Florida Lady Bird Deed With Mortgage

Description

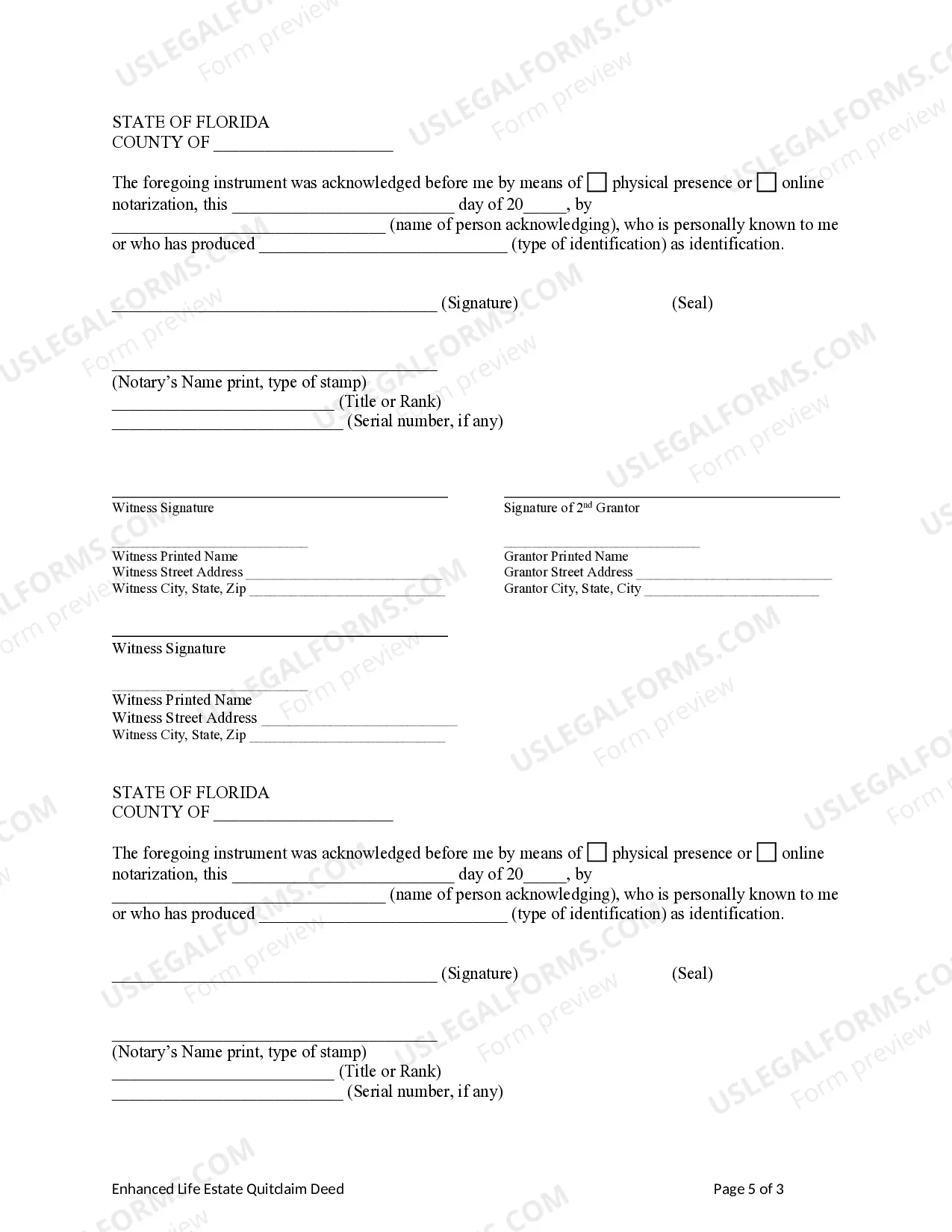

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Two Individual Or Husband And Wife To Individual?

There's no further necessity to squander hours searching for legal documents to satisfy your local state stipulations.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our website offers over 85k templates for any business and personal legal situations organized by state and area of application.

Use the search box above to find another sample if the previous one didn't meet your needs. Click Buy Now next to the template title when you identify the appropriate one. Choose the most fitting pricing plan and register for an account or Log In. Complete the payment for your subscription using a credit card or PayPal to move forward. Choose the file format for your Florida Lady Bird Deed With Mortgage and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing formal documentation in accordance with federal and state laws and regulations is fast and straightforward with our library. Experience US Legal Forms today to maintain your paperwork in order!

- All forms are expertly crafted and validated for accuracy, so you can trust in obtaining a current Florida Lady Bird Deed With Mortgage.

- If you are familiar with our service and already hold an account, you must confirm your subscription is active before acquiring any templates.

- Log In to your account, choose the document, and click Download.

- You can also access all saved documents at any time by opening the My documents tab in your profile.

- If you haven't utilized our service before, the process will take additional steps to finish.

- Here's how new users can find the Florida Lady Bird Deed With Mortgage in our collection.

- Review the page content thoroughly to confirm it includes the sample you need.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

You can write your own lady bird deed in Florida, but it requires precise legal language and formatting. This is especially important when the deed interacts with a mortgage, as any errors could lead to complications. A Florida lady bird deed with mortgage must meet specific criteria to be enforceable. For this reason, many individuals opt for legal assistance or templates available through US Legal Forms.

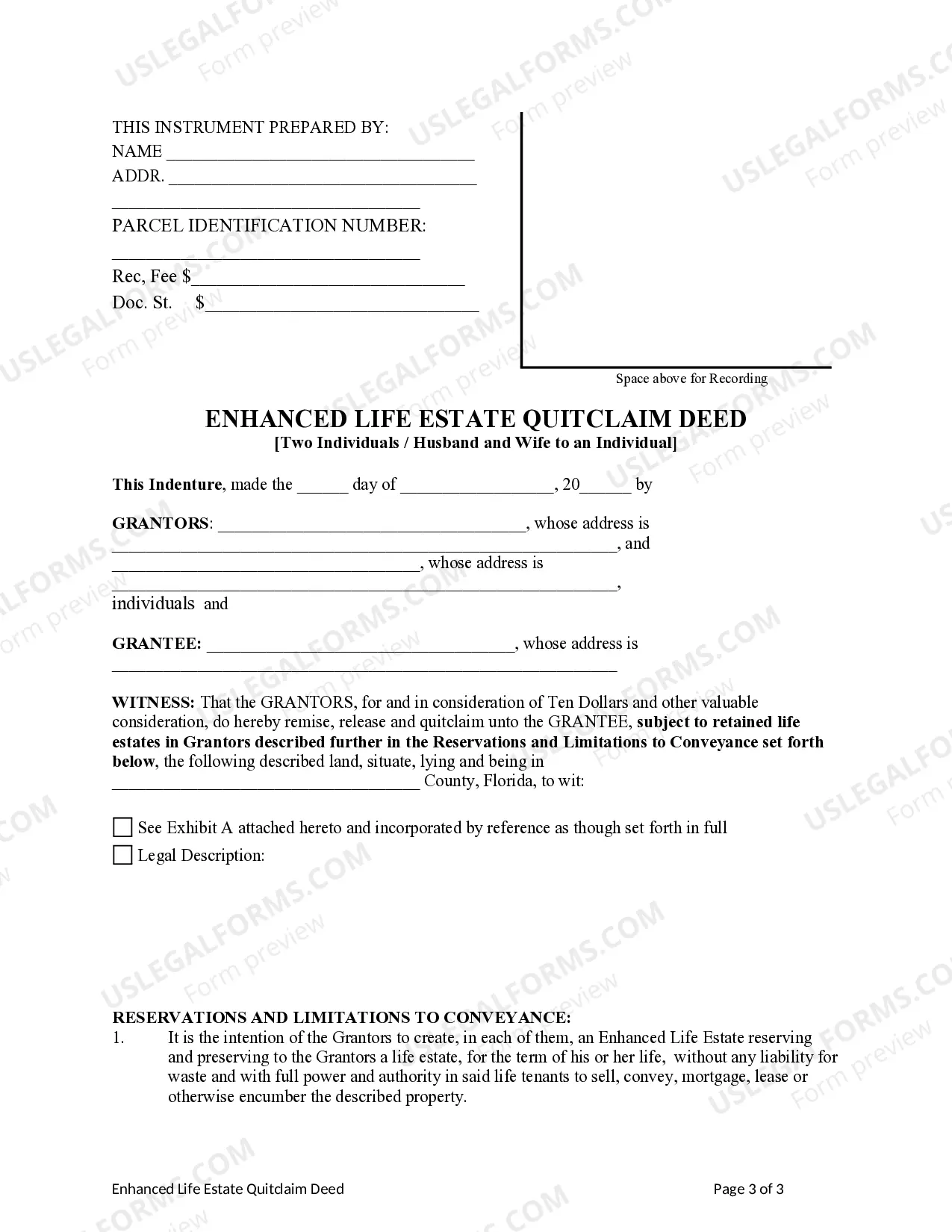

For a deed to be valid in Florida, it must be in writing, signed by the grantor, and have a legal description of the property. It also needs to be properly witnessed and notarized, especially for a lady bird deed, which has specific requirements. When dealing with a Florida lady bird deed with mortgage, ensuring compliance with all state laws is crucial. Using a service like US Legal Forms can help streamline this process.

One disadvantage of a lady bird deed in Florida is the potential tax implications when the property transfers ownership upon death. Additionally, if there is a mortgage on the property, it can complicate matters if not properly addressed. While a Florida lady bird deed with mortgage offers benefits, such as avoiding probate, it's wise to consider these drawbacks. Working with a qualified professional can help mitigate these risks.

Yes, you can create a lady bird deed yourself in Florida. However, the process requires specific language and legal knowledge to ensure it's done correctly. If there is a mortgage involved, it’s crucial to understand how a Florida lady bird deed with mortgage interacts with the debt. For peace of mind, consider using a service like US Legal Forms to assist you.

In general, a lady bird deed can help protect your home from Medicaid claims. When you properly establish a Florida lady bird deed with mortgage, it allows you to retain control of your home during your lifetime while ensuring it transfers to your heirs without going through probate. However, consulting with a legal expert or using resources like USLegalForms can provide clarity and guidance specific to your situation.

A lady bird deed indeed can override a will when it comes to property transfer in Florida. This type of deed allows the property owner to transfer their property to beneficiaries upon their death without going through probate. As a result, if you create a Florida lady bird deed with mortgage, the property passes directly to the designated beneficiaries, making your intentions clear and effective.

To remove or terminate a lady bird deed in Florida, the property owner can execute a new deed conveying the property back to themselves or to a different party. This newly executed deed needs to be recorded with the county clerk's office to be legally effective. It is essential to consult with a legal professional to understand all implications involved in this process. Using resources like the uslegalforms platform can provide templates and insights to simplify your journey of navigating a Florida lady bird deed with mortgage changes.

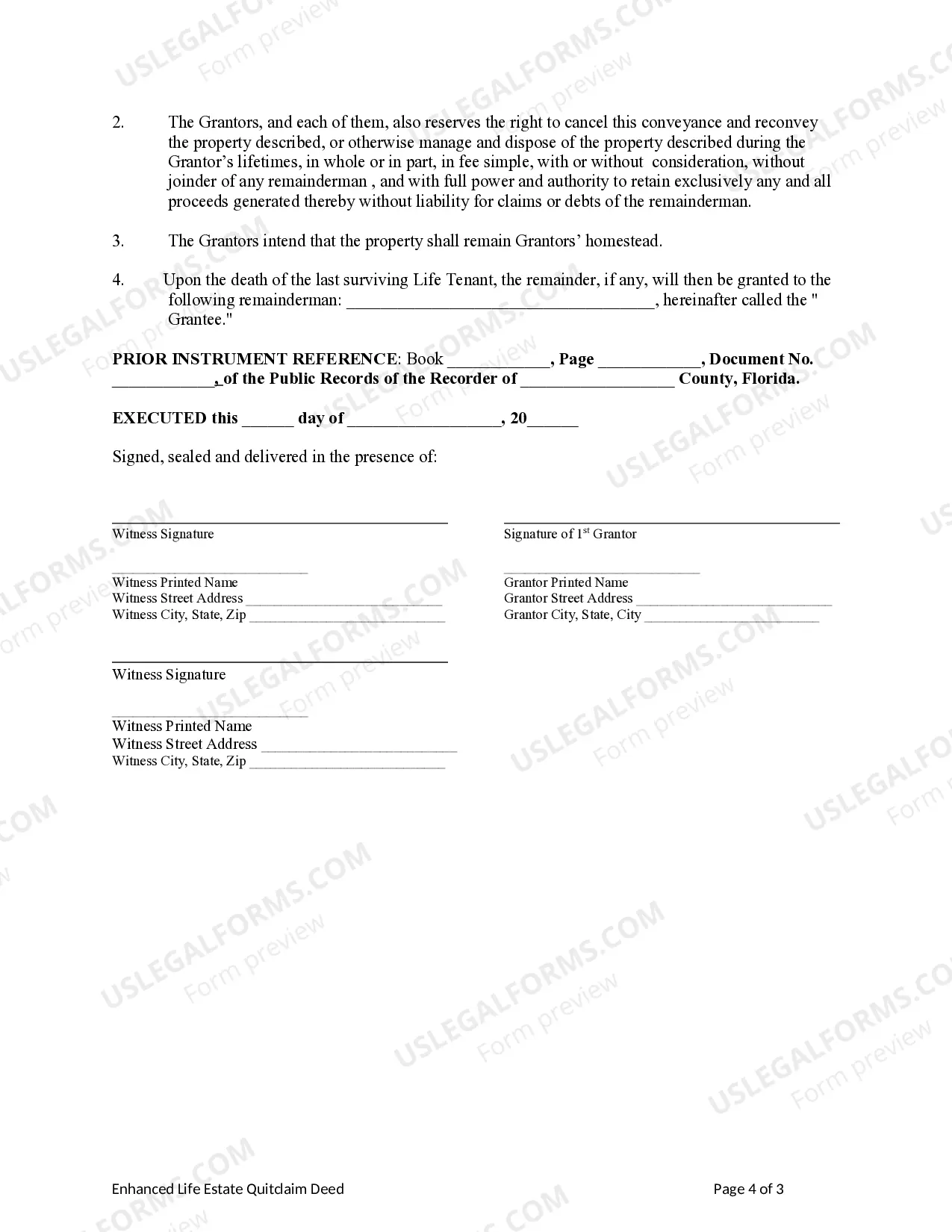

A mortgage does not automatically transfer when a Florida lady bird deed with mortgage is executed. The original owner remains responsible for mortgage payments, and the lender may enforce the mortgage if payments are missed, even if the property is deeded to a remainderman. However, the lady bird deed allows the owner to sell or refinance the property without consent from the remainderman. Properly understanding how this works ensures that you maintain your rights while managing your mortgage effectively.

To complete a lady bird deed in Florida, you need to prepare a specific legal document that details the property being transferred. You will need to specify the remainderman and include a clear statement of intent to retain control of the property during your lifetime. After signing the deed, you must record it with the local county clerk's office. If you need assistance navigating this process, consider using the uslegalforms platform, which provides helpful templates and guidance on creating a Florida lady bird deed with mortgage.

The primary difference between a life estate deed and a lady bird deed in Florida lies in the control retained by the property owner. A life estate deed allows the owner to live in the property until their death, but the property then transfers to the remainderman. In contrast, a Florida lady bird deed with mortgage provides the owner with the right to sell or mortgage the property without needing consent from the remainderman. This flexibility makes the lady bird deed a more advantageous option for many homeowners.