This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Delaware Corporation De Form De-w4

Description

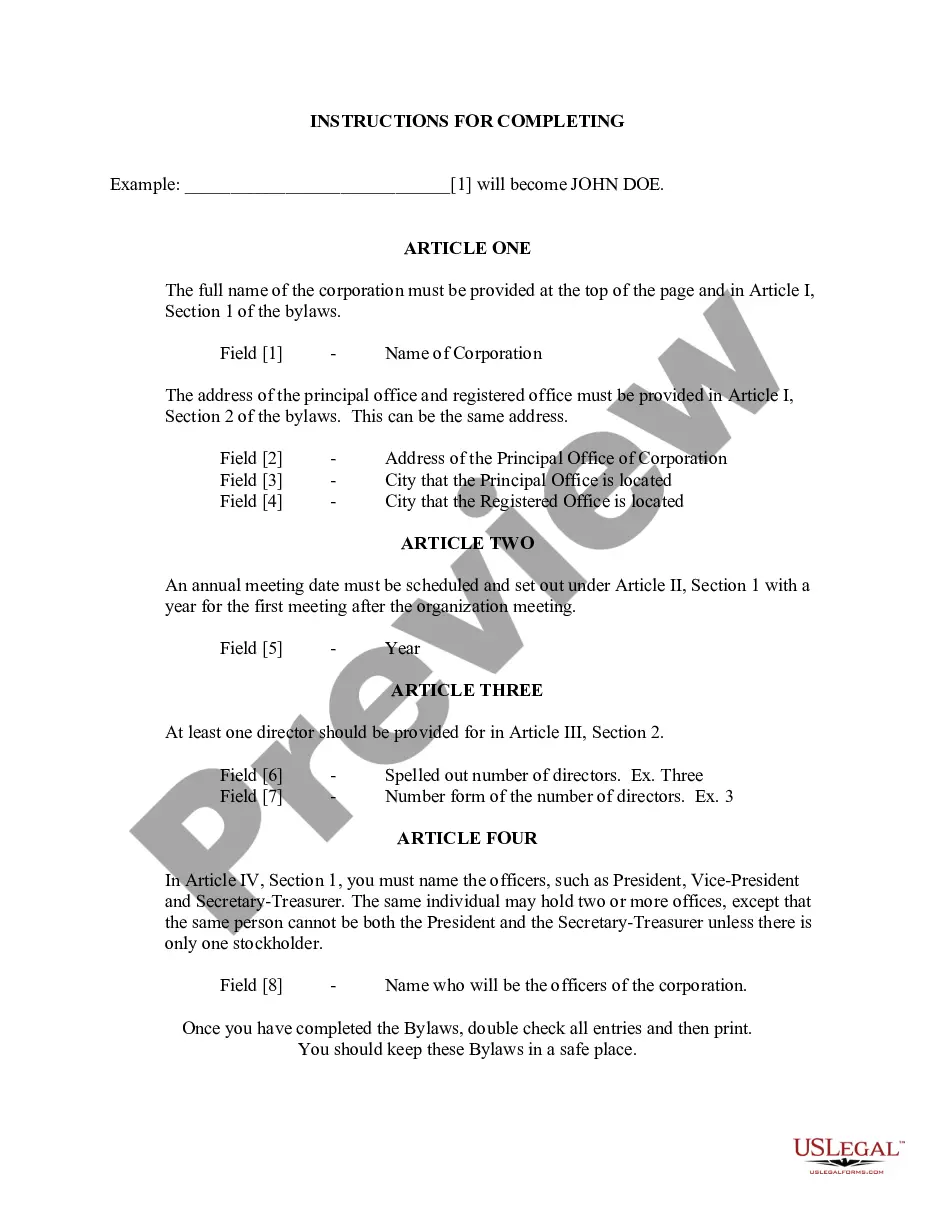

How to fill out Delaware Bylaws For Corporation?

Legal document management might be mind-boggling, even for the most knowledgeable professionals. When you are interested in a Delaware Corporation De Form De-w4 and don’t get the time to commit looking for the correct and up-to-date version, the procedures might be nerve-racking. A strong online form catalogue could be a gamechanger for anyone who wants to take care of these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from individual to organization paperwork, all in one place.

- Make use of advanced resources to complete and manage your Delaware Corporation De Form De-w4

- Gain access to a resource base of articles, instructions and handbooks and materials connected to your situation and needs

Save effort and time looking for the paperwork you will need, and utilize US Legal Forms’ advanced search and Preview feature to locate Delaware Corporation De Form De-w4 and get it. If you have a monthly subscription, log in in your US Legal Forms profile, look for the form, and get it. Review your My Forms tab to see the paperwork you previously downloaded as well as manage your folders as you can see fit.

Should it be your first time with US Legal Forms, make a free account and get unrestricted access to all advantages of the library. Here are the steps to take after accessing the form you want:

- Confirm this is the right form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the file format you want, and Download, complete, eSign, print out and send your papers.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of experience and reliability. Transform your everyday papers management into a easy and intuitive process today.

Form popularity

FAQ

Delaware creates its own specific form for income tax withholding, Form DE W-4. In late December 2019, the Delaware Division of Revenue published to its website a new Form DE W-4 that Delaware employees must use, starting in 2020, for state income tax withholding purposes.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

But because Delaware continues to permit employees to claim exemptions as part of the withholding calculation, withholding will be more accurate if employees use the Delaware form W-4.

Newly hired employees must complete and sign both the federal Form W-4 and the state DE 4. The W-4 is used for federal income tax and the DE 4 is used for California Personal Income Tax (PIT).

Purpose: This certificate, DE 4, is for California Personal Income Tax (PIT) withholding purposes only. The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation.