Limited Liability Company For Dummies

Description

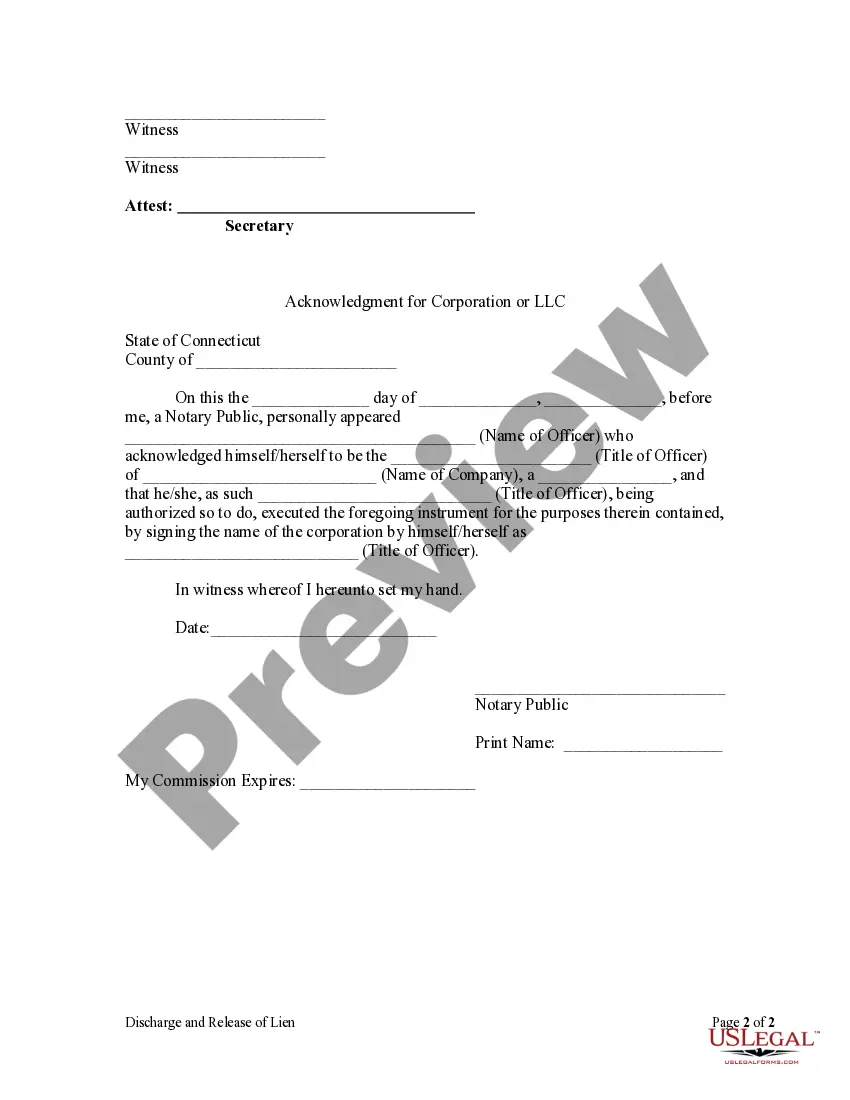

How to fill out Connecticut Discharge And Release Of Lien By Corporation Or LLC?

- If you're a returning user, simply log in to your account and click the Download button to get your required form template. Confirm that your subscription is still active; if not, renew it as needed.

- For first-time users, begin by checking the Preview mode and form descriptions. Make sure the forms you choose meet your requirements and align with your local jurisdiction's legal standards.

- If you need a different template, utilize the Search tab above to locate the right form. Once you find the suitable option, proceed to the next step.

- To purchase a document, click on the Buy Now button and select your desired subscription plan. You'll need to create an account for access to the extensive library.

- Finalize your purchase by entering your credit card information or using your PayPal account to complete the subscription payment.

- Once your purchase is successful, download the form to your device. You can also access it later in the My Forms section of your profile.

Using US Legal Forms allows you to benefit from an extensive collection of over 85,000 fillable legal forms, ensuring you can create precise and legally sound documents with ease.

Ready to streamline your LLC creation? Explore US Legal Forms today and empower your journey with the right legal support!

Form popularity

FAQ

Filling out an LLC involves completing specific forms provided by your state’s Secretary of State office. Start with the Articles of Organization, which requires information such as your business name, address, and the names of the owners. Each state has different requirements, so review the instructions carefully. If you want a seamless experience, uslegalforms offers tools to help you navigate the filing process.

An example of an LLC name could be 'Creative Solutions LLC', which not only describes the business but also indicates its legal structure. When selecting a name, ensure it is unique and not already in use by another business in your state. This helps establish your brand and protect your rights to the name. If you require assistance with naming, uslegalforms can provide support and resources.

Writing an LLC example involves choosing a business name and appending 'LLC'. For instance, if you select 'Coffee Corner', you write it as 'Coffee Corner LLC'. This clear designation helps potential customers recognize your business structure. If you want to see more examples, uslegalforms showcases various business names that effectively use LLC formatting.

In layman terms, an LLC, or limited liability company, is a business structure that protects owners from personal liability for the company’s debts. This means if the LLC incurs debt or is sued, your personal assets, like your home or car, are generally safe. It combines the benefits of a corporation and partnership, making it a popular choice for many. For further insights, uslegalforms can provide straightforward explanations.

To write an LLC example, think of a simple business name followed by 'LLC'. For instance, 'Tech Innovations LLC' is a clear and effective example. This format illustrates the limited liability company status while remaining professional. If you need more examples, uslegalforms offers a variety of names that comply with LLC regulations.

An LLC is properly written by placing 'LLC' after the full business name, without punctuation unless necessary for clarity. For example, if your business name is 'Green Gardens', you should write it as 'Green Gardens LLC.' This straightforward format signals your business's legal structure to customers and partners alike. If you’re unsure, uslegalforms provides templates for clarity.

To write LLC correctly, start by using the abbreviation 'LLC' after your business name. This indicates that your business is a limited liability company, which offers protection against personal liability. Ensure you follow state-specific regulations, as some states may have additional requirements for naming or formatting. For more guidance, you may find resources on uslegalforms helpful.

Yes, you can file paperwork to create your LLC on your own, often referred to as filing by yourself. This process involves submitting the Articles of Organization to your state’s business department and paying the required fees. Many individuals benefit from using resources that break down these steps for limited liability companies for dummies, making the process manageable and straightforward.

Failing to file taxes for your LLC can lead to serious consequences, including penalties and interest on unpaid taxes. Depending on your state's requirements, your LLC may ultimately lose its legal standing or face additional fines for non-compliance. Staying informed about your tax obligations is crucial for maintaining the benefits of limited liability, so seeking assistance catered to limited liability companies for dummies can be a smart choice.

Yes, you can file your LLC separately, especially if you choose to establish it as a corporation for tax purposes. When forming an LLC, make sure to follow your state's specific guidelines for filing business documents to register it as a separate legal entity. This separation provides limited liability protection, safeguarding your personal assets. For a clearer understanding of how to file separately as a limited liability company for dummies, consider utilizing educational materials crafted for new business owners.