Florida Deed Quitclaim Form With Notary

Description

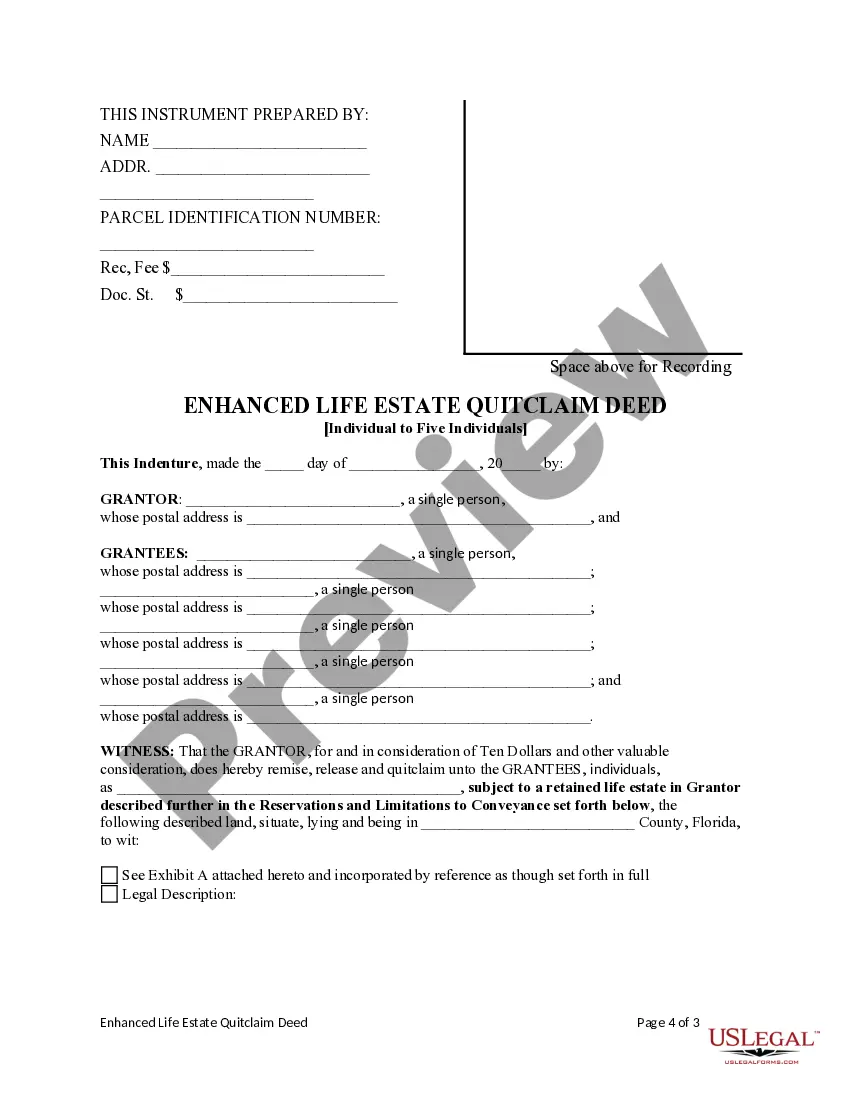

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Individual To Five Individuals?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more affordable approach to preparing the Florida Deed Quitclaim Form With Notary or any other paperwork without unnecessary complications, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal professionals.

Ensure that the form you select aligns with the regulations of your state and county. Choose the most suitable subscription plan to acquire the Florida Deed Quitclaim Form With Notary. Download the form, then complete, sign, and print it. US Legal Forms prides itself on an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- Utilize our platform whenever you require dependable services that allow you to effortlessly locate and download the Florida Deed Quitclaim Form With Notary.

- If you’re already familiar with our services and have previously created an account, simply Log In to your account, select the form, and download it, or re-download it anytime in the My documents section.

- Don’t possess an account? No worries. Setting it up takes minimal time, allowing you to explore the library.

- Before proceeding to download the Florida Deed Quitclaim Form With Notary, adhere to these suggestions.

- Examine the document preview and descriptions to confirm that you are selecting the correct form.

Form popularity

FAQ

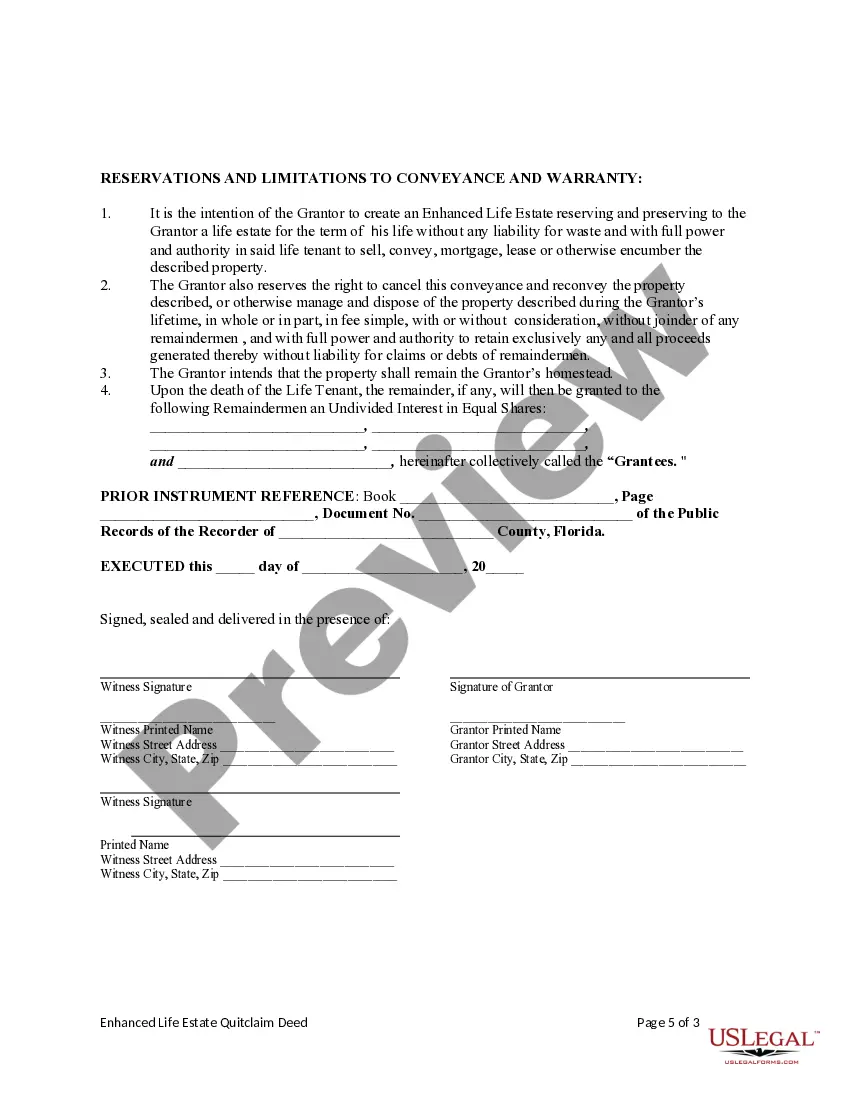

Hear this out loud PauseWhile the act of recording a quitclaim deed makes the transfer official in public records, Florida law does not mandate such recordation for the deed's validity. However, the state does emphasize the importance of recording the transfer of ownership interest in public records to maintain an accurate chain of title.

A quit claim deed should be filed with the clerk of court in the county where the property is located. This will involve taking the deed to the clerk's office and paying the required filing fee (typically about $10 for a one-page quit claim deed).

Hear this out loud PauseIn Florida, the grantor must sign a quitclaim deed in the presence of a notary public and have it witnessed by two disinterested parties. The notary must then sign and affix their official seal to the document.

Hear this out loud PauseIf you wish to remove someone from a deed, you will need their consent. This can be done by recording a new deed, which will require their signature. If the person in question is deceased, you will need their death certificate and a notarized affidavit along with the new deed.

Hear this out loud PauseQuitclaims are typically taxable The person giving the gift is responsible for paying tax, and the recipient doesn't have to report the gift at all. There are some exclusions, however. In 2022, one person can gift another person up to $16,000 in cash or assets in a calendar year without paying tax on the gift.