Fl Deed Form For Georgia

Description

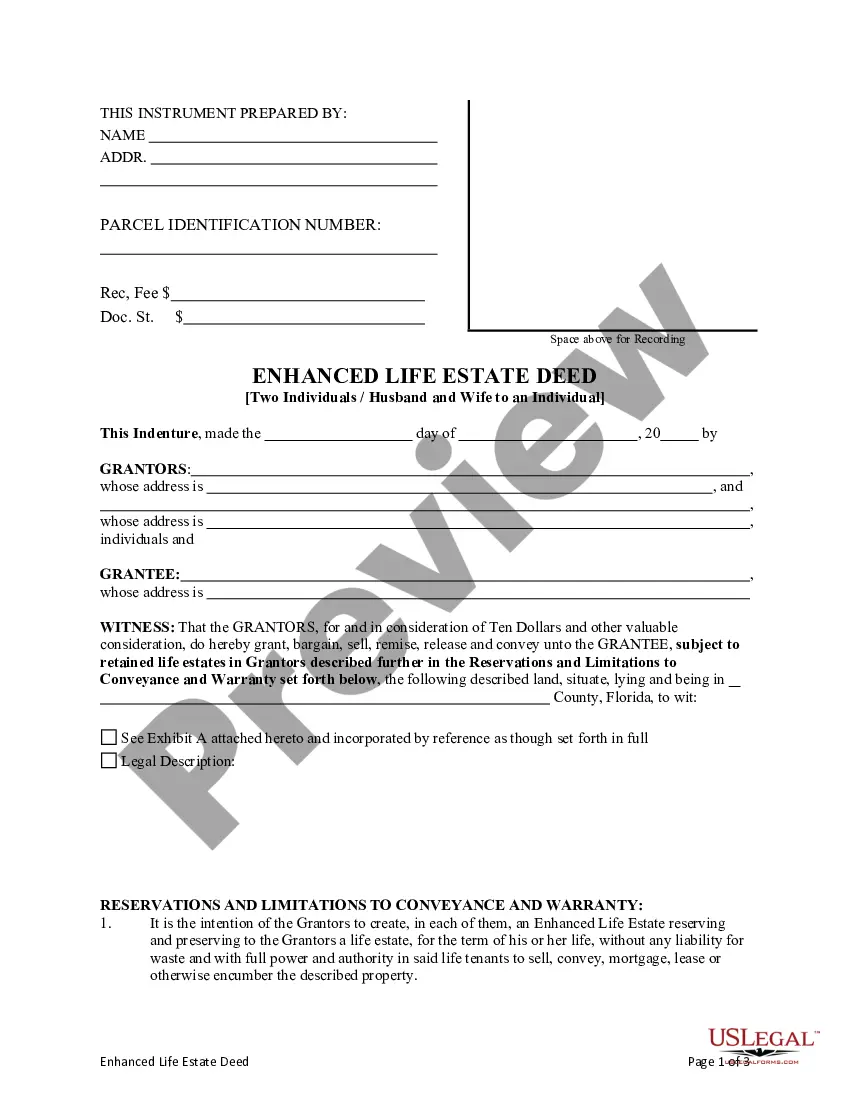

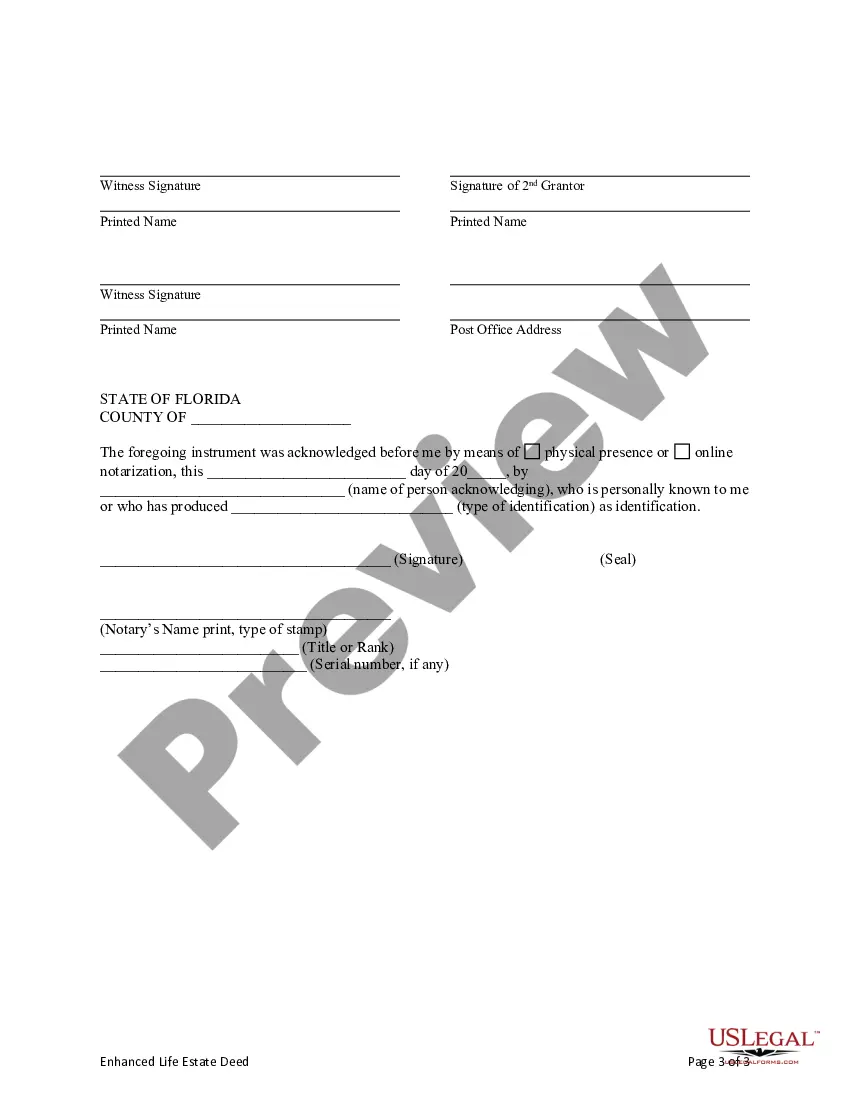

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Two Individual / Husband And Wife To Individual?

Regardless of whether it's for corporate reasons or personal matters, everyone encounters the need to handle legal circumstances at some stage in their lives.

Filling out legal documents requires meticulous care, starting with selecting the appropriate form example.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the appropriate template on the web. Utilize the library’s user-friendly navigation to find the correct form for any circumstance.

- Locate the template you require by using the search bar or catalog navigation.

- Review the form’s details to confirm it suits your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to locate the Fl Deed Form For Georgia sample you need.

- Download the file if it corresponds to your requirements.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- If you haven’t created an account yet, you may acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Specify the file format you desire and download the Fl Deed Form For Georgia.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

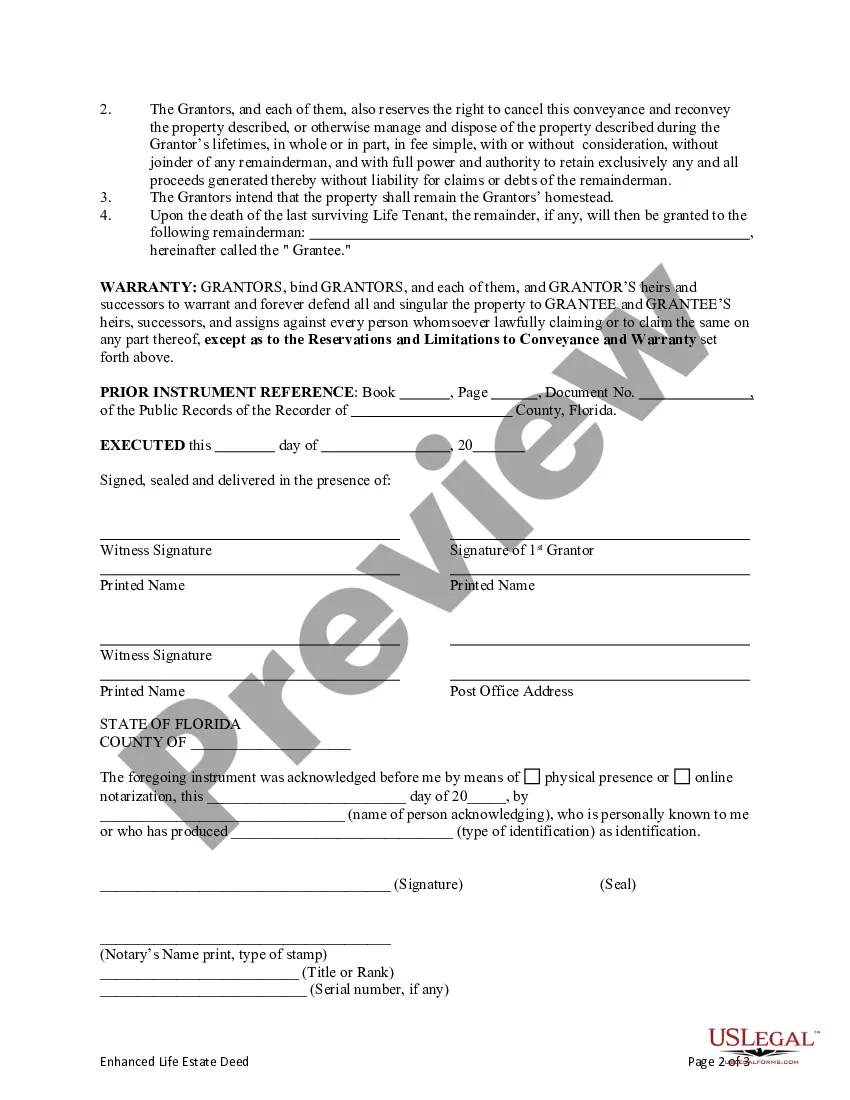

There are only a few steps that are required: The two parties would fill out a deed that includes certain basic information about the parties, properties, and transaction. Both parties would sign the deed and have it notarized. The quitclaim deed is then filed with the local county clerk's office.

Here are the steps to completing a deed transfer in Georgia: Names the Current Owner and New Owner. Contains a Description of the Property. Signed by Current Owner. Two Witnesses: Unofficial Witness & Notary Public. Complete a PT-61, Transfer Tax Form. Record Deed in County Real Estate Records.

Requirements to be filed The deed must describe the real property, full legal description. Name the party/parties transferring the property (grantor) Name the party/parties receiving the property (grantee) Be signed and notarized by the grantor with a witness.

A quit claim deed can be used to transfer property or titles. Deeds can be used to transfer property or titles from a grantor (or seller) to a grantee (or buyer). Warranty and limited warranty deeds are usually the most reliable because they offer a ?covenant? proving that the land is indeed owned by the grantor.

The State of Georgia Transfer Tax is imposed at the rate of $1.00 per thousand (plus $0.10 / hundred) based upon the value of the property conveyed. Example: A property selling for $550,000.00 would incur a $550.00 State of Georgia Transfer Tax.