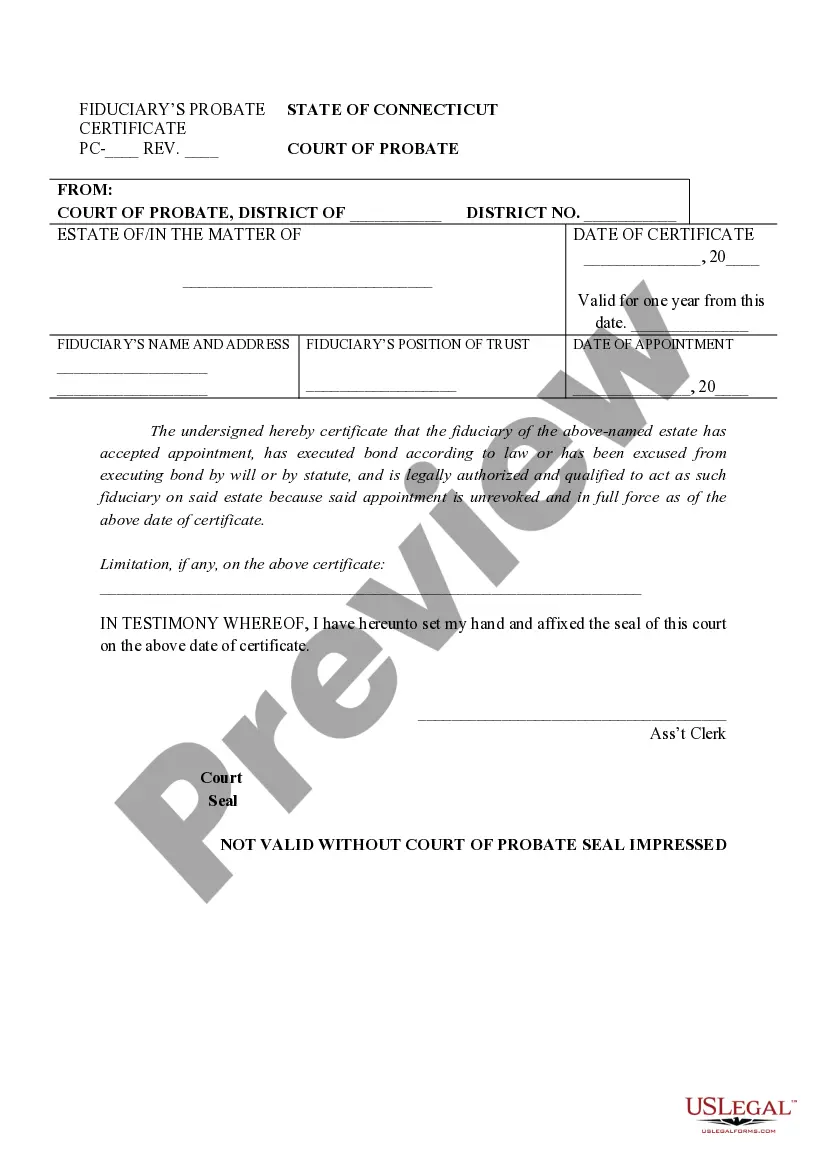

Fiduciary Probate Certificate Format

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

Managing legal documents can be perplexing, even for the most seasoned professionals.

If you are in search of a Fiduciary Probate Certificate Template and do not have the time to spend looking for the correct and updated version, the process can be stressful.

Employ cutting-edge tools to fill out and manage your Fiduciary Probate Certificate Template.

Access a valuable knowledge base filled with articles, guides, and resources pertinent to your situation and requirements.

Ensure that the template is accepted in your region. Choose Buy Now when you are ready. Select a subscription option. Choose the format you require, and Download, fill out, sign, print, and send your document. Experience the US Legal Forms online library, backed by 25 years of expertise and reliability. Elevate your daily document management to a seamless and user-friendly experience today.

- Save time and effort by avoiding tedious searches for the forms you require, and use US Legal Forms’ sophisticated search and Review feature to locate the Fiduciary Probate Certificate Template and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and obtain it.

- Check your My documents tab to view the documents you have previously saved and to organize your folders as needed.

- If this is your first visit to US Legal Forms, sign up for an account to gain unlimited access to all the platform's benefits.

- Here are the instructions to follow after obtaining the form you require: Validate that it is the correct form by previewing it and reviewing its details.

- Utilize a comprehensive online form repository that could revolutionize how individuals approach these matters efficiently.

- US Legal Forms stands out as a leading provider of web-based legal forms, boasting over 85,000 state-specific legal templates accessible to you at any time.

- Access state or county-specific legal and business forms, as US Legal Forms caters to all your requirements, ranging from personal to corporate documents in one centralized location.

Form popularity

FAQ

If the personal administrator decides to pay creditors from an insolvent estate, they must do so in the following order. Secured creditors. Reasonable funeral, administration and testamentary expenses. Testamentary expenses can include things like probate fees and solicitor fees.

Every state sets the priority ing to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.

The Closing Certificate for Fiduciaries is the document that is used by the department to inform the court that all tax returns have been filed and all taxes paid. The Closing Certificate may be issued in the year prior to the final year of the trust to expedite the closing of the trust.

This inventory must include all of the decedent's (i) personal estate under your supervision and control, (ii) interest in any multiple party account (which is defined in Part 2) in any financial institution, (iii) real estate over which you have a power of sale, and (iv) other real estate that is an asset of the ...

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.