Limited Liability Company For Dummies

Description

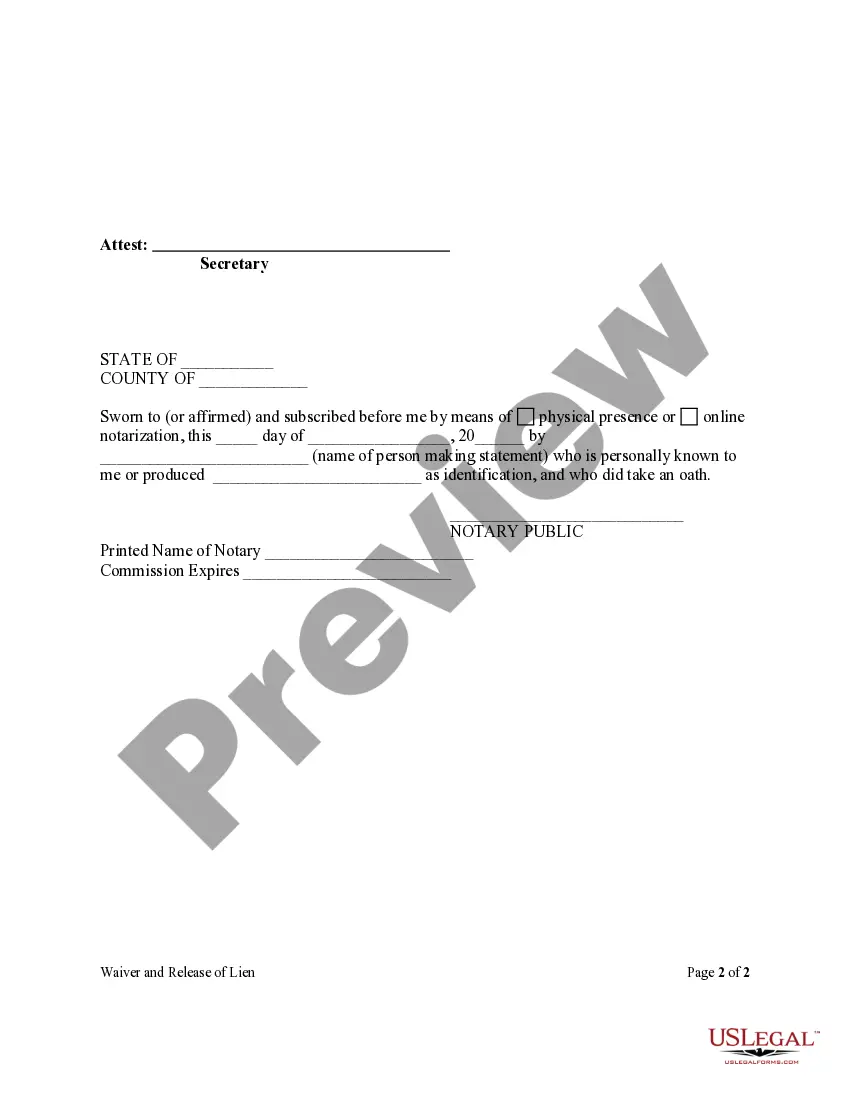

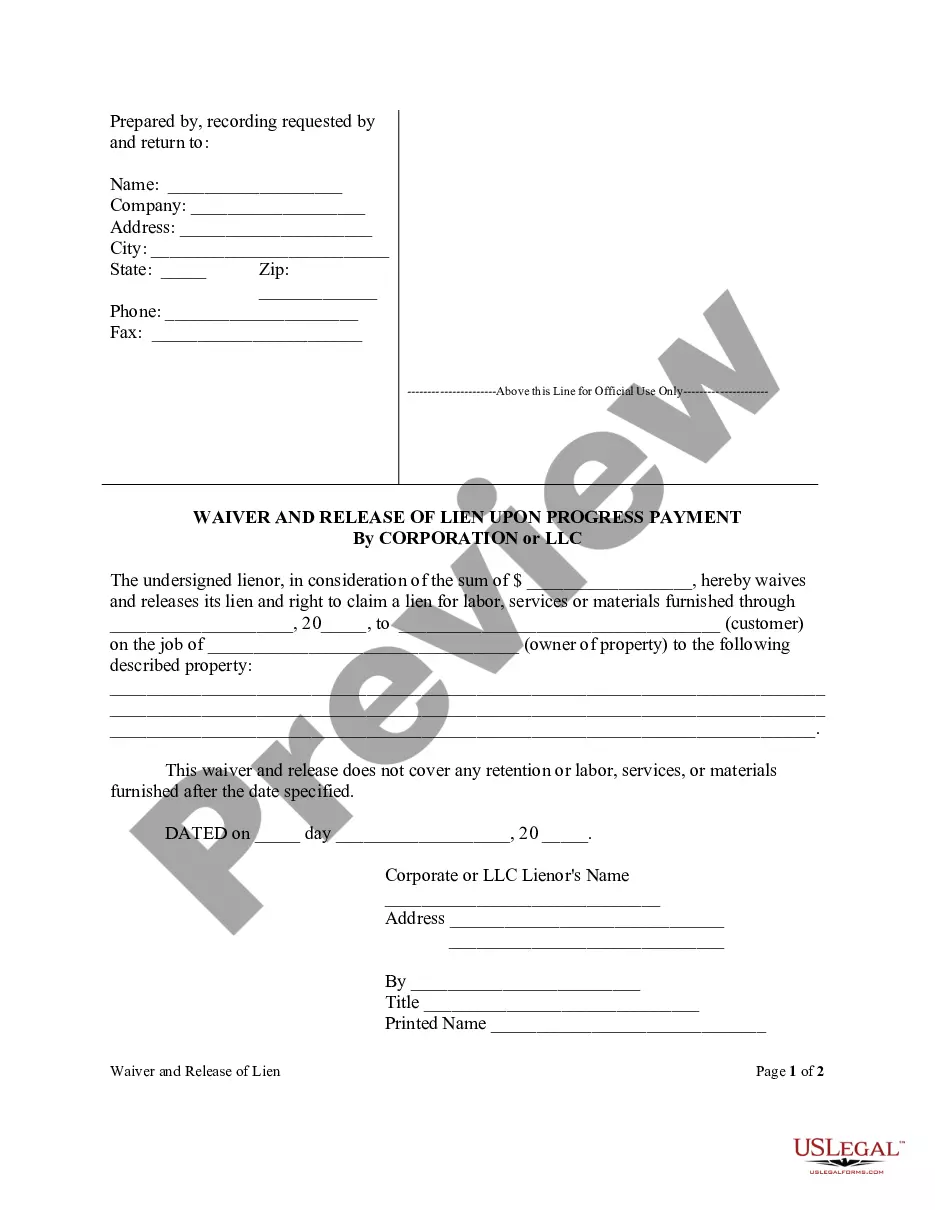

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your US Legal Forms account if you're an existing user. Check your subscription status to ensure it's valid; renew it if necessary.

- If you're new to the service, start by browsing the extensive online library. Look for the LLC form that meets your needs and complies with your state’s requirements.

- Review the form description carefully in the Preview mode to confirm it's the right choice. If not, use the Search tab to locate a more suitable template.

- Once you find the correct document, click the 'Buy Now' button. Choose the subscription plan that best fits your needs and register for an account to access additional resources.

- Complete your purchase by entering your payment information, either via credit card or PayPal.

- Download your LLC template directly to your device, ensuring you can access it anytime through the 'My Forms' section in your profile.

By following these steps, you will efficiently navigate the process of setting up your LLC through US Legal Forms. This service not only provides a comprehensive library of forms but also connects you with legal experts to ensure your documents are accurate and compliant.

Ready to start your LLC journey? Sign up with US Legal Forms today and unlock your access to thousands of legal templates!

Form popularity

FAQ

A reasonable salary for an LLC owner depends on several factors including business income, industry standards, and personal living expenses. Typically, the salary should reflect the work you perform and the revenue your limited liability company generates. For many, setting a salary between 50-60% of business profits ensures fair compensation while maintaining financial health. Consulting resources like uslegalforms can help you establish an appropriate salary structure for your LLC.

While there isn't a strict threshold for when to form an LLC, earning around $50,000 annually is often considered a good time to start. At this income level, the tax benefits and liability protection from a limited liability company for dummies become increasingly beneficial. However, consider your specific circumstances and potential growth when deciding. Tools from uslegalforms can provide clarity on costs and benefits.

Limited liability means that as a business owner, your personal assets are protected from business debts and legal actions. In simpler terms, if your limited liability company faces a lawsuit or incurs debt, creditors cannot claim your personal belongings. This protection is one of the key reasons why many choose to form a limited liability company for dummies. Understanding this concept helps you make informed decisions about your business structure.

Determining when an LLC is worth it often depends on your individual situation and income level. Generally, if you start making around $60,000 to $100,000 in profit, forming a limited liability company for dummies could provide valuable benefits like liability protection and tax advantages. At this level, the costs of maintaining an LLC are often outweighed by the protections and benefits it offers. Additionally, resources on uslegalforms can help guide you through the formation process.

The classification of an LLC as good or bad depends on your specific business circumstances. Generally, an LLC provides liability protection, which is beneficial for many entrepreneurs. For those exploring this structure, resources like USLegalForms can clarify how forming a limited liability company for dummies might suit your business needs.

There are several scenarios where an LLC may not offer the benefits you’re looking for. For instance, if you're projecting little risk or are operating a low-revenue business, the additional costs and paperwork may not be worth it. Evaluating your unique situation can help you decide if the limited liability company for dummies is beneficial in your case.

While many prefer the flexibility of an LLC, some might avoid it due to the administrative requirements and fees involved. Additionally, if an individual plans to operate a business with high upfront costs or prefers to remain a sole proprietor, forming a limited liability company may not be appealing. Understanding your specific business needs is crucial in determining if a limited liability company for dummies is right for you.

The best way to file for an LLC depends on your state requirements and personal comfort level. You can choose to do it yourself, hire an attorney, or utilize streamlined services like USLegalForms. For those new to the subject, this platform offers a guided approach that can make the process of forming a limited liability company for dummies much clearer and more manageable.

Filing taxes as a Limited Liability Company can initially seem complex. Generally, LLCs are pass-through entities, meaning the profits pass through to the owners' personal tax returns. This structure will simplify the tax process for you, and using resources like USLegalForms helps clarify the specific tax obligations associated with forming a limited liability company for dummies.

Yes, you can file for your Limited Liability Company (LLC) by yourself. The process typically involves completing the necessary paperwork and submitting it to your state’s business office. However, using a platform like USLegalForms can simplify this process and ensure you meet all state requirements, especially useful for beginners looking to understand the limited liability company for dummies.