Limited Lliability

Description

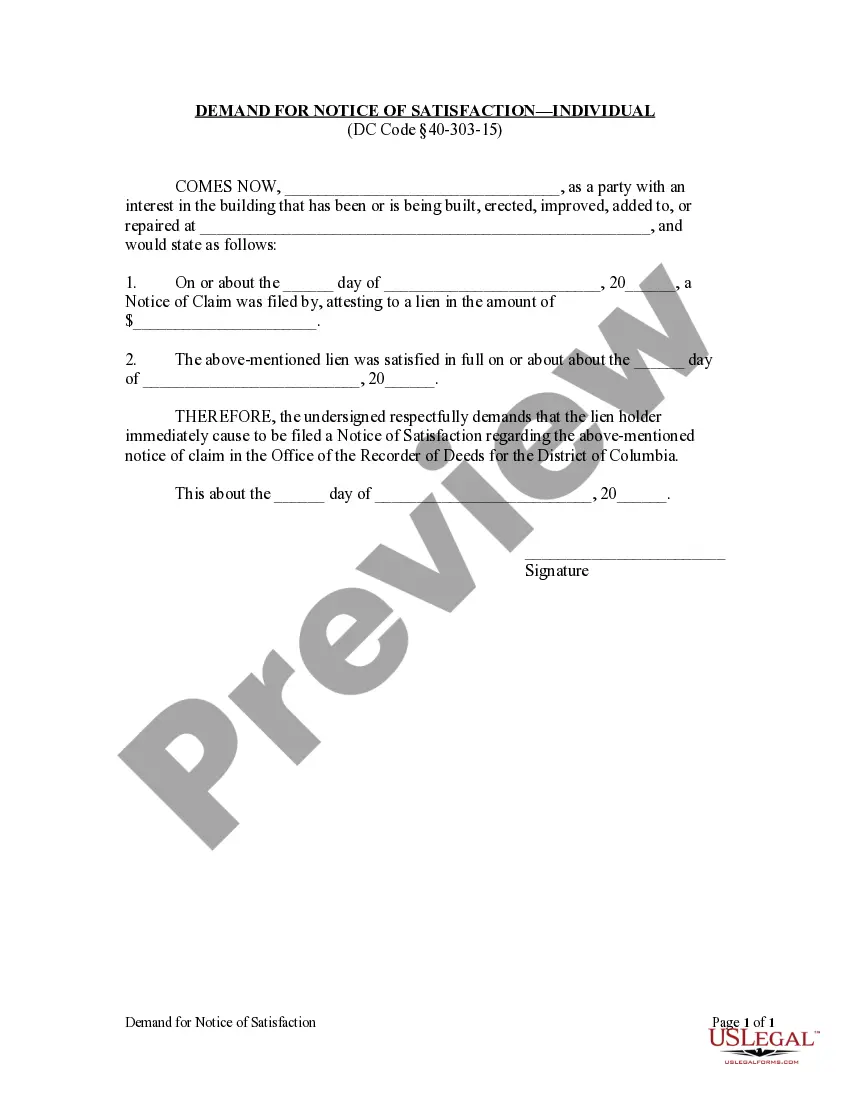

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- If you are an existing user, log in to your account and access the form library. Ensure your subscription is currently active. If not, renew it based on your chosen payment plan.

- For first-time users, start by exploring the Preview mode of the form. Confirm that the selected document aligns with your specific requirements and complies with your local jurisdiction.

- If you require a different template, utilize the Search function to find the appropriate legal form. Ensure it meets all necessary specifications before proceeding.

- To purchase the document, click the Buy Now button and choose a convenient subscription plan. A user account registration is needed to gain full access to the library.

- Complete your purchase by entering your credit card information or selecting your PayPal account to pay for the subscription.

- Once your transaction is successful, download the form to save it on your device. Access it later through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to efficiently execute legal documents through its vast library of over 85,000 easily fillable and editable legal forms. The service assures high quality with access to premium experts for assistance, guaranteeing that your documents are accurate and legally compliant.

Start simplifying your legal documentation process today by choosing US Legal Forms for all your limited liability needs!

Form popularity

FAQ

The tax form that a limited liability company files depends on its classification. Multi-member LLCs use Form 1065, while single member LLCs file Schedule C along with Form 1040. This flexibility allows LLCs to maximize their limited liability benefits while ensuring compliance with IRS regulations.

A single member LLC files taxes using Form 1040, along with Schedule C to report business income and expenses. Since the IRS treats a single member LLC as a disregarded entity, the business income is passed through to your personal tax return. This structure simplifies the tax process while still providing the advantages of limited liability.

No, you should not file your LLC and personal taxes together. The limited liability company’s income is typically reported separately on Schedule C of your personal tax return. Keeping these filings distinct helps protect your limited liability status and clarifies your financial obligations.

No, it is generally advisable to keep your personal and business taxes separate. Filing them together could complicate your financial situation and jeopardize the limited liability status of your LLC. Instead, file the LLC taxes separately to maintain clarity and uphold the protection granted by limited liability.

Yes, when you have a limited liability company (LLC), you typically file your taxes separately. The LLC is considered a pass-through entity, meaning its income typically passes through to your personal tax return. This separation helps maintain the limited liability protection the LLC provides while allowing you to report both LLC and personal income accurately.

The start-up costs for a Limited Liability Company (LLC) typically include state filing fees, which vary by state, as well as potential publication fees if required. You might also need to invest in professional services for legal advice or template formation. Don’t forget about ongoing expenses like annual reports, which are essential for maintaining your LLC status. US Legal Forms can assist you in identifying all potential costs and simplify the registration process.

While a Limited Liability Company (LLC) offers many advantages, there are downsides that you should consider. For instance, forming an LLC can involve higher initial costs and more extensive paperwork compared to sole proprietorships. Additionally, some states impose franchise taxes and annual fees, which can add financial obligations. It is wise to evaluate these factors carefully and US Legal Forms can help clarify your responsibilities.

Yes, you can form a Limited Liability Company (LLC) without having an active business, but you should have a clear purpose in mind. Many choose to create an LLC for asset protection or future endeavors. However, it’s important to understand that ongoing maintenance costs will apply even if the business is not currently operational. US Legal Forms can guide you through the process of establishing your LLC properly.

Having limited liability is generally beneficial for business owners as it protects personal assets from business-related risks. This protection encourages entrepreneurship by reducing the financial fears associated with starting or running a business. If you want to explore limited liability options further, platforms like USLegalForms can guide you through the process efficiently.

A limited liability company (LLC) is a flexible business structure that combines the benefits of both a corporation and a partnership. It protects individual owners from personal liability while allowing for pass-through taxation. Choosing an LLC can be an effective way to take advantage of limited liability protections while enjoying operational flexibility.