Ct Attorney Connecticut Withholding Code

Description

How to fill out Connecticut Durable Springing Power Of Attorney?

Legal administration can be daunting, even for seasoned professionals.

When you are searching for a Ct Attorney Connecticut Withholding Code and do not have the opportunity to spend time looking for the correct and updated version, the processes can be overwhelming.

With US Legal Forms, you can.

Access a comprehensive resource base of articles, guidelines, manuals, and materials pertinent to your situation and requirements.

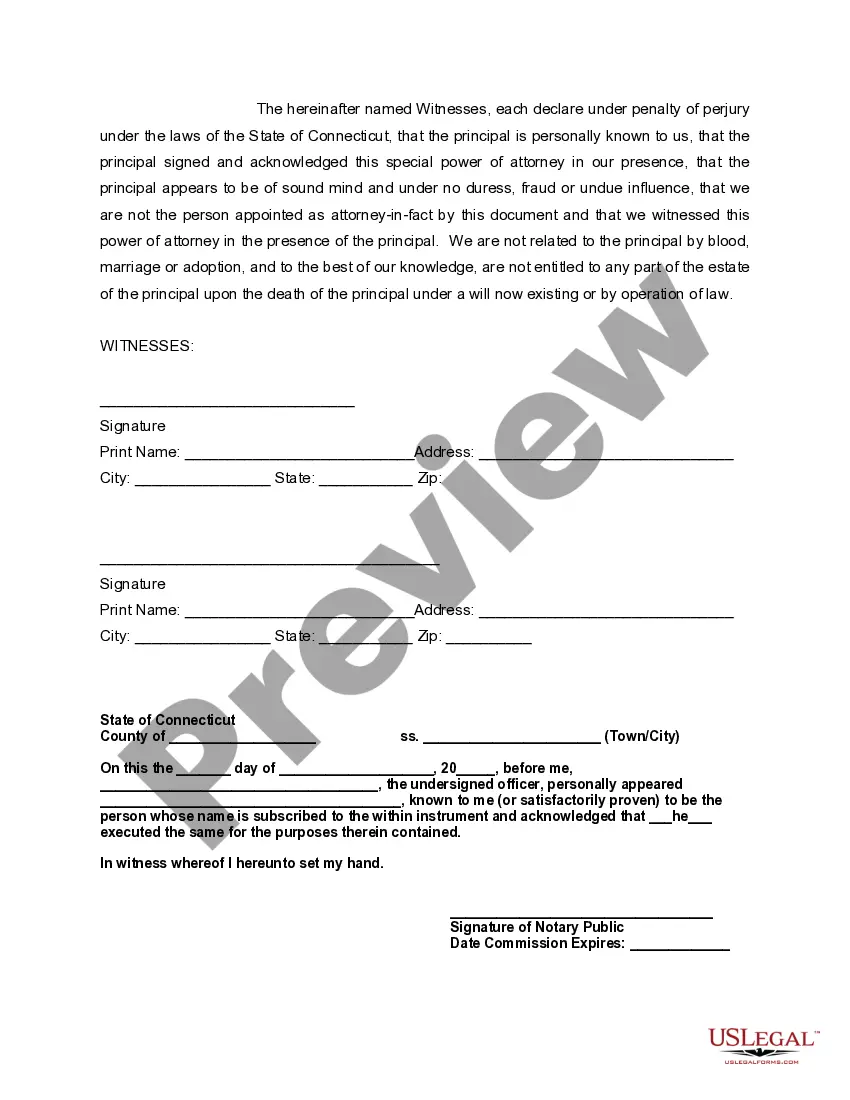

Confirm it is the appropriate form by previewing it and examining its details.

- Conserve time and effort searching for the documents you require, and make use of the US Legal Forms’ sophisticated search and Review tool to locate the Ct Attorney Connecticut Withholding Code and acquire it.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Visit the My documents tab to review the documents you have previously saved and manage your files as desired.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all advantages of the platform.

- Here are the steps to follow after downloading the form you desire.

- Implement an effective web form library for anyone wishing to manage these situations efficiently.

- US Legal Forms is a frontrunner in online legal documents, with over 85,000 state-specific legal forms accessible at any time.

- Utilize advanced tools to complete and manage your Ct Attorney Connecticut Withholding Code.

Form popularity

FAQ

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year. See Employees Claiming Exemption on Page 10.

To increase income tax deductions, the employee must fill out revised TD1 forms. Learn more: Get the completed TD1 forms from the individual.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

Either enter Withholding Code "E" on Line 1 which will result in $0 withholding; or enter Withholding Code ?E? on Line 1 and a dollar amount on Line 2 for a specific amount to be withheld. If neither of these options are indicated, your payer will withhold at 6.99%.