does not fulfill your requirements.

- Once you are certain about the form’s appropriateness, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to purchase the template.

- Select the payment plan that fits your needs.

- Proceed with the registration to complete your order.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Quit Claim Deed Form For Florida.

Form popularity

FAQ

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

Quitclaims are typically taxable The person giving the gift is responsible for paying tax, and the recipient doesn't have to report the gift at all. There are some exclusions, however. In 2022, one person can gift another person up to $16,000 in cash or assets in a calendar year without paying tax on the gift.

If properly executed, a Florida quitclaim deed usually requires two weeks to three months to be recorded. The parties involved in real estate transactions generally seek to record the deed immediately after the closing process is concluded.

A seller can allow a buyer's attorney to prepare the deed or the seller can retain a Daytona real estate attorney to represent the seller during the real estate closing process. All deeds executed in Florida must be signed in the presence of a notary public and two witnesses.

Ing to Florida Statute 695.26, a quitclaim deed must contain these certain elements: Name and address of person preparing the deed. Grantor's name and address. Grantee's name and address. Signatures of the grantors. Two witnesses for each signature/ Notary acknowledgment with signature.