Fiduciary Probate Certificate Ct With Contrast

Description

How to fill out Connecticut Fiduciary's Probate Certificate?

Finding a reliable location to access the latest and suitable legal templates is half the battle of navigating through bureaucracy.

Identifying the correct legal paperwork requires accuracy and careful attention, which is why it is vital to obtain samples of Fiduciary Probate Certificate Ct With Contrast solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong your situation.

Remove the hassle associated with your legal documentation. Explore the comprehensive US Legal Forms library where you can discover legal templates, verify their relevance to your situation, and download them immediately.

- Use the library navigation or search bar to find your sample.

- Examine the form’s description to verify if it meets the requirements of your state and locality.

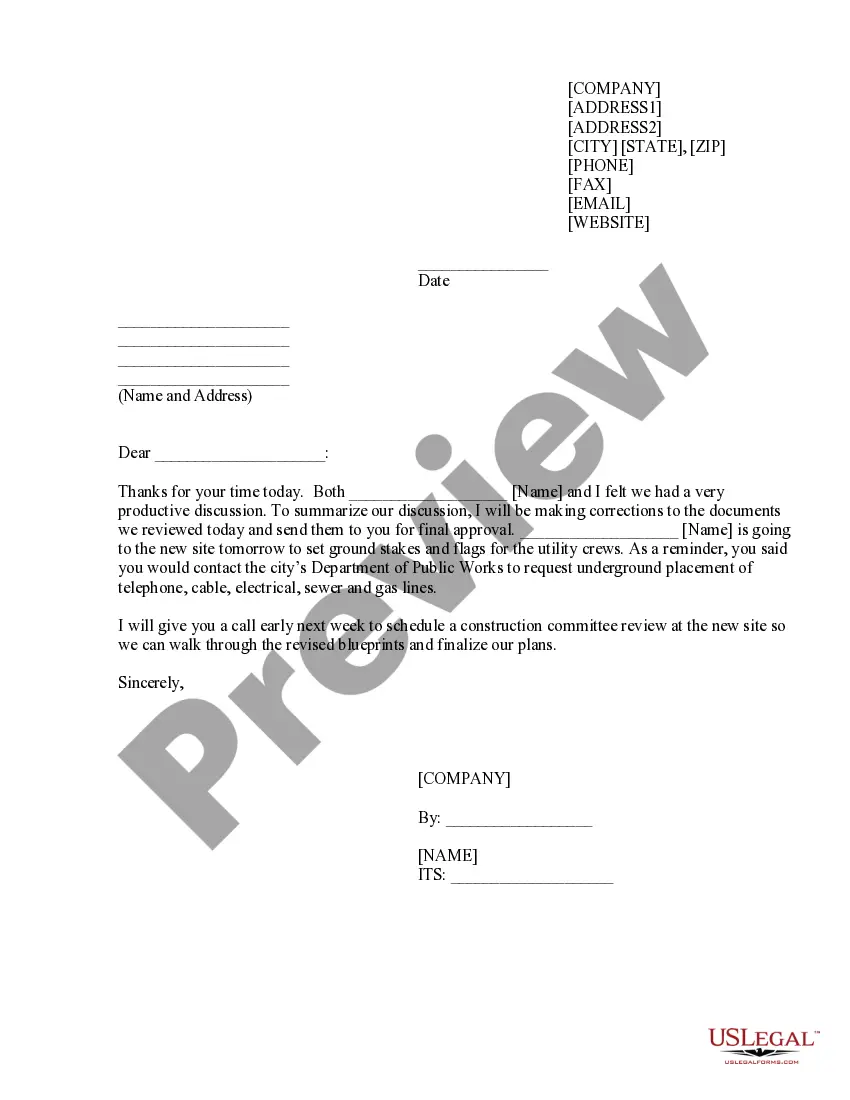

- Check the form preview, if available, to ensure the template is what you need.

- If the Fiduciary Probate Certificate Ct With Contrast does not suit your requirements, continue searching for the correct document.

- Once you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you haven’t created an account yet, click Buy now to acquire the template.

- Choose the pricing plan that suits your needs.

- Go through the registration process to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading the Fiduciary Probate Certificate Ct With Contrast.

- After obtaining the form on your device, you can edit it with the editor or print it out and complete it manually.

Form popularity

FAQ

It is only necessary to notarize the bill of sale, invoice, or title. However, if a trade vehicle is listed on the bill of sale, it must be notarized. If a tax credit is shown on an invoice, the invoice must be notarized. Exception: If the state is a non-notary state, then the invoice is not required to be notarized.

When you gift or donate your vehicle to a friend or family member, we can assist you with this type of transfer. An act of donation is an authentic act executed before a notary, and both buyer and seller need to be present in front of two witnesses (all parties must have valid identification).

A bill of sale serves as legally-binding evidence a transaction in which the vehicle's ownership changed from one party to another took place. New owners must show proof of purchase upon transferring the vehicle's title and when registering it under their name at the Office of Motor Vehicles (OMV).

That might get you to wonder if a handwritten bill of sale is legally binding. Handwritten bills of sale are indeed contractual agreements ? so long as they have the right elements.

The following details will need to be entered into the bill of sale on the day of signing and notarization: Parish Name. Seller's Name. Buyer's Name. Make. Model. Year. VIN (Vehicle Identification Number) Sale Price.

While it is common to present a bill of sale in a digital format, you can also create this type of contractual agreement as a handwritten document on paper. What's most important is to include all of the pertinent details in the bill of sale in order to protect both parties.

It is only necessary to notarize the bill of sale, invoice, or title. However, if a trade vehicle is listed on the bill of sale, it must be notarized. If a tax credit is shown on an invoice, the invoice must be notarized. Exception: If the state is a non-notary state, then the invoice is not required to be notarized.