Lien Release Letter For Vehicle

Description

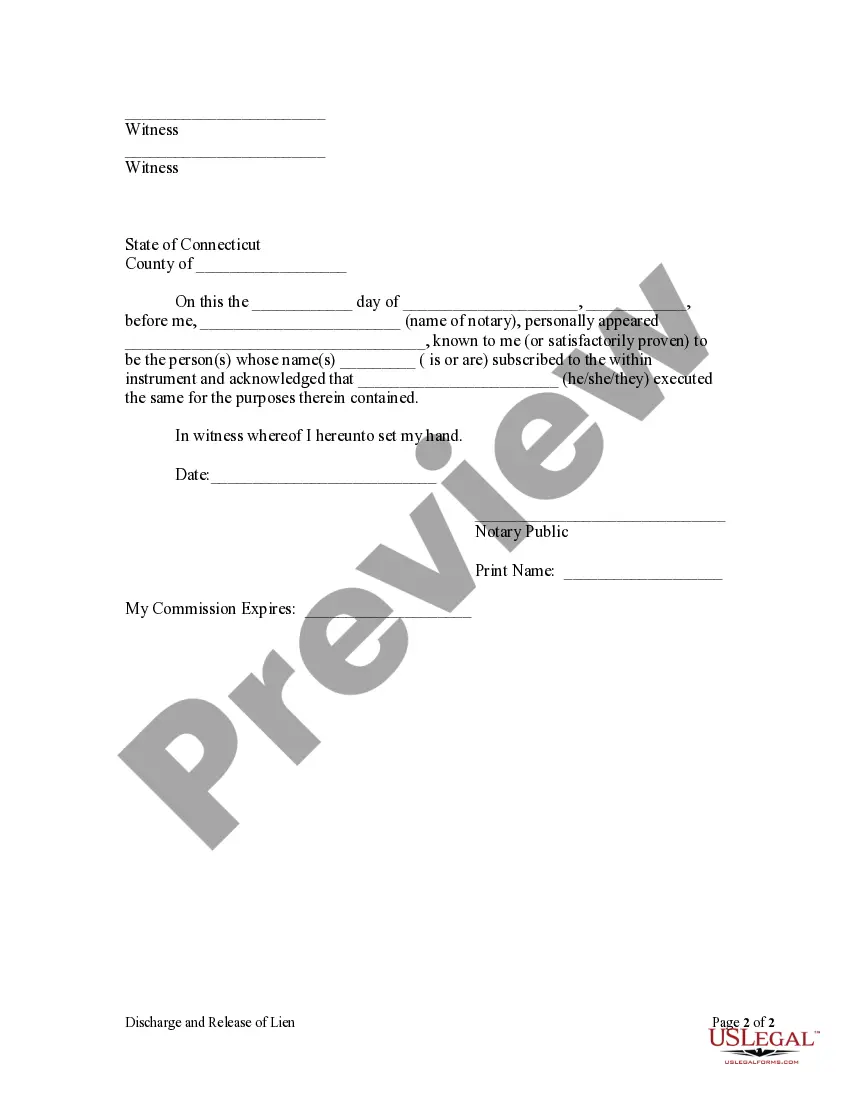

How to fill out Connecticut Discharge And Release Of Lien By Individual?

- If you’re an existing user, log into your account and download the lien release letter template to your device by clicking the Download button. Ensure your subscription is active; if not, renew it according to your plan.

- For first-time users, start by checking the Preview mode and the form description. Make sure you select the lien release letter that fits your requirements and complies with local jurisdiction.

- If the form does not meet your needs, utilize the Search tab to find a more suitable template.

- Once you find the correct form, click the Buy Now button and select a subscription plan. Create an account to access the library.

- Proceed to purchase by entering your payment details via credit card or PayPal.

- Download your lien release letter and save it on your device. You can access it anytime in the My Forms section of your profile.

US Legal Forms offers an extensive library with over 85,000 editable legal documents, empowering both individuals and attorneys. With a robust collection that exceeds competitors, users can easily create legally sound documents with expert assistance.

Don't let legal paperwork overwhelm you; take control today by accessing US Legal Forms for your lien release letter needs.

Form popularity

FAQ

Selling a car without a lien release letter can lead to complications. Buyers typically want assurance that no outstanding claims exist on the vehicle. Thus, it is crucial to obtain a lien release letter for vehicle before attempting to sell your car, as it protects both you as the seller and the buyer during the transaction.

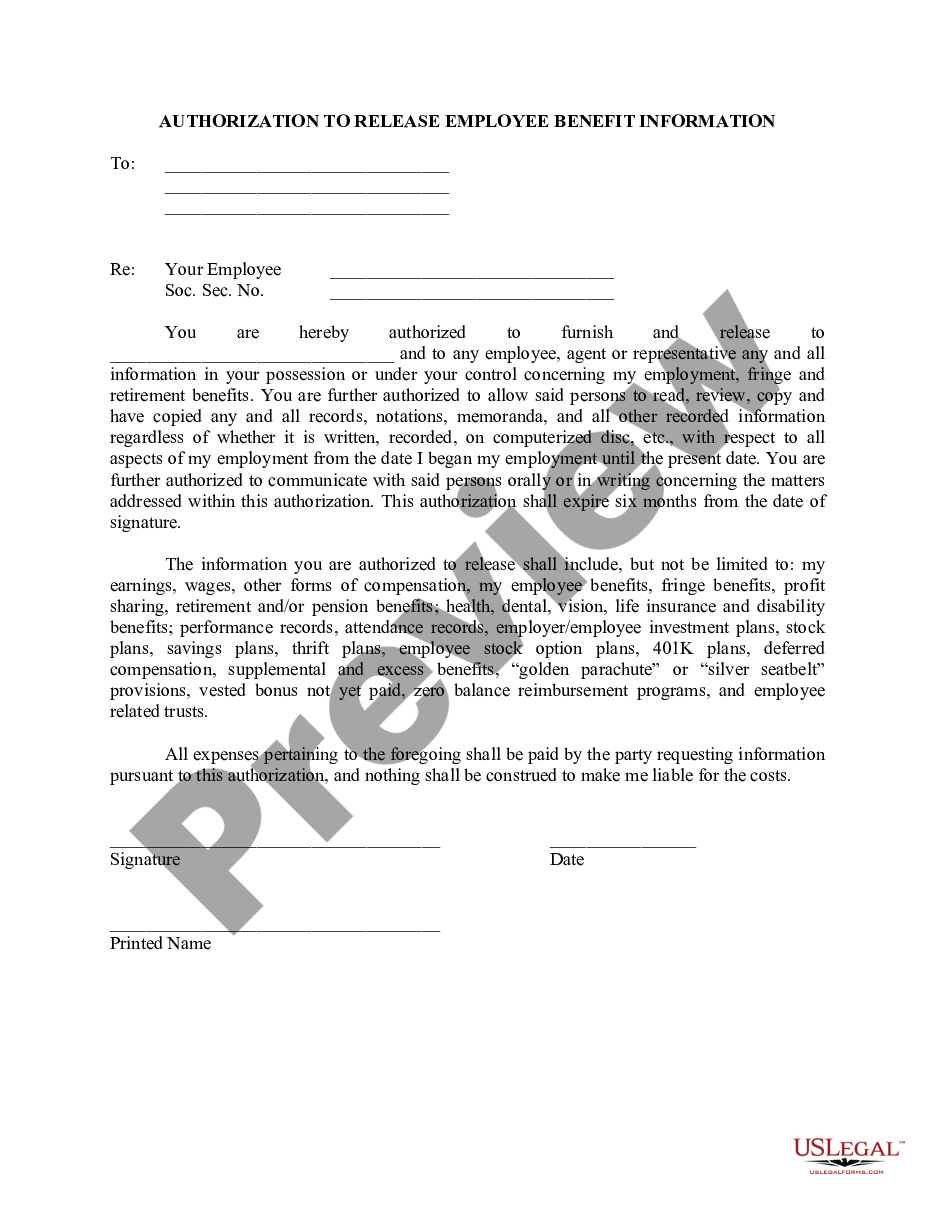

Writing a lien release letter involves clearly stating your intentions to release the claim on the vehicle. Start with the date, your contact details, and the details of the vehicle, including the VIN. Then, notify the recipient that you are releasing the lien and ensure you include both signatures where appropriate. If you need assistance, uslegalforms provides templates that can guide you through the process efficiently.

To complete a lien release, you start by obtaining a lien release letter from your lender. This letter must include key details such as your name, the vehicle identification number, and the lender's information. Once you have the letter, you can sign it and submit it to your local DMV along with the necessary forms. By doing this, you officially clear any claims against your vehicle.

To obtain a release of lien for a vehicle, start by contacting the lender that holds the lien. Request the lien release letter for your vehicle directly from them. Once the lender confirms that the debt is satisfied, they will provide you with the necessary documentation. You can then submit this letter to your state's Department of Motor Vehicles to update the title and ensure that the lien is removed from your vehicle records.

When a lien is released, you receive a lien release letter for the vehicle, confirming that the lender no longer has any claim on it. This allows you to sell, transfer, or modify the vehicle without any restrictions imposed by the lien. Keep this letter safe, as you may need it for future transactions.

To get your lien release letter, contact the lender that holds the lien on your vehicle. They will provide specific steps to request the letter, which may include verifying your identity. Once you meet their requirements, they will issue the lien release letter, freeing you from any obligation.

The speed at which you can obtain a lien release letter for vehicle depends on the lender. Many lenders process requests quickly, sometimes within a few days, while others may take longer. Always check with your lender for their specific processing times.

A release of lien is not the same as a title. The lien release letter for vehicle signifies that a lender has relinquished their claim on the vehicle, while the title is the document proving ownership. You must have both to sell or transfer the vehicle without issues.

To obtain a lien release letter for vehicle from the IRS, you need to file Form 10916-C. This form allows you to request a lien release if the IRS has placed a lien on your vehicle due to tax debt. After your request is processed, the IRS will send you the lien release letter, confirming that you are no longer responsible for the debt.