Florida Transfer Death With Mortgage

Description

Form popularity

FAQ

When someone dies in Florida, the mortgage does not automatically disappear. The responsibility for the mortgage typically shifts to the estate or the inheritor. If a Florida transfer death with mortgage is in place, the inheritor must continue making payments to avoid foreclosure. Consulting a legal professional can help you navigate this situation effectively.

The best way to transfer property after death largely depends on the situation, but a transfer on death deed is a popular option. It allows ownership to pass directly to beneficiaries without going through probate. Ensure you consider any existing mortgages in a Florida transfer death with mortgage, as these obligations will need to be addressed seamlessly.

The 3-year rule in Florida pertains to the requirement that estates must be settled or closed within three years of the death. This applies to the final distribution of assets, including a Florida transfer death with mortgage. If an estate isn't settled within this timeframe, a tax may be levied. Timely action and appropriate legal assistance can simplify this process.

In Florida, there isn’t a strict timeframe for transferring property after death, but timely action is recommended. Delays can lead to additional complications, especially if the property has a mortgage. It’s beneficial to engage in a Florida transfer death with mortgage as soon as possible to ensure beneficiaries receive their inheritance smoothly.

While you can technically create a transfer on death deed without an attorney in Florida, consulting with one is advisable. An attorney can help ensure that the deed is executed correctly, complies with state laws, and integrates well with any existing mortgages. This guidance is helpful to avoid future complications related to the Florida transfer death with mortgage.

In Florida, transferring a house deed after death usually requires the filing of a death certificate along with the appropriate deed. You would also want to check if a Florida transfer death with mortgage is in place, as this can simplify the process. If the deceased had a will, the property would be transferred according to its terms. Legal advice may be beneficial during this process.

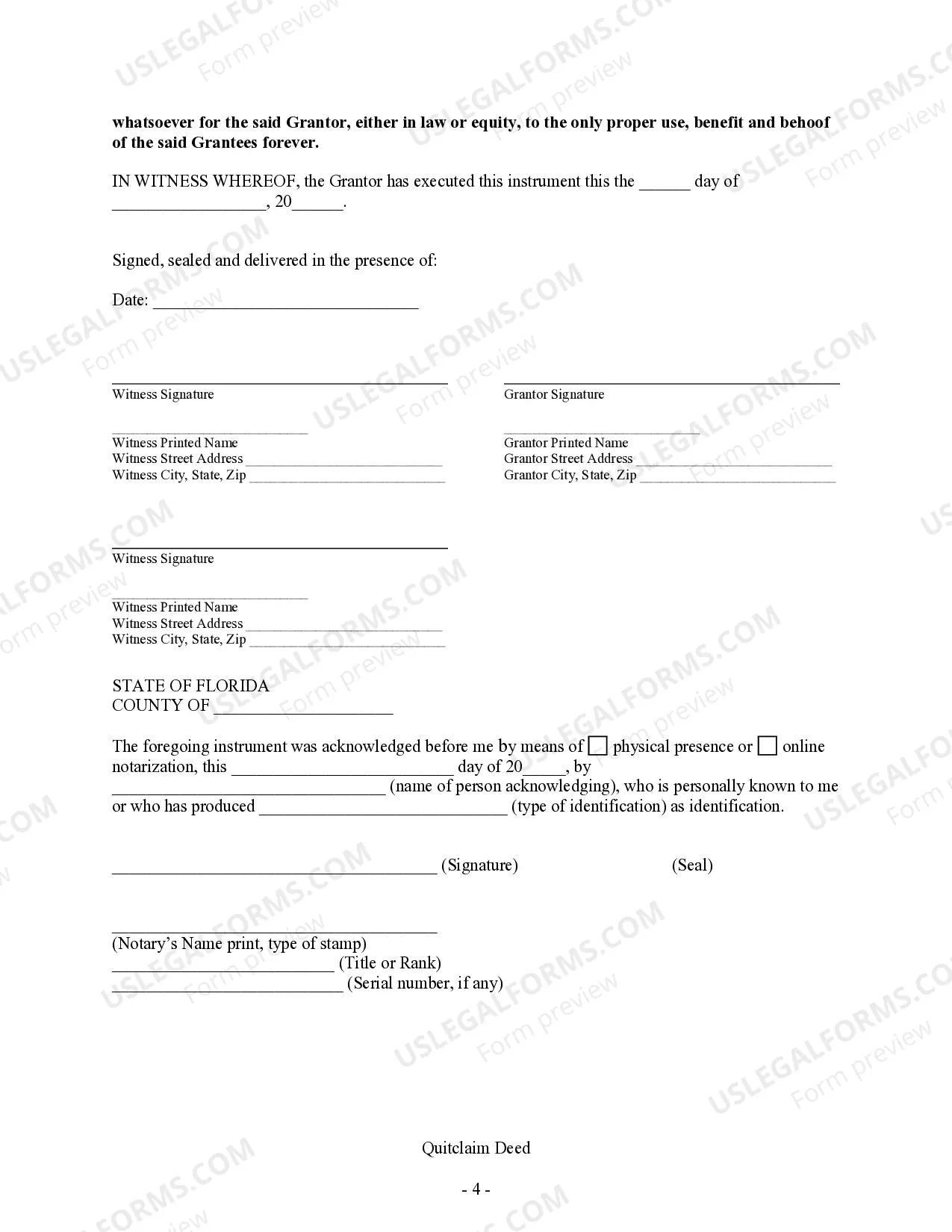

To transfer property in Florida, you typically need to execute a new deed, such as a quitclaim deed. This document must be signed, notarized, and then recorded at the local county's property appraiser’s office. When handling a Florida transfer death with mortgage, ensure that the current mortgage terms are reviewed to prevent issues for the new owner.

A transfer on death deed may not fit every situation. For instance, it does not eliminate the mortgage obligation, so the inheritor must manage that debt. Additionally, unforeseen complications may arise if legal disputes occur among heirs. Therefore, it is wise to fully understand the implications of a Florida transfer death with mortgage before proceeding.

You can absolutely establish a Transfer on Death (TOD) designation on real estate in Florida. This allows you to ensure that your property passes directly to your chosen beneficiaries without the complexities of probate. For anyone concerned about Florida transfer death with mortgage implications, this method offers a clear and efficient solution.

Yes, Florida does allow Transfer on Death (TOD) designations for property. This legal mechanism permits individuals to name beneficiaries who will receive the property automatically upon their death. Utilizing Florida transfer death with mortgage features can effectively streamline the process for property owners seeking to pass on their assets.