Florida Foreclosure Lien Priority

Description

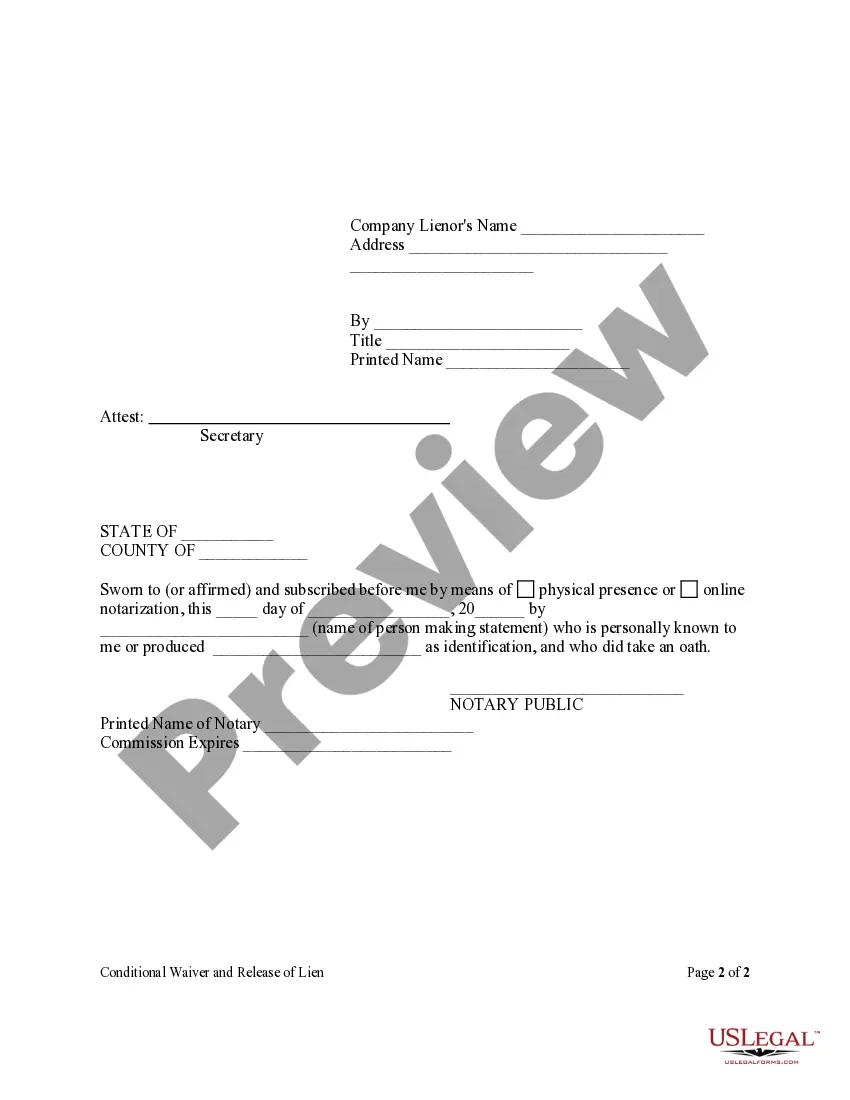

How to fill out Florida Conditional Waiver And Release Of Lien Upon Final Payment - Corporation Or LLC?

It’s widely recognized that you cannot instantly transform into a legal professional, nor can you swiftly master the drafting of Florida Foreclosure Lien Priority without a specific educational background.

Compiling legal documents is a lengthy endeavor that demands specialized training and expertise. So why not entrust the assembly of the Florida Foreclosure Lien Priority to the experts.

With US Legal Forms, one of the most comprehensive libraries of legal documents, you can discover everything from judicial forms to templates for internal company communication. We understand how vital compliance with federal and state regulations is. That’s why, on our platform, all forms are location-specific and current.

You can access your documents again from the My documents section anytime. If you are an existing customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the intention behind your documents—whether for financial, legal, or personal use—our platform caters to your needs. Experience US Legal Forms today!

- Find the document you require using the search bar at the top of the website.

- View it (if this feature is available) and review the accompanying description to determine if Florida Foreclosure Lien Priority suits your needs.

- Initiate another search if you seek a different template.

- Create a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the transaction is completed, you can download the Florida Foreclosure Lien Priority, fill it out, print it, and send it or mail it to the required parties or organizations.

Form popularity

FAQ

The hierarchy of liens in Florida determines the order in which claims against a property are settled. Generally, property tax liens take the first position, followed by mortgage liens, and then other types of liens such as judgment liens. Understanding this hierarchy is crucial to grasp how Florida foreclosure lien priority affects property ownership and financial responsibilities.

The highest priority lien in Florida generally belongs to property tax liens. These liens must be addressed before any other claims during a foreclosure sale. Grasping this fact is crucial for homeowners as they navigate the complexities of Florida foreclosure lien priority.

Property tax liens take the highest priority in Florida, followed closely by liens from homeowners' associations. This prioritization is integral to finding a resolution during a foreclosure. By understanding Florida foreclosure lien priority, property owners can better navigate their options and outcomes.

In Florida, property tax liens and HOA liens hold the highest priority among all lien types. This means they are settled before other debts when a property is sold in foreclosure. Knowing this hierarchy is essential for anyone dealing with Florida foreclosure lien priority, as it directly affects financial outcomes.

Typically, property tax liens receive the highest priority in disbursing funds from a foreclosure sale in Florida. After that, HOA liens also enjoy high priority, which can influence how much you receive from the sale. Familiarizing yourself with Florida foreclosure lien priority helps property owners protect their interests effectively.

In Florida, the general order of lien priority starts with property taxes, followed by HOA liens, then mortgages, and finally unsecured debts. It is vital to grasp this order to navigate effective foreclosure strategies. Knowing the correct order helps homeowners make informed decisions, especially when addressing Florida foreclosure lien priority.

In Florida, the super priority lien is typically held by homeowners' associations (HOAs). This means that HOA liens can take precedence over other liens on the property, even existing mortgages. Understanding Florida foreclosure lien priority is crucial for property owners facing foreclosure, as this could significantly impact the distribution of funds during the process.

In Florida, the priority of liens generally follows a 'first in time, first in right' rule. This means that liens recorded first have priority over those recorded later. When it comes to Florida foreclosure lien priority, understanding this order is crucial for property owners and creditors. If you're navigating lien issues, platforms like UsLegalForms can help clarify your rights and responsibilities.

The priority of liens is established by several factors, primarily the recording date of each lien. The first lien filed has the highest priority unless a later lien is given a specific priority status by law or agreement. Additionally, certain liens, like tax liens, can supersede others regardless of recording order. Familiarizing yourself with Florida foreclosure lien priority is essential to ensure you understand how liens impact your asset's financial landscape.

During a foreclosure sale, the highest priority for disbursing funds is typically the payment of the first mortgage lien. After satisfying the primary mortgage, any remaining funds are distributed to junior liens and then to the homeowner, as applicable. This distribution process highlights the importance of understanding Florida foreclosure lien priority, as it affects how much you may recover from the sale. Seeking guidance from legal services can provide clarity on your specific situation.