Limited Liability Company For Dummies

Description

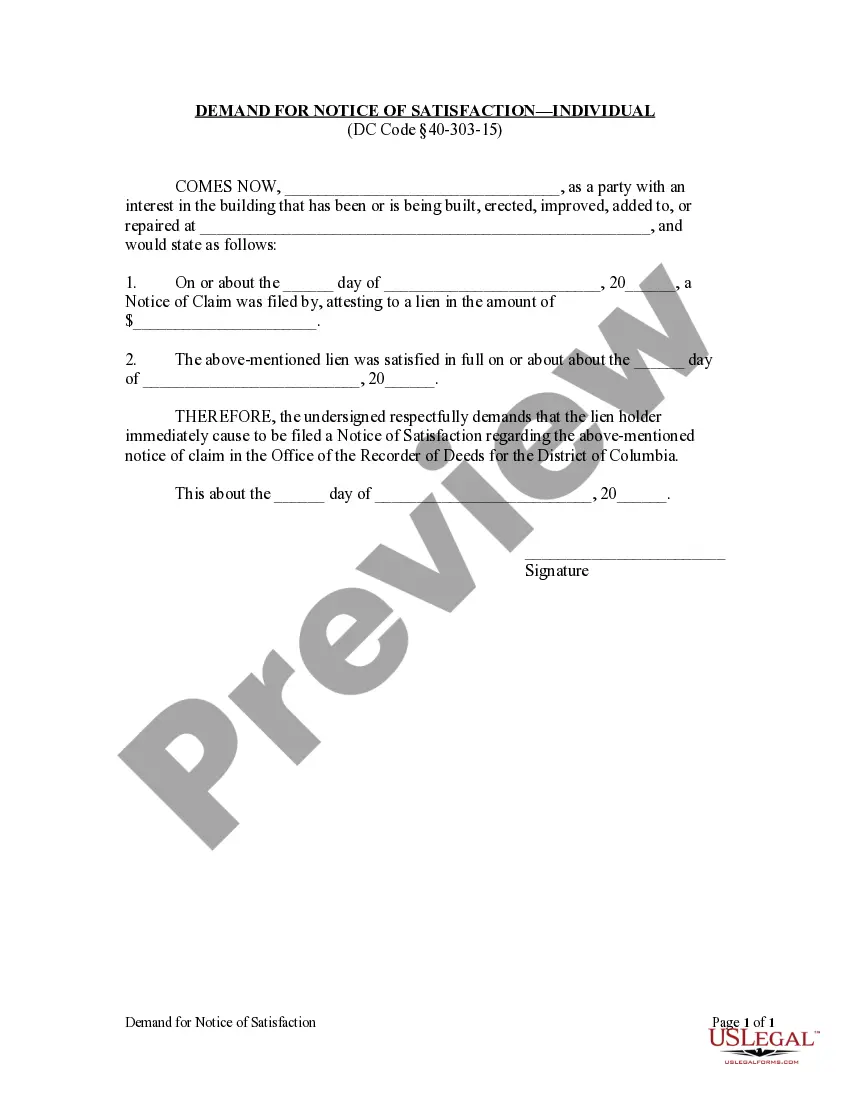

How to fill out District Of Columbia Demand For Notice Of Satisfaction By Corporation?

- If you're a returning user, log into your account and download the required form template by clicking the Download button. Ensure your subscription is valid; if not, renew based on your payment plan.

- For first-time users, begin by browsing the Preview mode and form descriptions to find the correct template that meets your state requirements.

- If you need to look for a different template, use the Search tab to find one that suits your particular needs.

- Once you've found the right document, click the Buy Now button and select your preferred subscription plan, then create an account for access to the legal forms library.

- Complete your purchase by entering your credit card info or using your PayPal account for the subscription.

- Finally, download your form to your device, and access it later via the My Forms section of your profile.

US Legal Forms provides a robust collection of over 85,000 legal forms, making it a top choice for individuals and attorneys alike. You can also access premium experts to assist you in ensuring your documents are complete and compliant with legal requirements.

Start your journey now with US Legal Forms and make the LLC formation process seamless. Don't hesitate—get your legal forms today!

Form popularity

FAQ

Failing to file taxes for your limited liability company for dummies can lead to penalties and interest on unpaid taxes. Your LLC may also lose its good standing with the state and face accusations of fraud. Additionally, the IRS can take enforcement actions, including liens against your business assets. It's essential to stay on top of your tax filings to avoid these issues.

To file taxes as a limited liability company for dummies, you need to determine your tax classification first. Most single-member LLCs will file as a sole proprietorship, while multi-member LLCs file as partnerships. You will report income and expenses using specific forms, like the 1065 for partnerships. It's advisable to leverage resources or professionals that can simplify this process.

The best way to file for a limited liability company for dummies is to gather your necessary information, choose your business name, and file the Articles of Organization with your state. Additionally, you may consider using an online service like USLegalForms, which guides you through the process step-by-step, ensuring you don’t miss any critical details.

A single owner LLC typically files taxes using a Schedule C form along with their personal tax return. The profits or losses from the business pass through directly to the owner's personal income. This approach simplifies tax filing for those new to the concept of a limited liability company for dummies. Always consult a tax professional to understand your obligations.

Yes, you can file your limited liability company for dummies separately from your personal assets. This separation helps in protecting your personal belongings from any liabilities tied to the business. You can use services like USLegalForms to facilitate the separate filing process and ensure you complete all necessary paperwork correctly.

You can establish a limited liability company for dummies, and choose not to actively manage it. However, it is essential to maintain the legal status of the LLC by filing necessary documents and paying required fees. If you let it sit without action, it may become inactive or dissolve. So, while you technically can have it, you still need to keep up with certain responsibilities.

Determining the income level at which an LLC becomes worthwhile varies, but many find it beneficial when their earnings exceed $50,000. By forming a limited liability company for dummies, you can maximize tax benefits and protect your assets as your income grows. Consulting with a tax professional can provide personalized insights tailored to your circumstances.

One downside to forming a limited liability company for dummies is the fees and paperwork involved in establishing and maintaining the entity. Additionally, LLCs may have self-employment taxes that can be higher than traditional corporations. Nonetheless, the liability protection often outweighs these concerns, making it a popular choice.

Limited liability simply means that as a business owner, you are not personally responsible for your company's debts and liabilities. This protection allows you to separate your personal assets from your business assets. Understanding this concept is crucial for anyone considering a limited liability company for dummies.

Starting a limited liability company for dummies is simpler than you might think. The easiest LLC to establish is typically a single-member LLC because it requires less paperwork and fewer formalities. You can form it online through platforms like USLegalForms, which guides you through the process seamlessly.