2023 Instructions For Form 568 Limited Liability Company Tax Booklet

Description

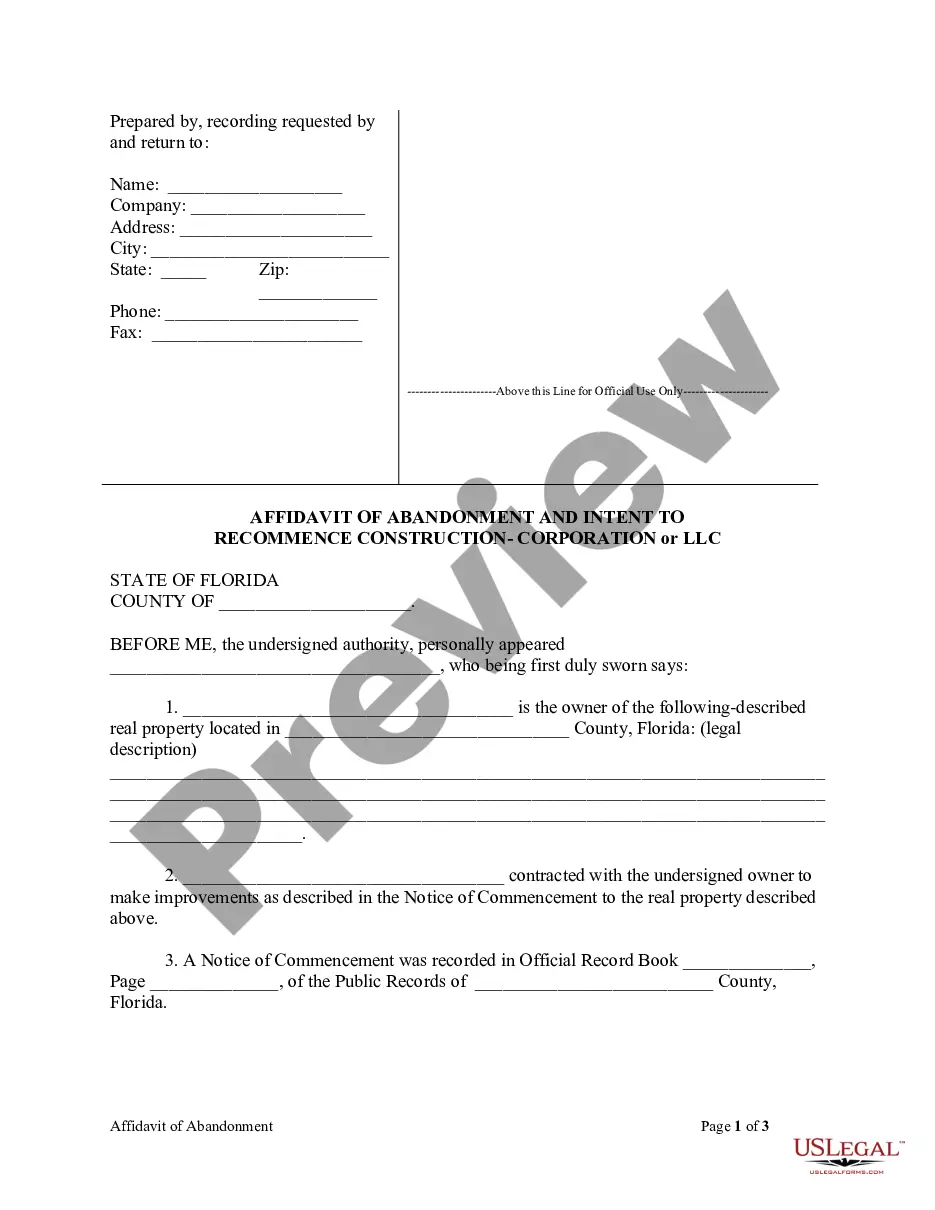

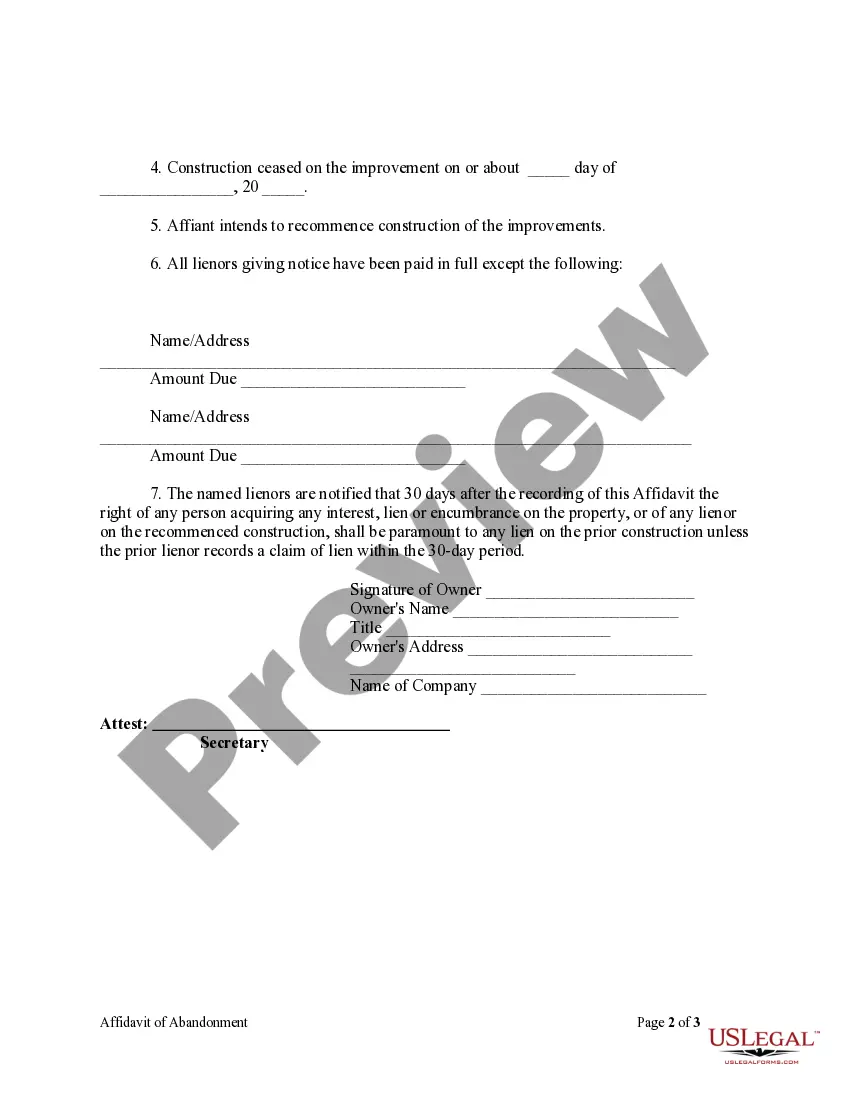

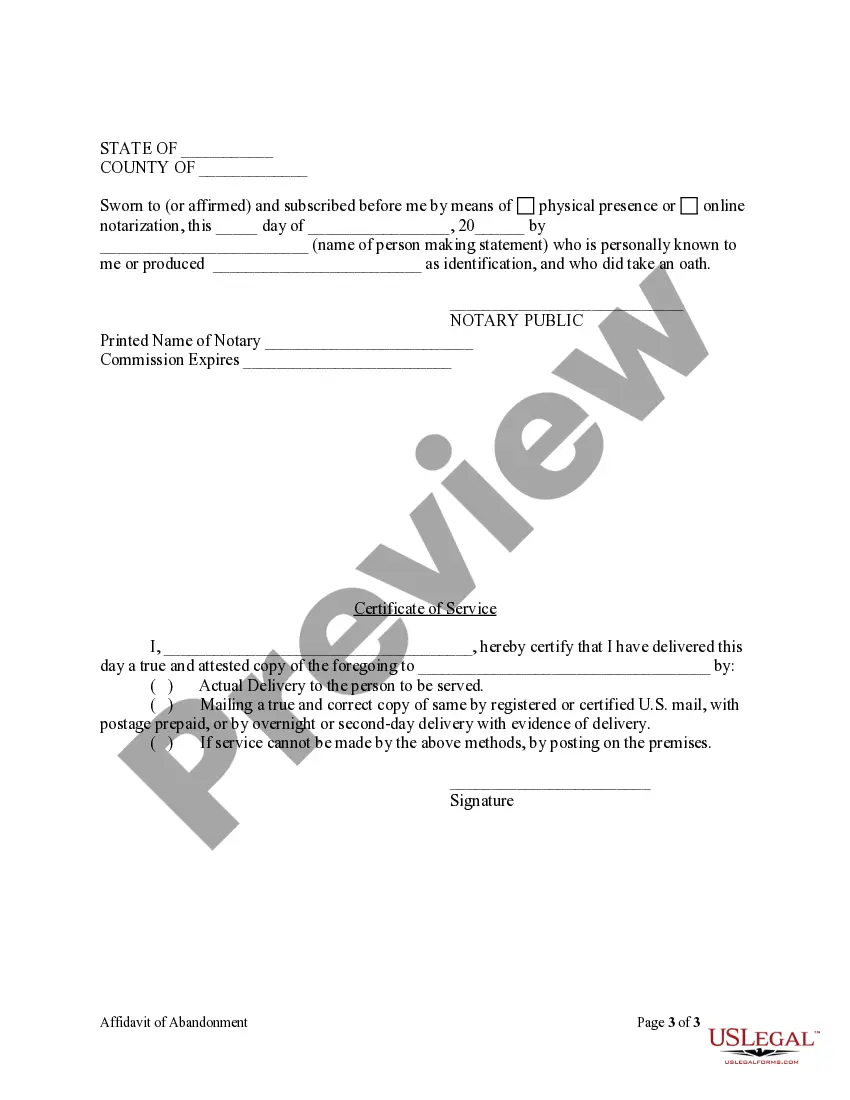

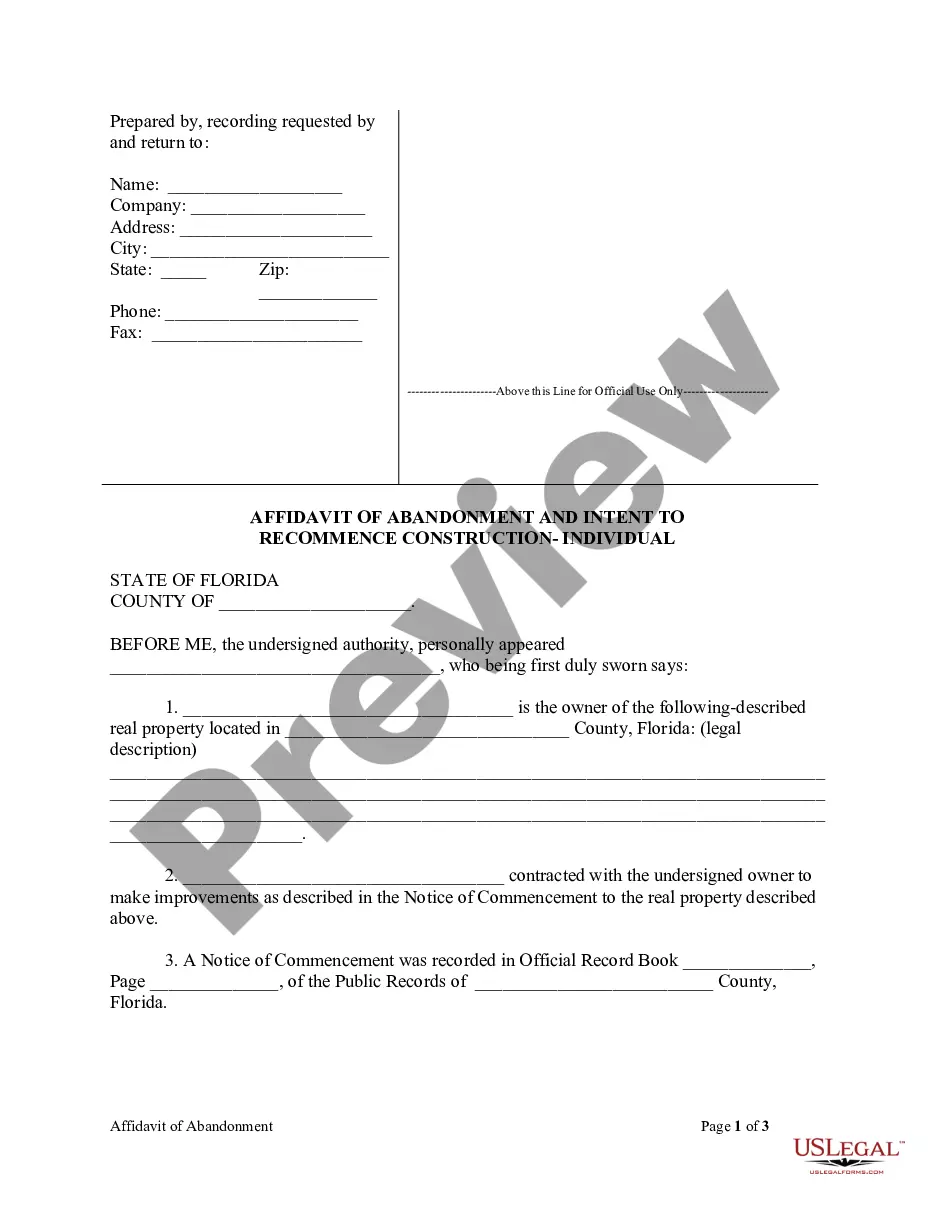

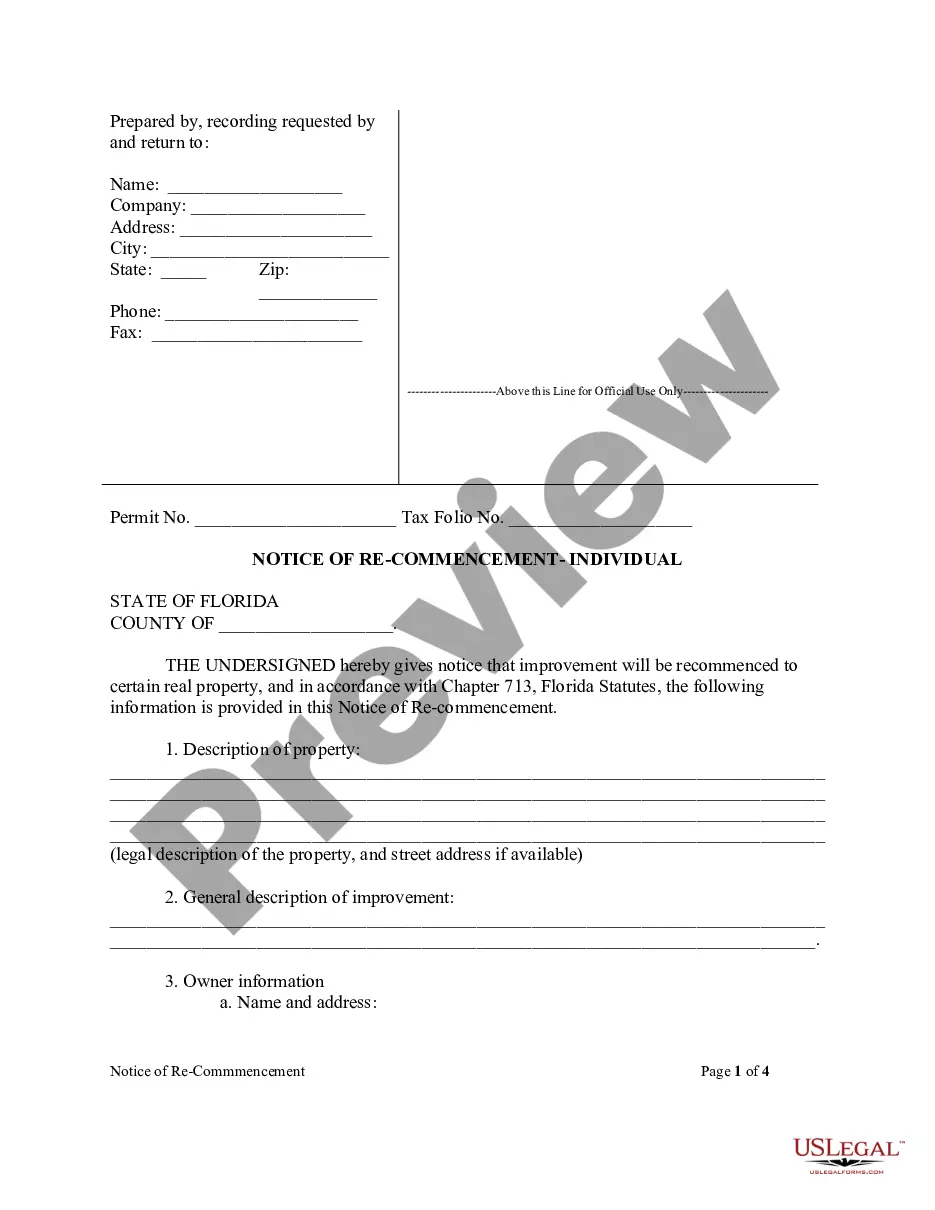

How to fill out Florida Affidavit Of Abandonment And Intent To Recommence Construction Form - Mechanic Liens - Corporation Or LLC?

- For returning users, log in to your account to find the form you need. Click the Download button to save it on your device, ensuring your subscription is active.

- For first-time users, start by reviewing the form's Preview mode and description to confirm it fits your requirements.

- Search for alternative templates if you find inconsistencies, using the Search tab at the top of the page.

- Proceed by clicking the Buy Now button and selecting your desired subscription plan, creating an account for access.

- Complete your purchase using your credit card or PayPal to finalize your subscription.

- Download the template to your device, and you can always access it later through the My Forms section.

With its extensive library of over 85,000 fillable legal forms, US Legal Forms empowers users to create legally sound documents quickly and easily. The premium expert assistance ensures that every form is completed correctly.

Don’t let paperwork overwhelm you. Start your journey with US Legal Forms today and simplify your legal documentation process!

Form popularity

FAQ

You can obtain California state tax forms through the official state website or by following the 2023 instructions for form 568 limited liability company tax booklet. These forms are often available for download in various formats, making them accessible to all users. If you prefer physical copies, visiting local tax offices or government buildings can also be effective. Additionally, consider using US Legal Forms to ensure you have the correct, up-to-date documents at hand.

You can file form 568 electronically if you follow the 2023 instructions for form 568 limited liability company tax booklet. Make sure to utilize certified software or professional services that cater to electronic submissions. This approach allows for timely processing and may reduce the risk of errors in your filing. US Legal Forms can be an excellent option for finding the right tools for your electronic filing needs.

Yes, California returns can be electronically filed using the appropriate methods outlined in the 2023 instructions for form 568 limited liability company tax booklet. Electronic filing offers several advantages, such as quicker processing and confirmation of receipt. Keeping your documents organized and accurate enhances your tax filing experience. Platforms like US Legal Forms can help you navigate these requirements easily.

Form 568 can be e-filed when following the 2023 instructions for form 568 limited liability company tax booklet. This smooth process allows you to submit your forms conveniently online, saving time and reducing paperwork. However, be sure to check for any specific requirements or limitations that may apply based on your situation. For direct assistance, using US Legal Forms can simplify your experience.

Yes, you can fill out many tax forms electronically, including those following the 2023 instructions for form 568 limited liability company tax booklet. Various software options and platforms make electronic filing easy and convenient. They guide you through the process, ensuring that you do not miss any critical details. If you're unsure, platforms like US Legal Forms provide resources to assist you.

Certain forms related to the 2023 instructions for form 568 limited liability company tax booklet cannot be filed electronically. For instance, some signature forms and specific tax returns may require paper submission. It's important to check the latest IRS guidelines to ensure compliance. Always consider using professional resources or platforms like US Legal Forms for clarity.

Yes, a single member LLC must file form 568 to report its California income and expenses, even though it is treated as a disregarded entity for tax purposes. Utilizing the 2023 instructions for form 568 limited liability company tax booklet will provide you with the necessary steps to complete this filing correctly. Filing is crucial for ensuring compliance with state tax laws and avoiding potential penalties. It’s a straightforward process that helps you maintain good standing with California tax authorities.

The first step in LLC business tax filing is to gather all relevant financial documents and ensure you understand your tax obligations. Refer to the 2023 instructions for form 568 limited liability company tax booklet for comprehensive guidelines regarding income reporting and deductions. It’s essential to identify your LLC’s tax classification, as this will influence the forms you need to complete. Once you have this information, you can prepare to file form 568 accurately and on time.

To avoid the $800 LLC fees in California, one option is to qualify for an exception such as being classified as a multi-member LLC or a disregarded entity for federal tax purposes. Consider leveraging the resources in the 2023 instructions for form 568 limited liability company tax booklet, as it provides guidance on maintaining compliance and understanding your financial obligations. Additionally, you may want to explore the possibility of dissolving your LLC if it is not actively conducting business. This approach can help you save on unnecessary fees while ensuring a straightforward exit strategy.

To write a check to the Franchise Tax Board, start by ensuring you have the correct amount and your LLC details. Write the check payable to the 'Franchise Tax Board' and include your LLC's name and account number in the memo line. This method aligns with the guidelines provided in the 2023 instructions for form 568 limited liability company tax booklet. For detailed assistance, consider accessing tools on US Legal Forms that simplify your tax payment process.