This form is an application for custody and visitation. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Stay Of Execution Eviction Ct Withholding Tax

Description

How to fill out Connecticut Stay Of Execution Application - Summary Process?

Creating legal documents from the ground up can frequently be daunting. Certain situations may require extensive investigation and significant financial investment.

If you’re looking for a simpler and more cost-effective method of generating Stay Of Execution Eviction Ct Withholding Tax or any other documents without navigating complex processes, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific templates meticulously prepared for you by our legal professionals.

Utilize our service whenever you require a dependable and trustworthy platform through which you can conveniently find and download the Stay Of Execution Eviction Ct Withholding Tax. If you’re already familiar with our services and have previously registered an account with us, simply Log In to your account, find the template, and download it right away or re-download it at any time later in the My documents section.

Ensure that the form you select aligns with the laws and regulations of your state and county. Choose the most suitable subscription plan to purchase the Stay Of Execution Eviction Ct Withholding Tax. Download the document, then fill it out, verify it, and print it. US Legal Forms enjoys a solid reputation and over 25 years of experience. Join us today and make document completion an effortless and efficient process!

- Not registered yet? No problem.

- Setting it up and browsing the catalog takes little to no time.

- Before diving straight into downloading Stay Of Execution Eviction Ct Withholding Tax, keep these tips in mind.

- Review the document preview and descriptions to confirm you have located the correct form.

Form popularity

FAQ

In Connecticut, evictions can remain on your record for up to seven years, affecting your rental history and future housing opportunities. However, if you successfully expunge the eviction, it can be removed from your record sooner. It is advisable to act promptly and consult resources like US Legal Forms to understand your options for expungement. Taking these steps can significantly enhance your chances of securing a new rental agreement.

The time it takes to evict a tenant in Connecticut typically ranges from a few weeks to several months, depending on various factors, including court schedules and tenant response. After serving notice, if the tenant does not leave, the landlord must file an eviction suit, which then requires a court hearing. If a stay of execution eviction is granted, the timeline may extend further. Engaging with US Legal Forms can help you navigate the legalities and potentially speed up the process by ensuring proper procedures are followed.

To expunge an eviction in Connecticut, you must file a motion in court demonstrating valid reasons for the expungement. This may include evidence that the eviction was resolved in your favor or that it was filed incorrectly. Using US Legal Forms simplifies this process by providing templates and instructions tailored for Connecticut’s legal requirements. Successfully expunging an eviction helps improve your rental history and can ease future housing challenges.

The eviction process in Connecticut begins with the landlord serving a notice to quit, which provides the tenant with a specific timeframe to vacate the property. If the tenant does not leave, the landlord can file an eviction lawsuit in court. Following a court hearing, if the judge rules in favor of the landlord, a stay of execution eviction may be granted, allowing for a legal eviction to take place. It's crucial to follow all legal protocols to avoid complications, and resources like US Legal Forms can assist with the necessary forms and guidelines.

To remove an eviction from your record in Connecticut, you can consider filing a motion for expungement. This process involves demonstrating that the eviction was vacated or that you settled the case in a way that warrants removal. Utilizing a service like US Legal Forms can guide you through the necessary documentation and procedures, helping you ensure that your filing is correct and timely. Remember, addressing any outstanding debts may also contribute to a smoother expungement process.

Here are seven steps to remove an eviction from your record. Check Your State Laws. ... Win Your Eviction Case. ... Review Your Eviction Paperwork. ... Determine Your Expungement Type. ... File Your Motion of Expungement. ... Attend the Hearing. ... Check the Court Record. ... Send Copies to Tenant Screening Companies.

You might be able to get 3 extra months to move out if you are evicted because you did not pay the rent, but you must fill out a Stay of Execution (#JD-HM-21) form and pay the court all of the rent you owe within 5 days of the judgment. You must be prepared to pay for each month that you stay.

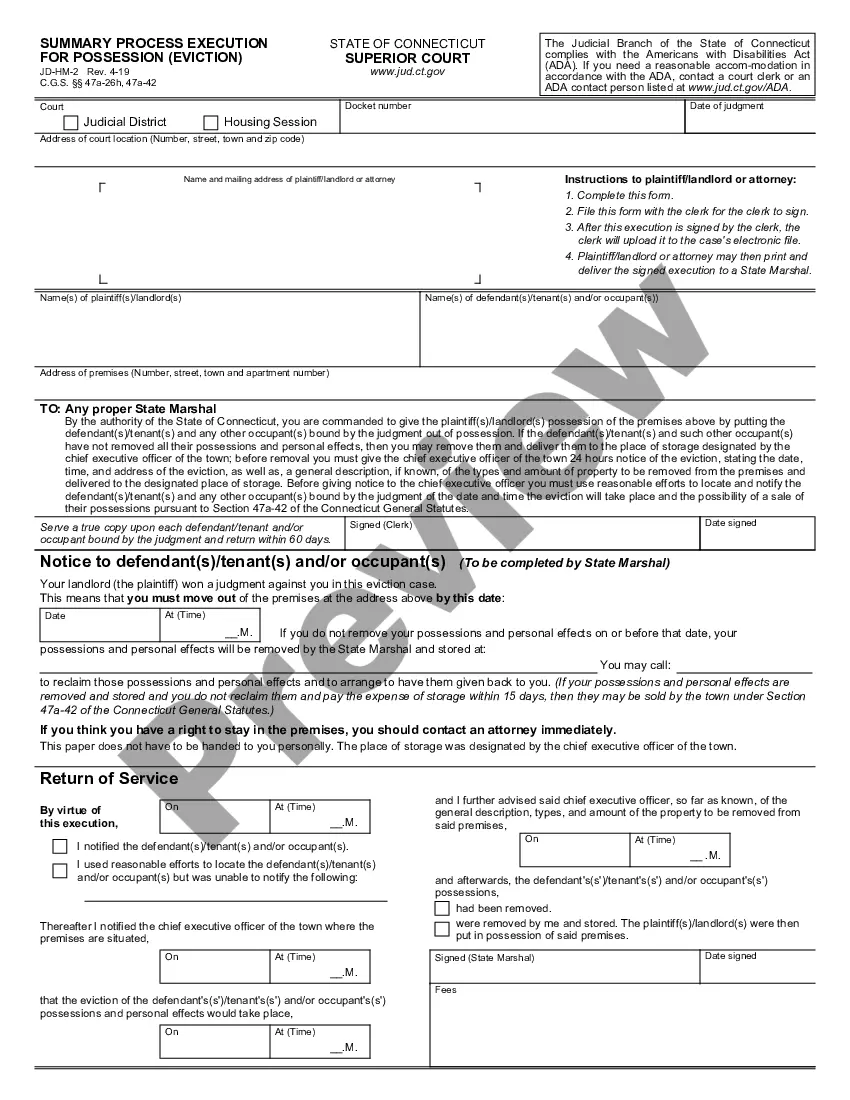

The Execution informs the defendant that they must vacate the premises within a minimum of 24 (twenty-four) hours or be physically removed from the premises and that if the defendant does not move the defendant's possessions and personal effects they will be removed by the marshal and stored at the defendant's expense.

Stay of execution. Appeal (a) Execution shall be stayed for five days from the date judgment has been rendered, provided any Sunday or legal holiday intervening shall be excluded in computing such five days. (b) No appeal shall be taken except within such five-day period.

How Long Does an Eviction Stay on Your Record? An eviction itself doesn't appear on your credit report. However, any unpaid rent and fees could be sent to collections and remain on your credit report for seven years from the original delinquency date.