Limited Liability Company With The Ability To Establish Series

Description

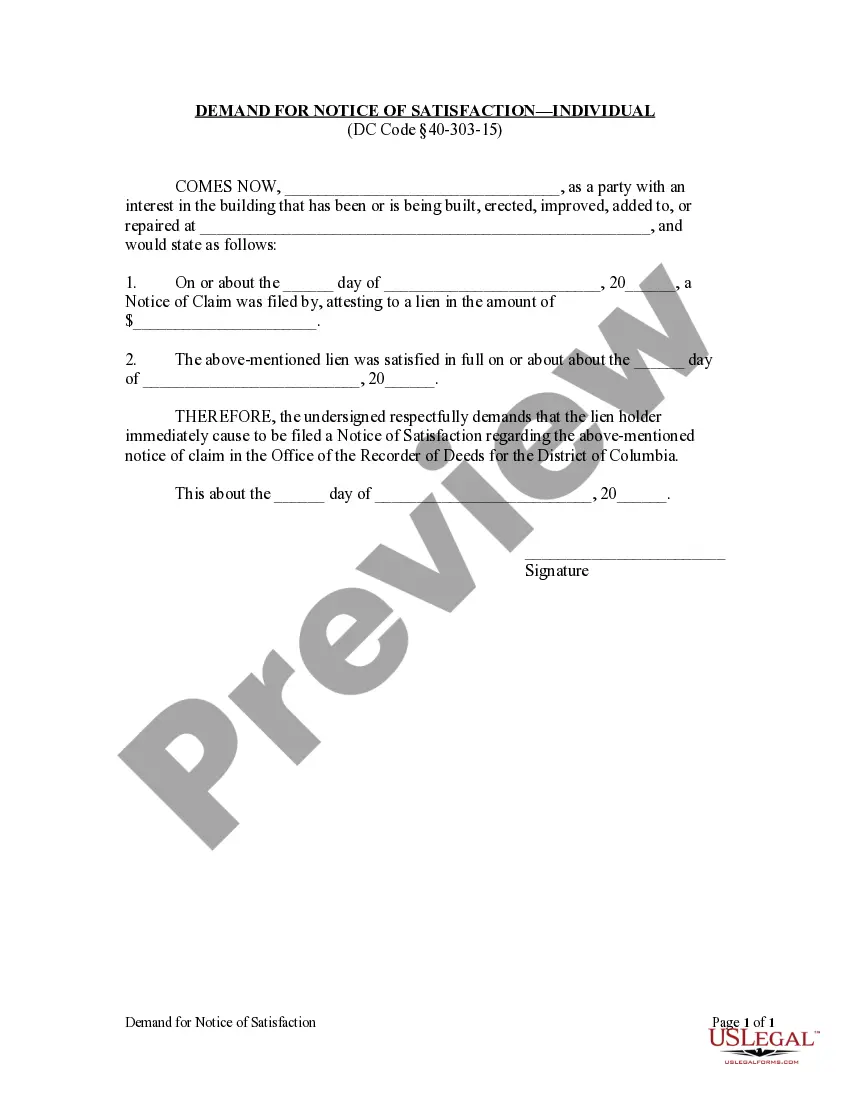

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- If you're a returning user, log into your account, ensuring your subscription is current. Click the Download button to retrieve your desired form template.

- For first-time users, start by checking the Preview mode and reading the form description. Confirm that it meets your unique needs and complies with your local regulations.

- If the template doesn't fit your requirements, utilize the Search tab to find an alternative document that suits your situation.

- Once you identify the correct form, click the Buy Now button and select your preferred subscription plan. You'll need to register for an account to access all available resources.

- Proceed with the purchase by entering your credit card information or opting for PayPal.

- After purchase, download the form to your device. You can find it anytime in the My Forms section of your account.

By leveraging US Legal Forms, you're equipped to create precise and legally compliant documents swiftly.

Start your journey today and explore the comprehensive library that empowers you to take control of your legal needs!

Form popularity

FAQ

Yes, an LLC can establish a series, allowing it to create different divisions under the same legal structure. Each series operates separately while sharing resources, making it an effective strategy for managing multiple business ventures. This flexibility makes Series LLCs an attractive option for entrepreneurs looking to expand their operations without incurring significant costs.

To transform your LLC into a Series LLC, you need to file the appropriate paperwork with your state, often called an amendment or conversion application. You should carefully follow your state's guidelines to ensure compliance and legal recognition. For step-by-step assistance, consider utilizing services like uslegalforms, which streamline the process with expert resources.

While a Series LLC offers significant advantages, it also has some drawbacks. Not all states recognize Series LLCs, which can create legal ambiguities. Additionally, maintaining compliance and understanding the associated responsibilities can be more complex than operating a traditional LLC.

Filing taxes for a Series LLC involves treating each series as a separate entity for tax purposes. This means you can deduct expenses and report income for each series individually. It’s essential to keep accurate records to comply with tax regulations, and consulting with a tax professional can help you navigate the process efficiently.

Yes, you can change your existing LLC to a Series LLC, but the process varies by state. You will typically need to file specific documents and may need to meet particular requirements under your state's laws. Using platforms like uslegalforms can simplify this transition, providing necessary resources and guidance.

A Series LLC offers flexibility and asset protection by allowing you to create multiple divisions under one umbrella. Each series can operate independently, helping you manage risks and liabilities effectively. This structure is particularly beneficial for entrepreneurs looking to minimize exposure while optimizing operational efficiency.

A limited liability company that has the ability to establish series is a specialized form of an LLC designed for flexibility. This structure enables the creation of multiple series, each functioning like a separate entity, which safeguards each series from liabilities of others. This characteristic makes it an appealing option for entrepreneurs looking to diversify their investments while maintaining protection. You can explore this option with uslegalforms for seamless setup and management.

A limited liability company with the ability to establish series is a unique business structure that allows you to form multiple divisions under a single LLC. Each series can own its own assets, incur liabilities, and operate independently, all while being protected from the debts of other series. This setup can help you effectively manage diverse business interests while minimizing risks.

The main difference lies in the ability to create multiple series within a series LLC, each with its own assets and liabilities. In contrast, a normal LLC operates as a single entity without this division. This added flexibility allows your business to limit risks and manage assets more effectively. Understanding these differences is crucial when deciding on a limited liability company with the ability to establish series.

A series LLC can be a beneficial choice for many businesses. This structure allows you to create separate divisions under one entity, protecting each from liabilities associated with the others. It also simplifies management and potential tax reporting. If you plan to operate multiple ventures, a limited liability company with the ability to establish series may be an excellent fit.