Release Of Lien Form Connecticut With Notary

Description

How to fill out Connecticut Discharge And Release Of Lien By Individual?

Managing legal documentation and procedures can be a lengthy addition to your schedule.

Release Of Lien Form Connecticut With Notary and similar documents frequently necessitate that you locate them and grasp how to fill them out correctly.

Consequently, whether you are addressing financial, legal, or personal issues, having a comprehensive and straightforward online database of forms readily available will be highly beneficial.

US Legal Forms is the premier online source for legal templates, offering over 85,000 state-specific documents and various resources to help you complete your forms with ease.

- Browse the collection of applicable documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific documents available at all times for download.

- Safeguard your document management processes with a high-quality service that allows you to create any form in minutes without additional or hidden fees.

- Simply Log In to your account, search for Release Of Lien Form Connecticut With Notary, and download it instantly under the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

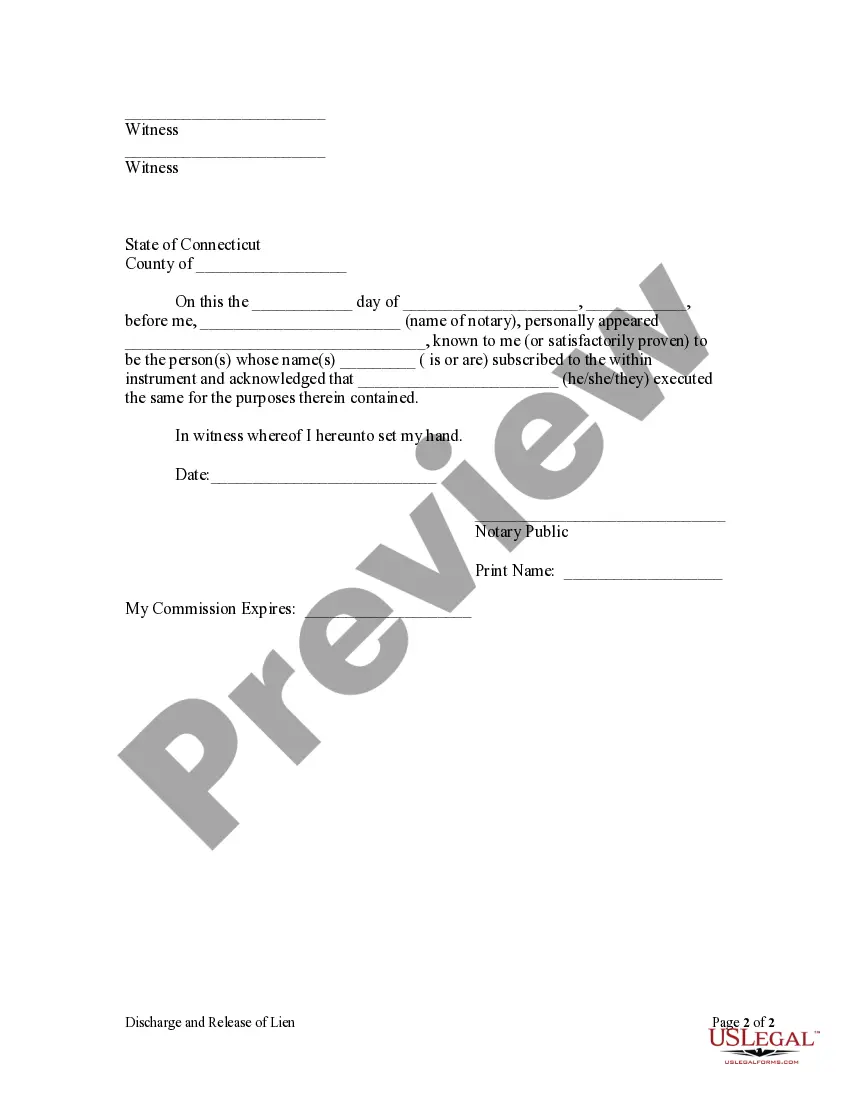

4 steps to file a mechanics lien in Connecticut Prepare the lien form. First, make sure you are using a lien form that meets the statutory requirements in Connecticut. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.

Release details: Provide a statement confirming that the borrower has fully repaid the debt and that the lienholder is relinquishing their legal claim on the property or asset. Include the date when the borrower paid off the debt.

Under Connecticut law, a mechanic's lien becomes valid when recorded on a town's land records within 90 days after the work is done or materials furnished, and remains valid for one year, unless the claimant takes legal action to foreclose the lien on the property.

Pursuant to subsection (a), "Whenever any mechanic's lien has been placed upon any real estate pursuant to sections 49-33, 49-34 and 49-35, the owner of that real estate, or any person interested in it may make an application to any judge of the Superior Court that the lien be dissolved upon the substitution of a ...