Connecticut Poa Withdrawal

Description

Form popularity

FAQ

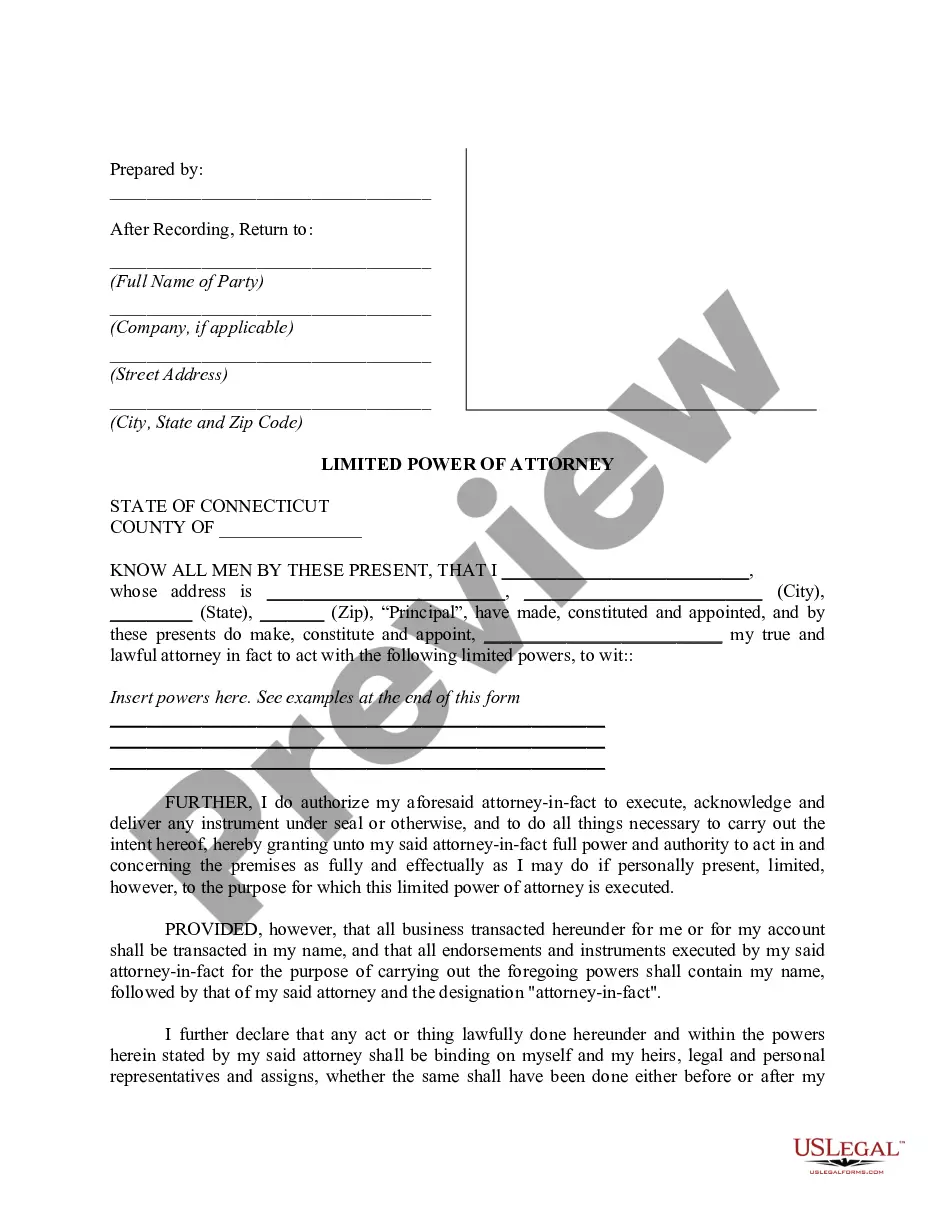

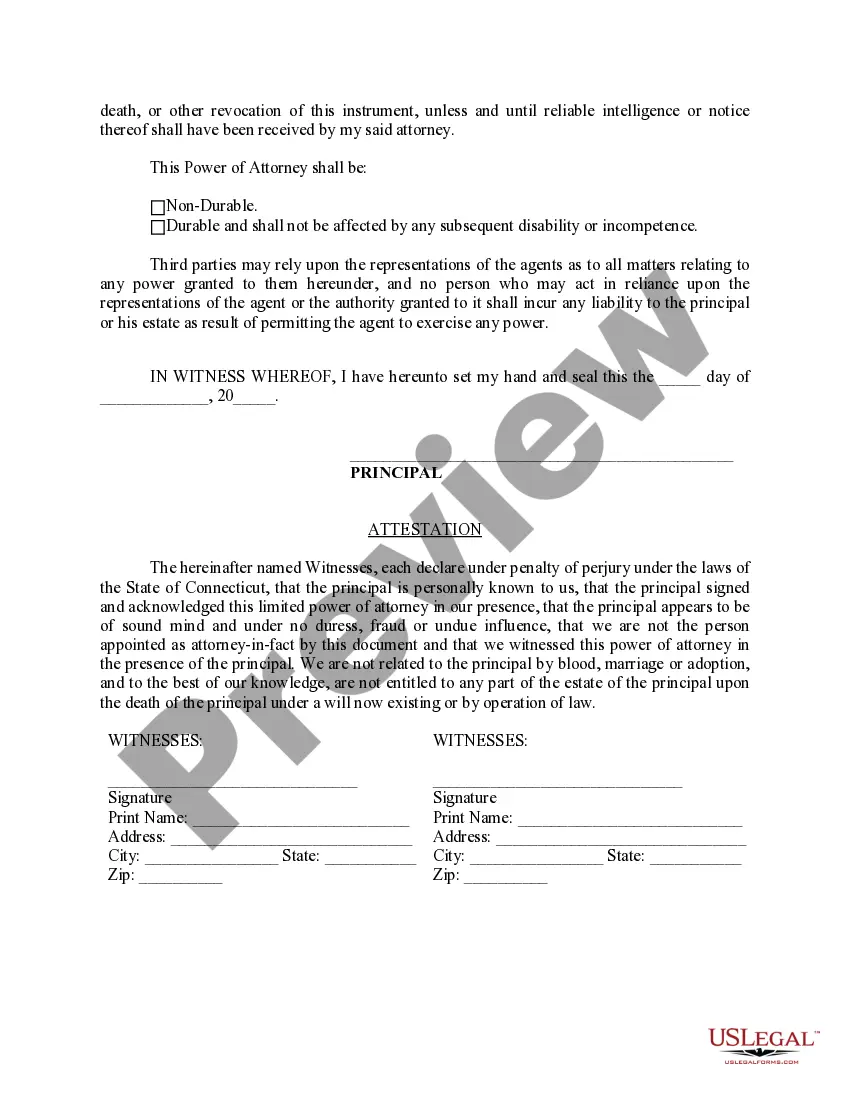

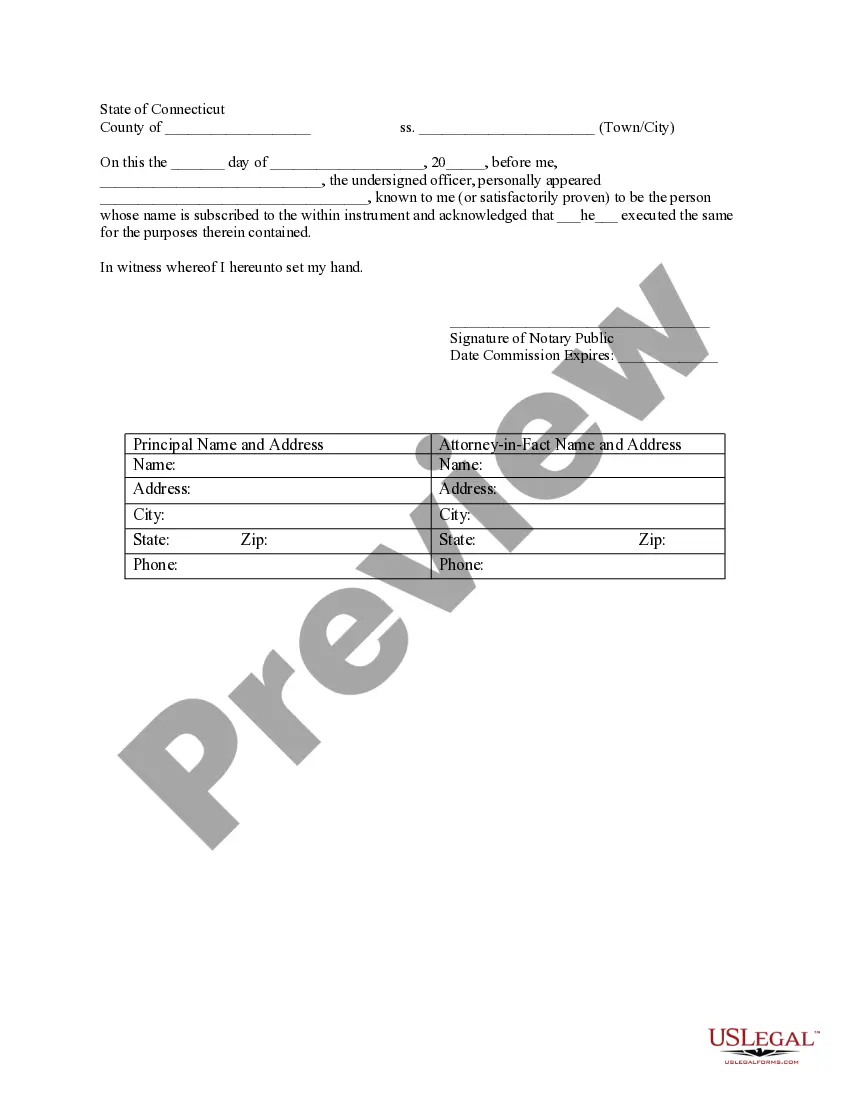

Yes, a power of attorney in Connecticut must be notarized to be considered valid. The notarization process reinforces the legitimacy of your document, making it more likely to be accepted by institutions. Keeping this in mind will ensure a smoother Connecticut POA withdrawal process. Our platform simplifies this requirement by providing notary services and easy-to-follow instructions.

To submit a Connecticut POA, you must first complete the appropriate power of attorney form. After filling out the document, you’ll need to sign it in the presence of a notary. Once you have notarized your form, you can submit it to the necessary institutions, such as banks or healthcare facilities. Utilizing our US Legal Forms platform can help streamline this process, guiding you through each step of the Connecticut POA withdrawal.

To file a power of attorney in Connecticut, you will first need to create a document that clearly states your intentions. After drafting, sign the document in front of a notary public. Once completed, you can submit it to the local town clerk if desired. For a smooth process involving Connecticut POA withdrawal, consider using US Legal Forms for reliable templates and guidance.

In Connecticut, a judgment typically lasts for 20 years. However, you can renew it for another 20 years if necessary. This duration means that if you are considering a Connecticut POA withdrawal, it’s essential to factor in how judgments could impact your financial or legal decisions. Always consult with a legal expert if you need guidance on handling judgements in relation to your power of attorney.

Yes, in Connecticut, you can write your own will and have it notarized. However, it is essential to follow the state's legal guidelines to ensure its enforceability. If you plan to use a Connecticut POA withdrawal in conjunction with a will, consulting a legal expert ensures your documents align correctly with your intentions.

You should file a certificate of closed pleadings in Connecticut once all necessary pleadings have been completed and the case is ready for trial. This documentation ensures clarity and helps streamline legal proceedings. If you're unsure about managing a Connecticut POA withdrawal during this process, consulting with a legal professional can provide valuable insights.

A Connecticut tax POA allows an individual to authorize another party to handle tax matters on their behalf. This legal tool can be essential when navigating tax obligations efficiently. Understanding your Connecticut POA withdrawal rights can bolster your financial strategy, ensuring tax responsibilities are appropriately managed.

In Connecticut, a motion to dismiss can arise from several grounds, including lack of jurisdiction or failure to state a claim. When considering a Connecticut POA withdrawal, knowing your rights is crucial. Legal assistance helps clarify the grounds applicable in your situation, leading to a more informed decision.

Yes, Connecticut is an attorney closing state. This means that an attorney must oversee certain property transactions. When dealing with a Connecticut POA withdrawal, legal guidance can be invaluable to ensure all processes are correctly followed. Utilizing a professional can help streamline your experience.

To write a revocation of power of attorney, start with a clear statement indicating your intent to revoke any previous POA documents. Include your name, the agent’s name, and a brief description of the powers being revoked. Finally, sign your revocation in front of a notary to confirm its authenticity, ensuring that your Connecticut POA withdrawal is recognized by all relevant parties.