District Of Columbia Lien Waiver Form With Notary Signature

Description

Form popularity

FAQ

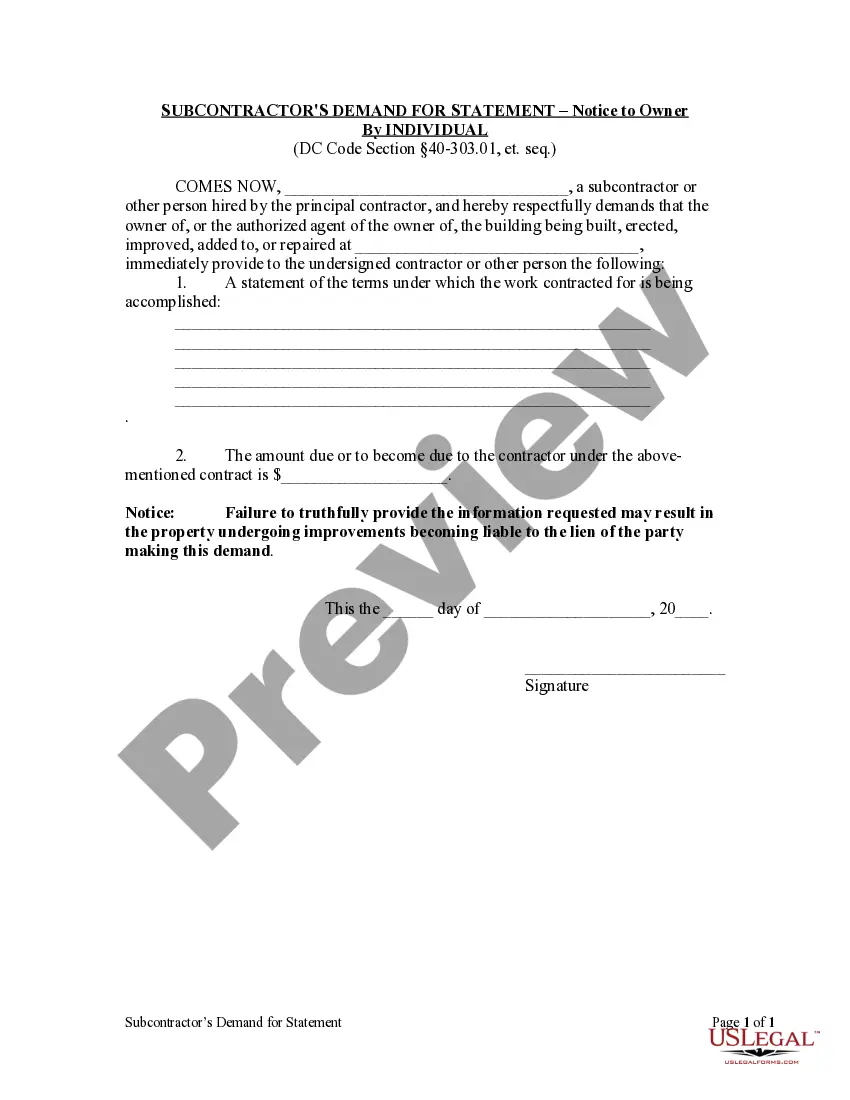

An unconditional release confirms that a party has received full payment and waives any future claims on the property. This document holds significant value for property owners wishing to eliminate concerns about future liens. Specifically, the District of Columbia lien waiver form with notary signature serves as a solid way to formalize this release, providing assurance that the claims have been settled. Consider platforms like US Legal Forms to guide you through obtaining this essential document efficiently.

Conditional lien waivers are effective only when a specific condition, such as payment, is met, while unconditional waivers take immediate effect regardless of payment status. This clarity is crucial for both contractors and property owners. When utilizing the District of Columbia lien waiver form with notary signature, understanding the implications of each type can aid in making informed decisions for all parties involved. For comprehensive resources, US Legal Forms remains a trustworthy option.

In North Carolina, there are typically two main types of lien waivers: conditional and unconditional waivers. Each serves distinct purposes, but the District of Columbia lien waiver form with notary signature is applicable beyond NC and ensures recognition across jurisdictions. Understanding these types helps ensure clarity in transactions, protecting against potential liens. For specific forms, consider exploring US Legal Forms, which offers accurate and state-compliant options.

Oregon does not require notarization for all lien waivers, but having a notary signature can be beneficial for legal strength. When using a District of Columbia lien waiver form with notary signature, it's advisable to follow best practices by including a notary. This enhances the form's validity and may protect you in potential disputes. Always consult local regulations and legal advice to ensure your waivers meet all necessary standards.

In California, notarization is generally required for lien waivers, particularly for those involving a conditional waiver. Thus, when using a District of Columbia lien waiver form with notary signature, it’s crucial to adhere to California's requirements to avoid legal issues. Notarization adds an extra layer of validation, ensuring that all parties recognize the agreement's authenticity. Always check with a legal advisor for specific project guidance in California.

Yes, many jurisdictions allow electronic signatures on lien waivers, increasing convenience for all parties involved. While using a District of Columbia lien waiver form with notary signature, ensure that the electronic signature complies with state law, as some may still have specific requirements. Check whether the receiving party accepts electronic waivers, as acceptance can vary. Using digital tools can help streamline the process and save time.

Some states mandate notarization for lien waivers to give them legal weight, while others do not. It's essential to check state-specific regulations to know if you need a District of Columbia lien waiver form with notary signature. States like California and Florida typically require notarized waivers, while others may offer more flexibility. Always verify local laws to ensure compliance with lien waiver requirements.

Filling out a conditional waiver of a lien involves specifying details that outline the conditions under which the waiver is valid. Begin with your name, the property owner's name, and relevant project information, ensuring you incorporate the phrase District of Columbia lien waiver form with notary signature if applicable. Clearly state the conditions that need to be met for the waiver to take effect. Lastly, sign the form in the presence of a notary public to finalize it.

In New York, lien waivers do not necessarily require notarization, but having a notary signature can enhance the document’s credibility. The District of Columbia lien waiver form with notary signature serves as a clear example of how to make a waiver more reputable. Using notarized documents can help clarify agreements and protect against potential disputes. It is wise to check specific project requirements to confirm whether notarization is preferred.

To file a lien waiver, start by obtaining the correct form, specifically the District of Columbia lien waiver form with notary signature. Complete the form with the necessary details, such as project information and the amounts involved. After filling it out, ensure that you sign it in front of a notary to validate the document. Once notarized, you can submit the waiver to the relevant party, usually the property owner or contractor.