Declaration Of Heirship With Special Power Of Attorney

Description

How to fill out District Of Columbia Heirship Affidavit - Descent?

How to acquire professional legal documents consistent with your state laws and create the Declaration Of Heirship With Special Power Of Attorney without consulting a lawyer.

Numerous online services provide templates for various legal matters and requirements.

However, it may require time to identify which of the offered samples meet both your situation and legal standards.

Download the Declaration Of Heirship With Special Power Of Attorney using the associated button next to the file name. If you lack an account with US Legal Forms, follow the steps outlined below.

- US Legal Forms is a reliable platform that assists you in locating formal documents crafted in accordance with the latest state legal updates and helps you save on legal fees.

- US Legal Forms is not just an ordinary online directory.

- It's an assortment of over 85,000 validated templates for various business and personal circumstances.

- All documents are categorized by area and state to streamline your search experience.

- It also integrates with advanced tools for PDF editing and electronic signatures, allowing users with a Premium membership to promptly complete their documents online.

- Obtaining the necessary documents requires minimal effort and time.

- If you already have an account, Log In and verify that your subscription is active.

Form popularity

FAQ

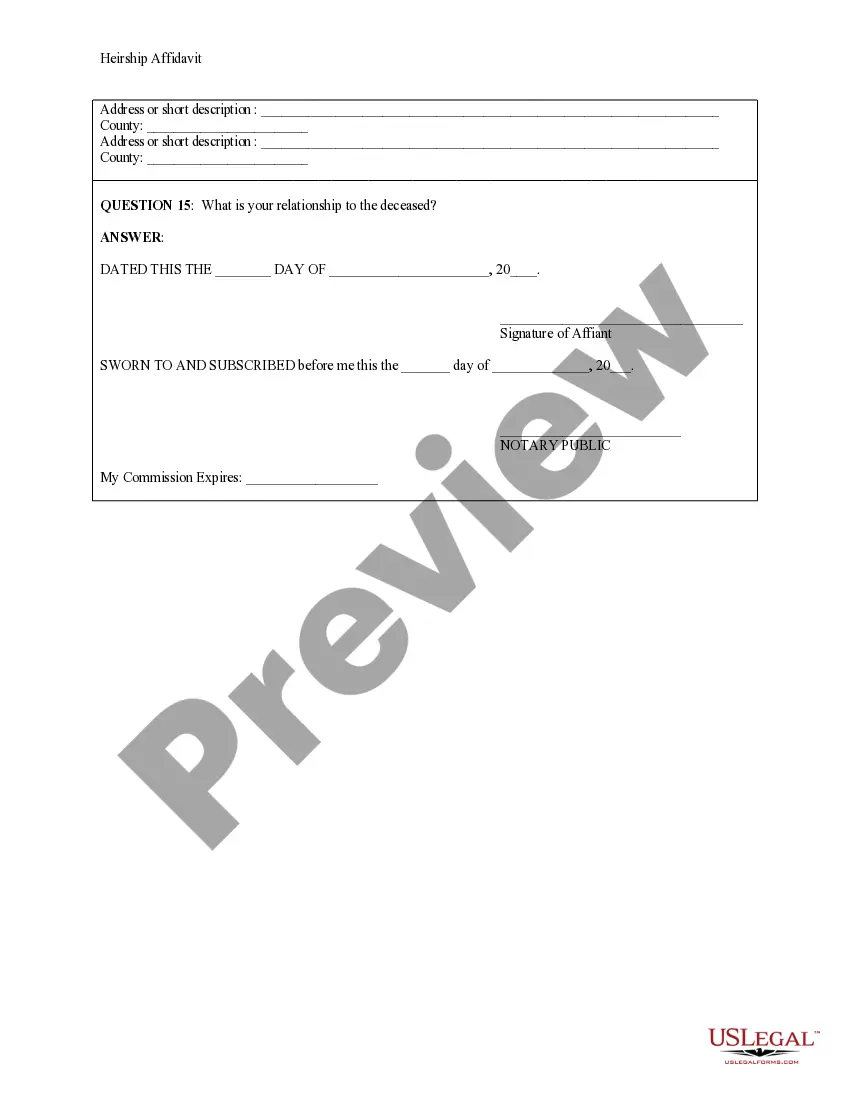

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

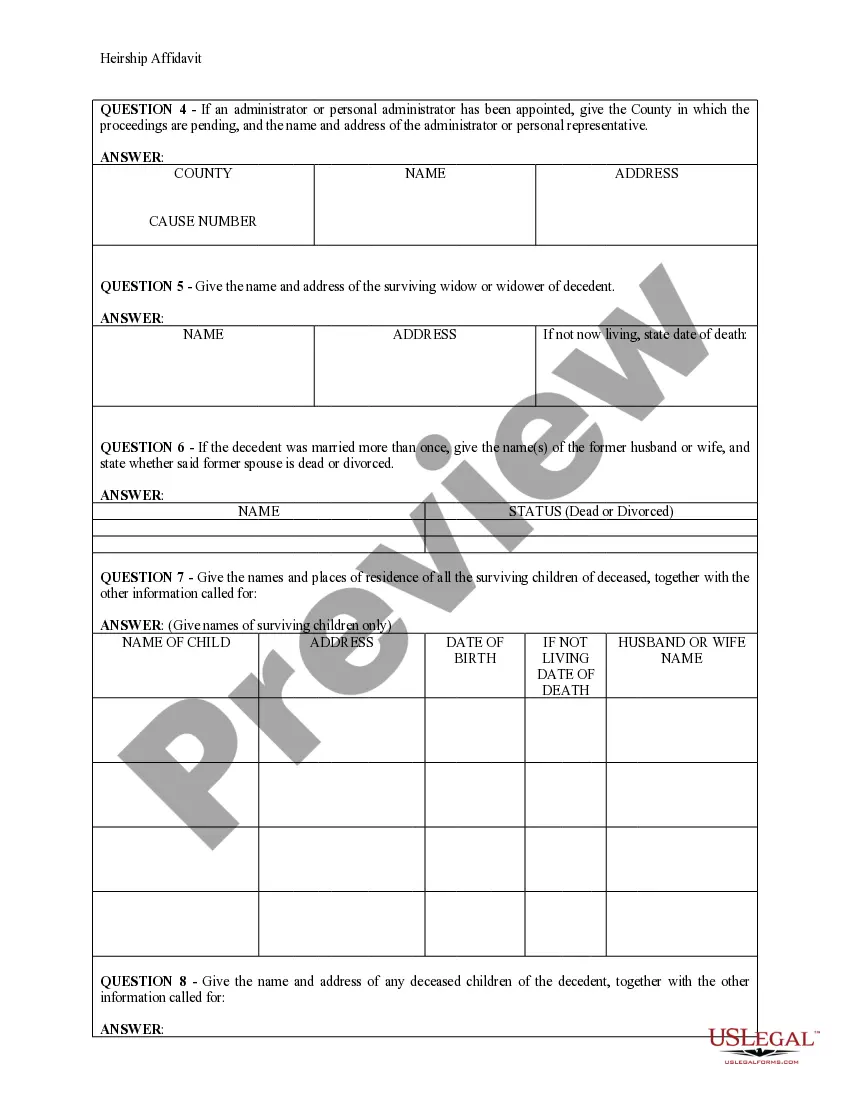

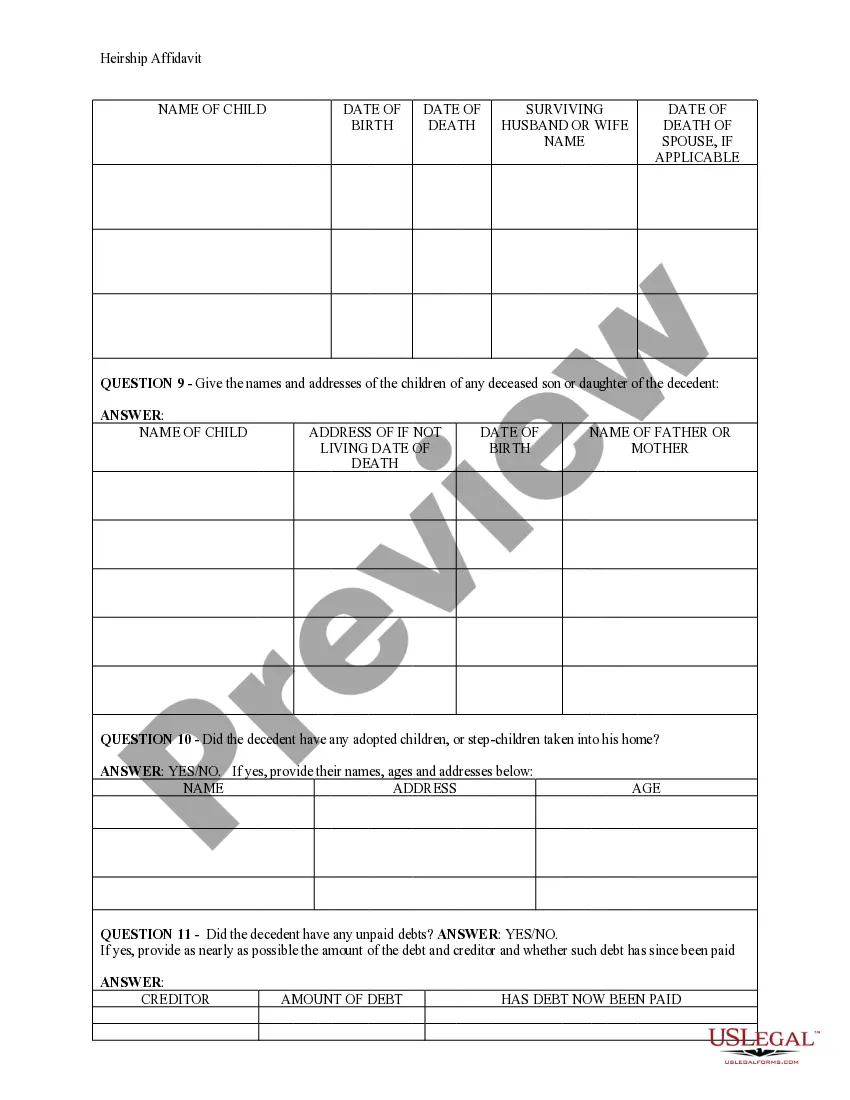

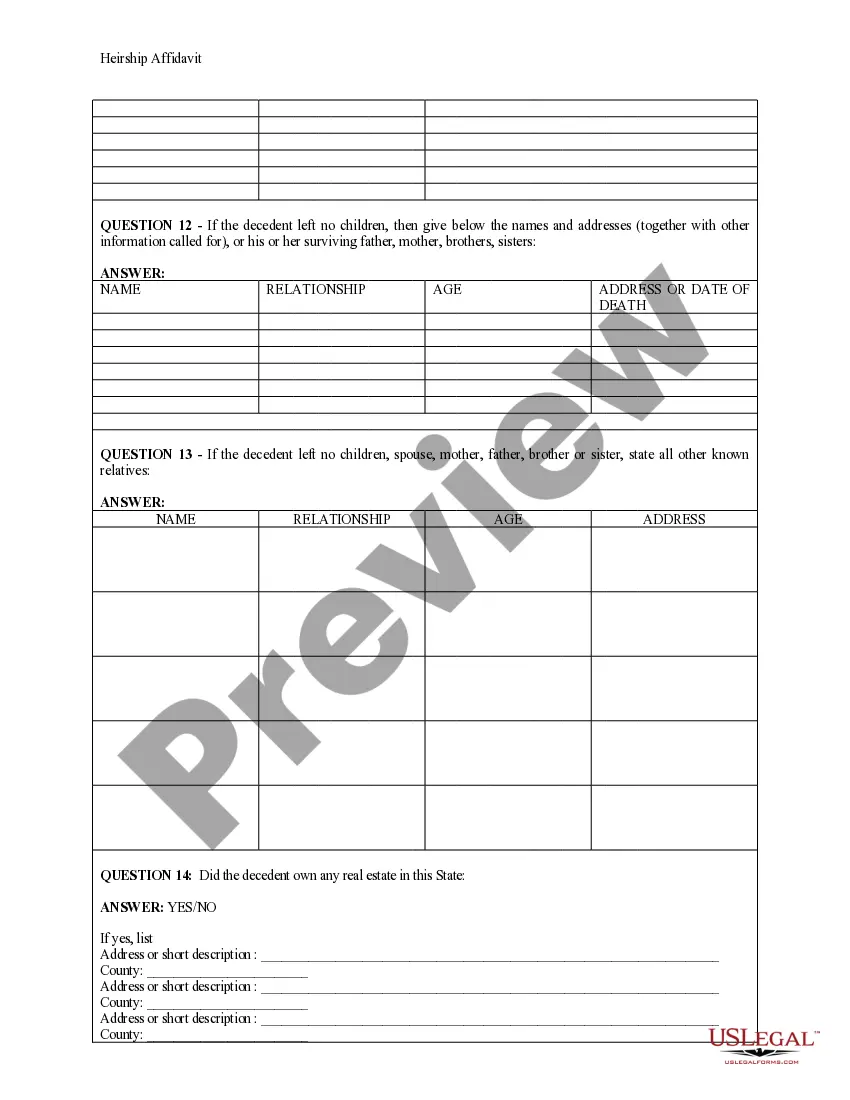

The Affidavit of Heirship form you file must contain:The decedent's date of death.The names and addresses of all witnesses.The relationships the witnesses had with the deceased.Details of the decedent's marital history.Family history listing all the heirs and the percentage of the estate they may inherit.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...