Fl Corporations With Established Credit

Description

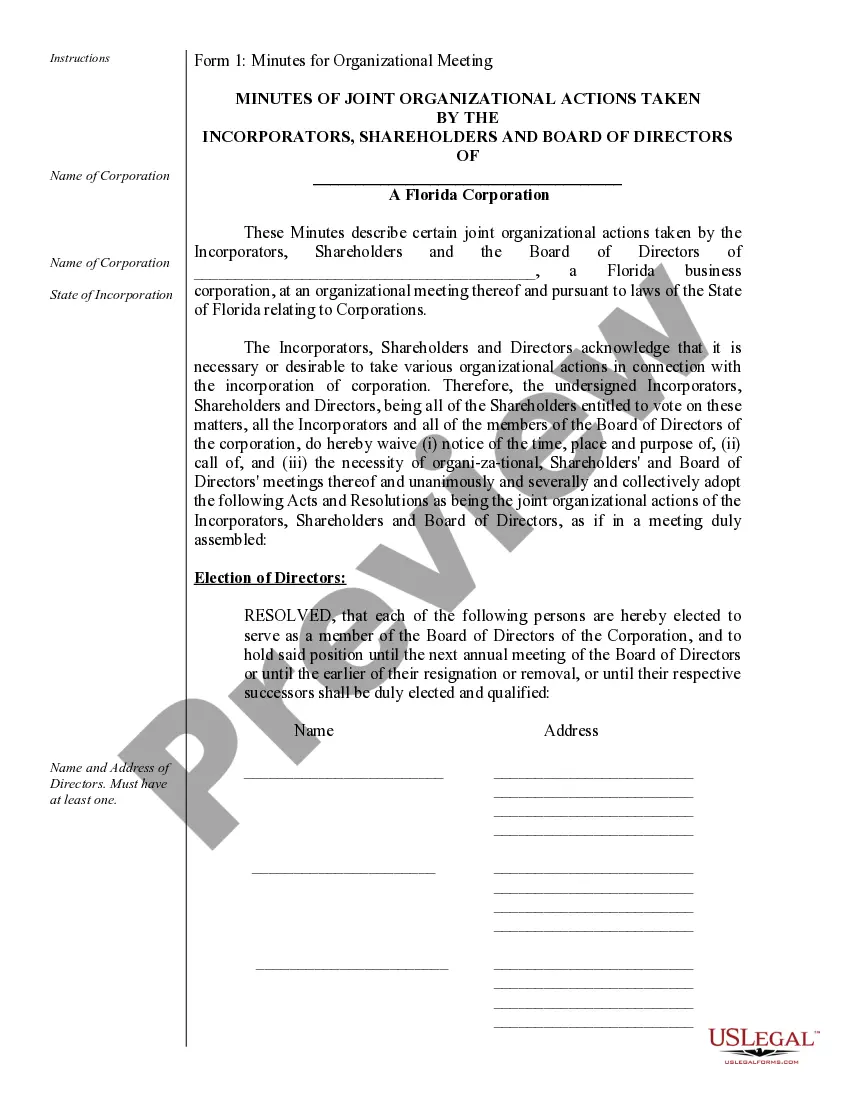

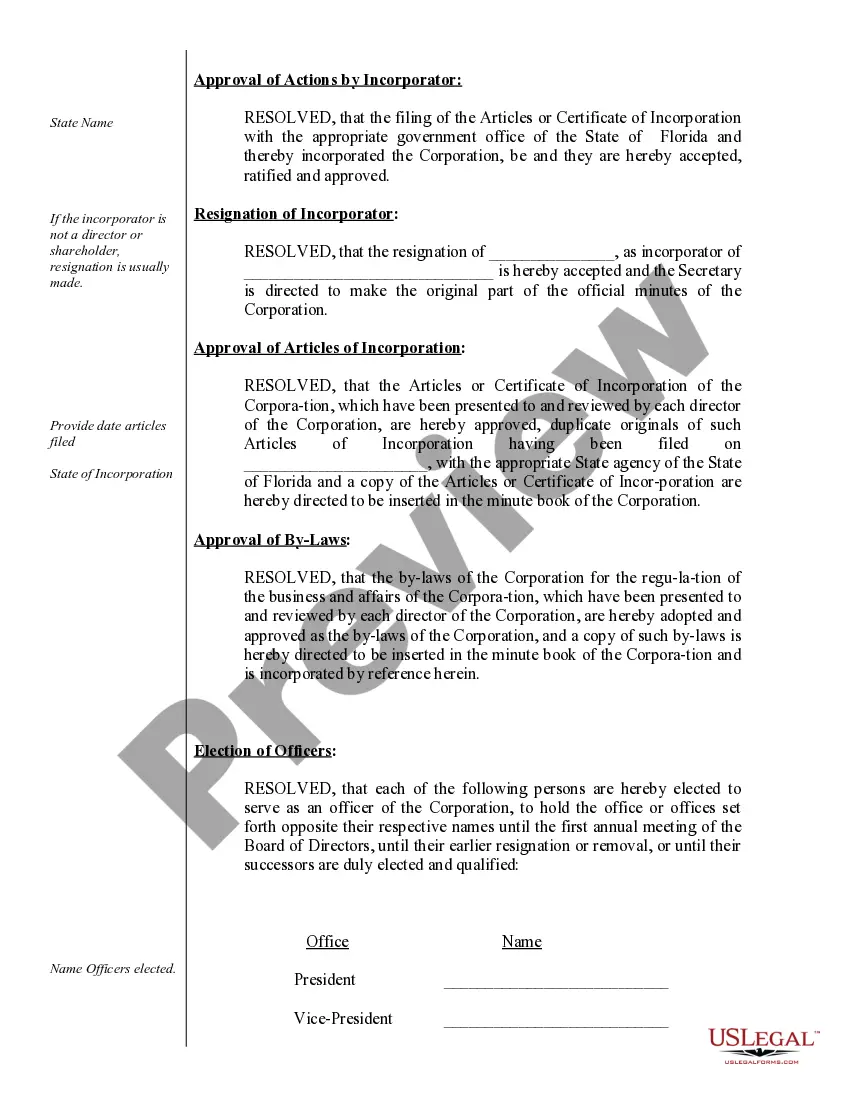

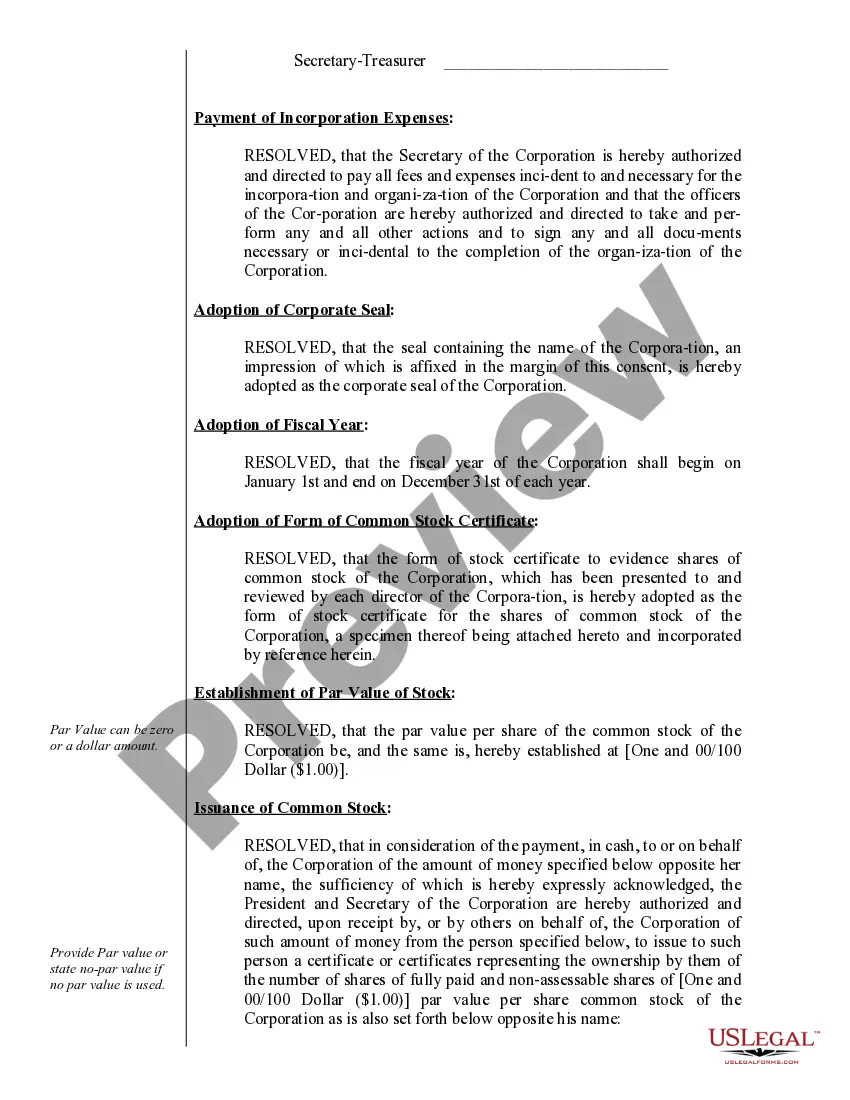

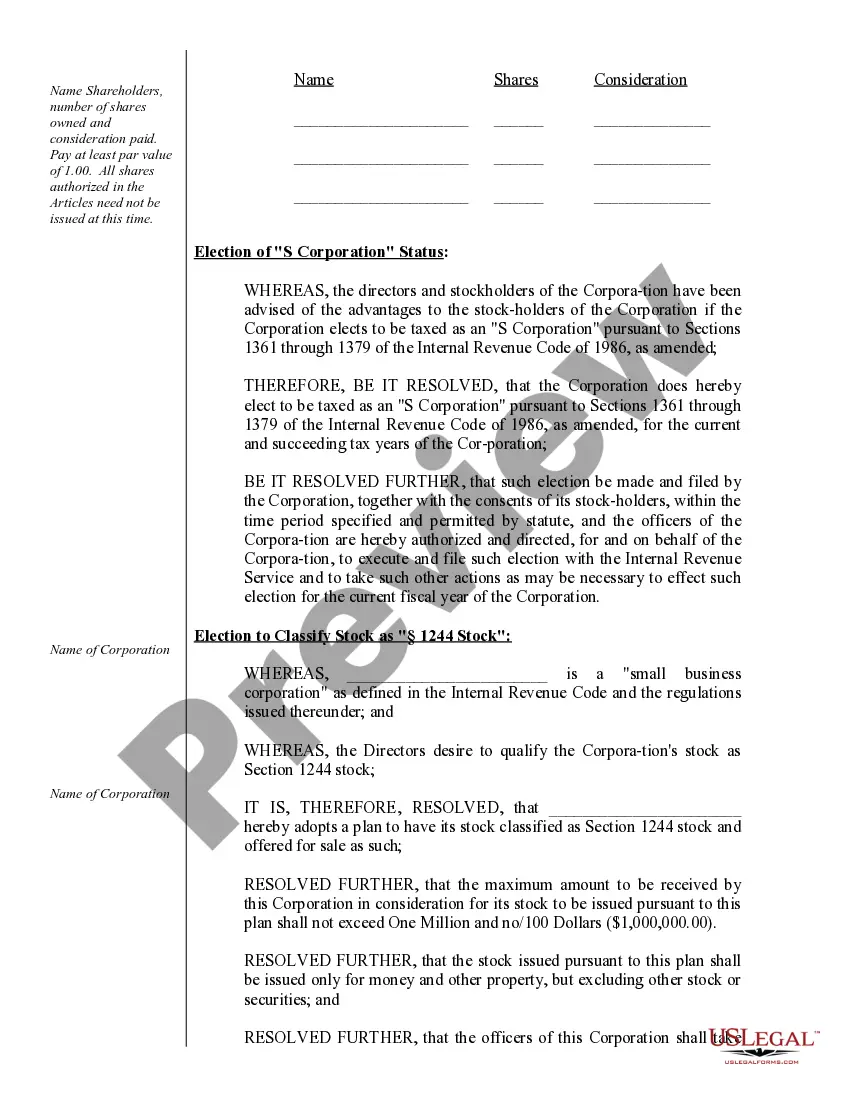

How to fill out Florida Corporate Records Maintenance Package For Existing Corporations?

Obtaining legal templates that comply with federal and state laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the appropriate Fl Corporations With Established Credit sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal library with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are simple to browse with all papers grouped by state and purpose of use. Our experts stay up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a Fl Corporations With Established Credit from our website.

Getting a Fl Corporations With Established Credit is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the guidelines below:

- Examine the template utilizing the Preview option or through the text description to ensure it meets your needs.

- Locate a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve located the right form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Fl Corporations With Established Credit and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

To become an S Corporation, a company must file Form 2553 and pay the fee while meeting the following criteria: The company only has one class of stock. The company must qualify as a small business having no more than 100 shareholders. All shareholders must be domestic, meaning that they cannot be nonresident aliens.

Who is Eligible to File Florida Form F-1120A? Corporations or other entities subject to Florida corporate income tax must file Florida Form F-1120 unless qualified to file Florida Corporate Short Form Income Tax Return, Florida Form F-1120A.

You must: Choose an organization name ing to Florida's rules. File your organization's articles of incorporation with the Department of State. Request a Federal Employer Identification Number (FEIN) from the IRS. Obtain all necessary licenses from the state, city, and county. Pay the relevant costs and fees.

Corporate income and franchise tax returns. Every taxpayer must file a Florida corporate income and franchise tax return using Form F-1120 for each taxable year in which the taxpayer is liable for tax under the Florida income tax code or is required to file a federal income tax return.

Once enrolled, select "Corporate Income Tax File and Pay" from the File and Pay webpage to: File the Florida Corporate Short Form Income Tax Return (Form F-1120A) File Form F-7004. Pay the corporate income tax due on Forms F-1120 and F-1120A. Pay the tentative tax due on Form F-7004.