Connecticut Notice Of Intent To Lien Form Arkansas

Description

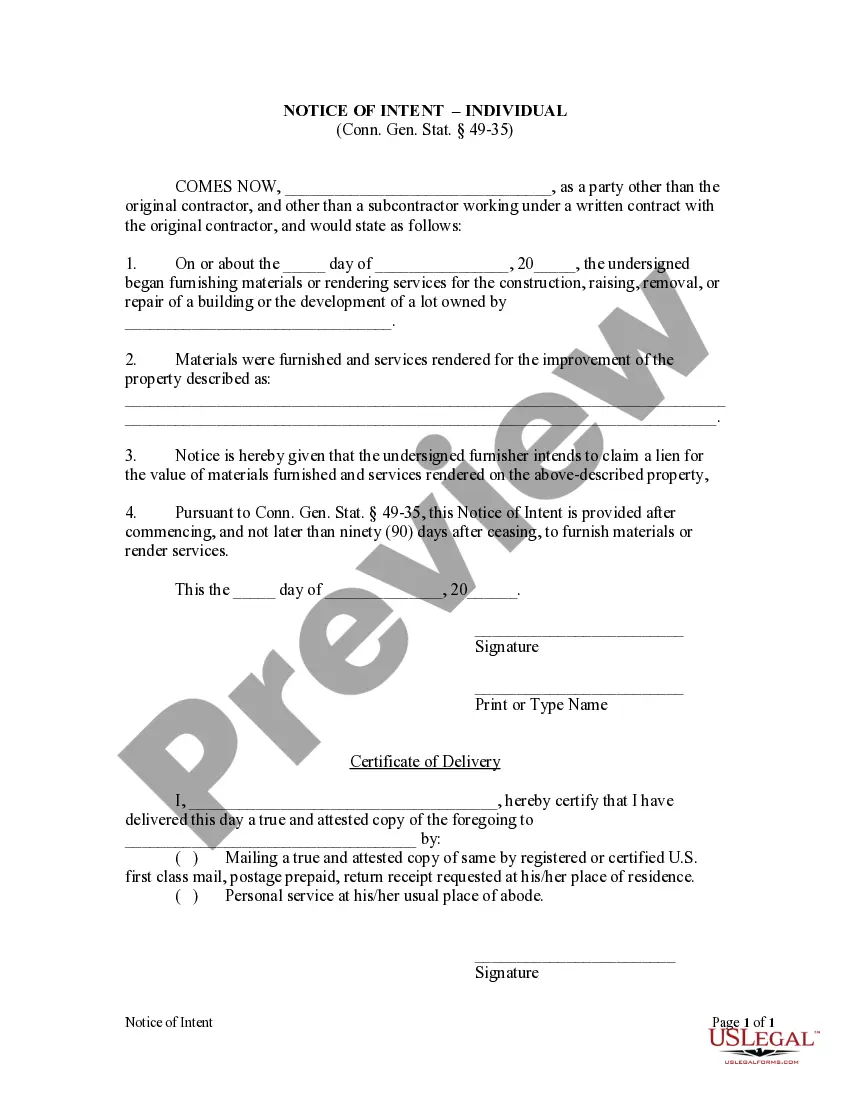

How to fill out Connecticut Notice Of Intent - Individual?

Handling legal paperwork can be bewildering, even for the most seasoned experts.

If you're looking for a Connecticut Notice Of Intent To Lien Form Arkansas and lack the time to thoroughly hunt for the correct and current version, the process can be overwhelming.

Utilize a valuable knowledge base of articles, manuals, and resources pertinent to your case and requirements.

Save time and effort searching for the documents you need and make use of US Legal Forms’ advanced search and Preview feature to find the Connecticut Notice Of Intent To Lien Form Arkansas and download it.

Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document management into a seamless and user-friendly experience today.

- If you have a membership, Log In to your US Legal Forms account, find the form, and download it.

- Visit the My documents tab to see the documents you have previously downloaded and manage your folders as desired.

- If it's your first experience with US Legal Forms, create a no-cost account and enjoy unlimited access to all the benefits the library offers.

- Here are the steps to follow after downloading the form you need.

- Confirm it is the correct form by previewing and reviewing its description.

- Make sure that the template is acknowledged in your state or county.

- Select Buy Now when you are ready.

- Choose a subscription plan.

- Find the format you desire, and Download, fill out, sign, print, and send your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to any requirements you might have, from personal to corporate paperwork, all in one place.

- Employ sophisticated tools to complete and manage your Connecticut Notice Of Intent To Lien Form Arkansas.

Form popularity

FAQ

Putting a lien in Arkansas involves several steps, including serving a notice of intention to file a lien and then filing the actual lien with the appropriate county office. This process requires careful documentation to support your claim, detailing the work completed and payment statuses. A well-prepared Connecticut notice of intent to lien form Arkansas is a valuable tool for those navigating this process to secure their interests.

Wage Garnishment Example Assume your weekly disposable income is $640. This is the amount you take home after all necessary deductions have been made. Under Louisiana law, a judgment creditor can garnish up to 25% of $640, or the amount by which $640 exceeds $217.50, whichever is less.

The GARNISHMENT JUDGMENT is an order instructing the garnishee to deliver defendant's wages and/or commission to the Constable of the City of Baton Rouge. ANY QUESTIONS YOU MAY HAVE CONCERNING THE SEIZED WAGES AND/OR COMMISSIONS ARE TO BE DIRECTED TO THE CONSTABLE'S OFFICE AT NUMBER (225) 389-3004.

In Louisiana, wage garnishments can last as long as it takes to pay the money you owe back. Judgment creditors are limited in the total amount they can garnish and how much they can garnish from each paycheck. Creditors can only garnish the amount you owe ing to the judgment.

When you represent yourself, you are referred to as a "self-represented litigant" or "pro-se litigant." Even if you don't have a lawyer, judges and court employees are not allowed to provide you with legal advice and may not be able to speak with you at all about your case outside of the courtroom.

Withhold 25% of all disposable earnings that you now owe or may hereafter owe to your employee. The attached statement of sums is an estimate of the total due from the date of filing the garnishment. Interest continues to accrue until the principal amount is paid.

Wage Garnishment Example Assume your weekly disposable income is $640. This is the amount you take home after all necessary deductions have been made. Under Louisiana law, a judgment creditor can garnish up to 25% of $640, or the amount by which $640 exceeds $217.50, whichever is less.

A wage garnishment requires your employer to deduct a specified amount from your wages to pay your tax debt. Your employer must continue to deduct the specified amount from your net wages until the tax debt is paid.

However, filing for bankruptcy can provide an immediate stop to wage garnishment. This is due to an injunction known as the automatic stay, which comes into effect as soon as you file for bankruptcy. The automatic stay prohibits most creditors from continuing collection activities, including wage garnishment.