Release Of Lien Form Connecticut With Title

Description

How to fill out Connecticut Discharge And Release Of Lien By Individual?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may entail extensive research and substantial expenses.

If you’re seeking a more simple and economical method of preparing the Release Of Lien Form Connecticut With Title or any other documents without the hassle of unnecessary obstacles, US Legal Forms is readily available to assist you.

Our online collection of over 85,000 current legal forms addresses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can promptly acquire state- and county-compliant templates meticulously crafted for you by our legal experts.

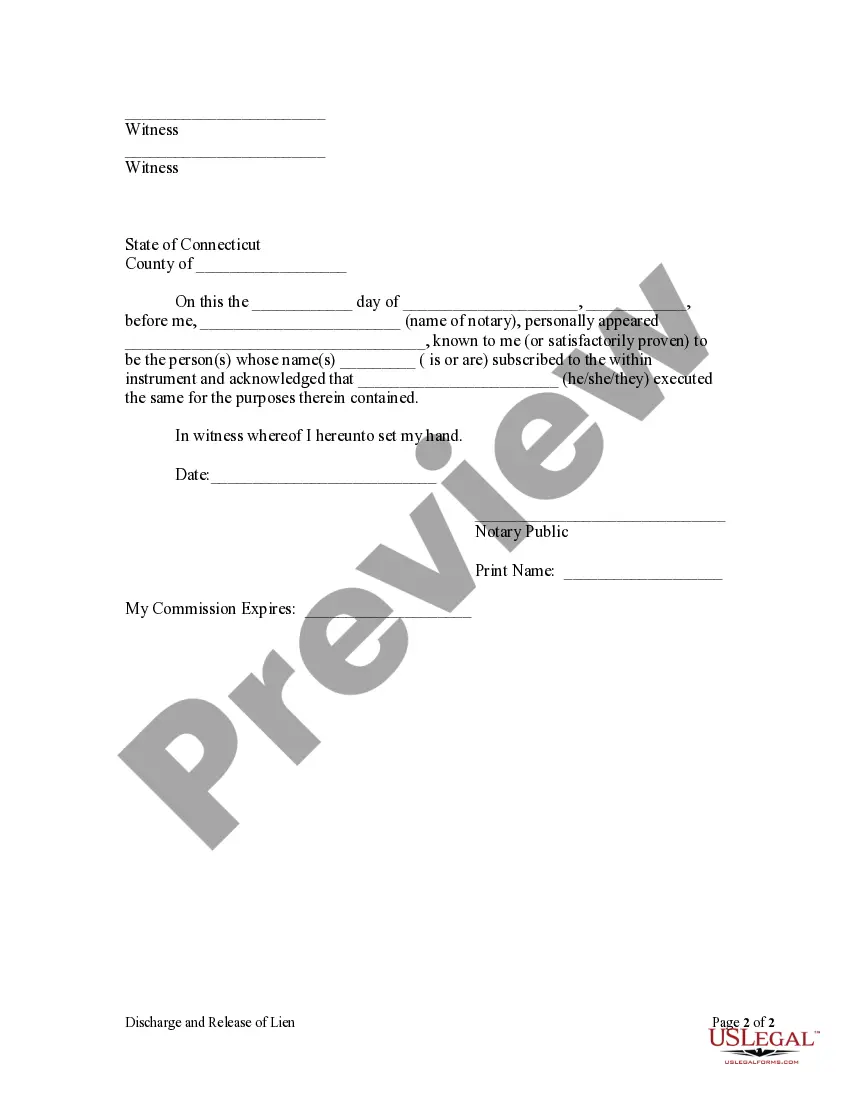

Verify the document preview and descriptions to ensure you are on the correct form.

Ensure that the template you select adheres to the regulations of your state and county.

Select the appropriate subscription plan to obtain the Release Of Lien Form Connecticut With Title.

Download the form, then fill it out, verify, and print it.

US Legal Forms boasts a strong reputation and over 25 years of expertise. Join us today and transform form completion into a straightforward and efficient process!

- Utilize our platform whenever you require a dependable and trustworthy service to swiftly find and download the Release Of Lien Form Connecticut With Title.

- If you’re familiar with our services and have already registered an account with us, simply Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Don't have an account? No problem. Setting it up and browsing through the catalog takes minimal time.

- Before directly proceeding to download the Release Of Lien Form Connecticut With Title, consider these suggestions.

Form popularity

FAQ

§ 13-52-102(a). A judgment lien expires twenty years after the judgment was rendered, unless the party claiming the lien commences an action to foreclose. Conn.

Removing a CT Car Title Lien Once your car loan agreement is fulfilled, you do not have to apply for a new title. The Connecticut Department of Motor Vehicles requires the lienholder to sign off on the title and send it to you, and/or provide you with a lien release letter on the their letterhead attached to the title.

Title services If your loan has been satisfied, you don't need to request a new certificate of title removing the previous lienholder. You may retain the stamped paid certificate of title from your lienholder. This title can be used for the future sale or transfer of the vehicle.

Back of the title - sign name(s) in the box where it reads "Signature(s) of Seller(s)." Back of the title right next to where you signed your name(s) - print name(s) where it reads "Printed Name(s) of Seller(s)."

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.