Power Attorney

Description

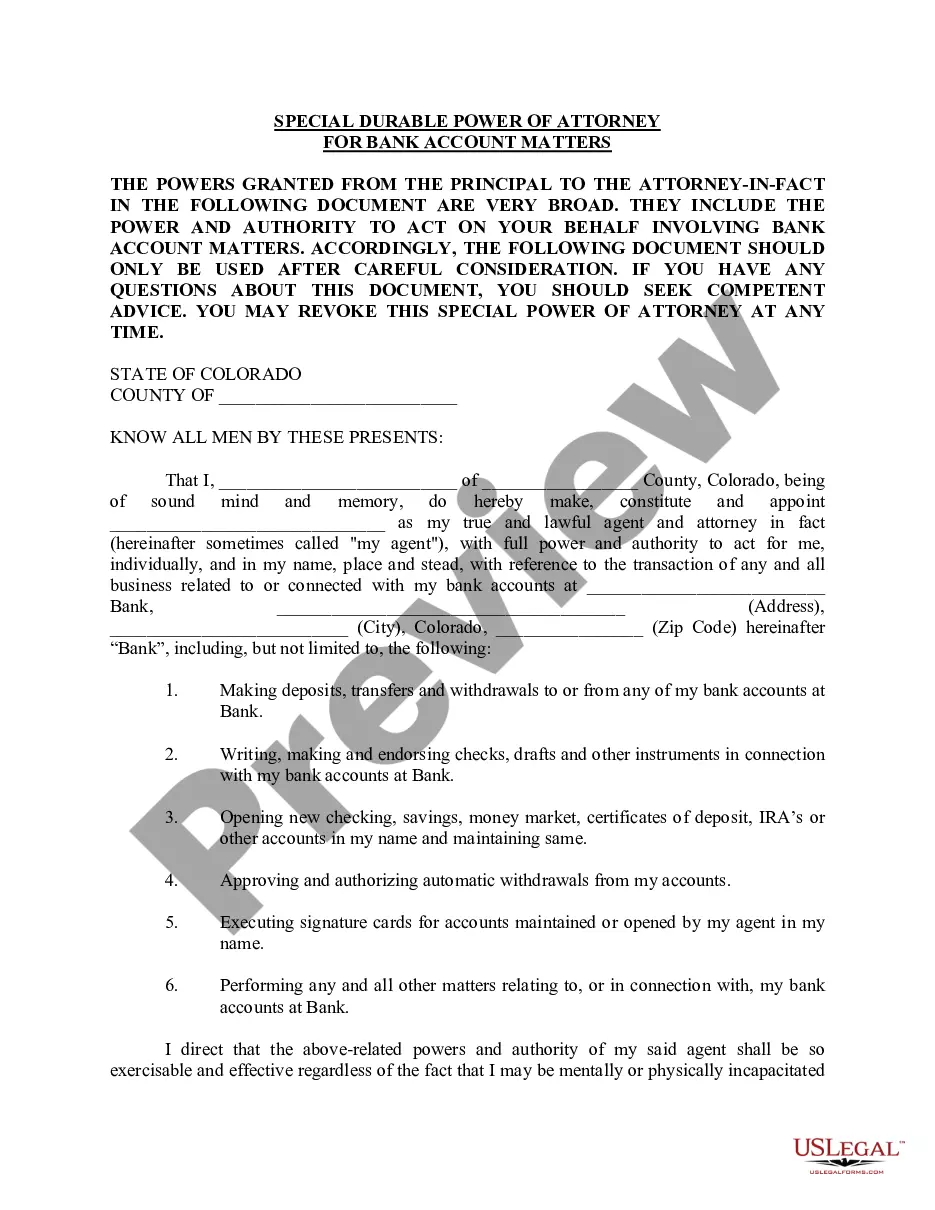

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

- Log into your US Legal Forms account. If you’re a new user, create an account to access our resources.

- Preview the power attorney form description to ensure it meets your specific requirements and adheres to your jurisdiction’s laws.

- If the chosen template isn’t suitable, utilize the Search feature to find a more appropriate document.

- Select the required document and click on the 'Buy Now' button to pick a subscription plan that fits your needs.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download your completed form to your device and access it anytime from the 'My Forms' section in your profile.

In conclusion, utilizing US Legal Forms can save you time and ensure that your power attorney documents are accurate and legally sound. With access to over 85,000 forms and premium expert assistance, you can proceed with confidence.

Explore US Legal Forms today and take the first step towards managing your legal needs effortlessly!

Form popularity

FAQ

In New Jersey, a power of attorney must be in writing and signed by you in the presence of a notary public. You also need to designate an agent who will act on your behalf. It is important to keep in mind that this document needs to clearly outline the powers granted to your agent. US Legal Forms offers comprehensive resources to guide you through the requirements in New Jersey.

To create a power of attorney in Michigan, you must have a written document that names an agent to act on your behalf. This document must be signed by you and a witness, who also needs to sign the document. Additionally, a notary public must acknowledge your signature. Using US Legal Forms can simplify this process by providing easy-to-fill templates specifically for Michigan.

To file a power of attorney with the IRS, you need to complete Form 2848, which allows you to designate an agent to act on your behalf. Ensure that all required information is accurate and complete to avoid delays. After signing and dating the form, you can submit it to the relevant IRS office or through the agent you’ve authorized. Having a power attorney for tax matters can help you navigate complex issues with confidence.

The key requirements for a power of attorney in Maryland include being at least 18 years old, mentally competent, and having your document properly executed. This means you must sign the power attorney in front of a notary and have it witnessed. Furthermore, clearly specifying the powers granted ensures that your agent can act effectively. By having a clearly defined power attorney, you minimize ambiguity and enhance your agent's effectiveness.

To create a valid power of attorney in Maryland, the document must be signed by you, the principal, and a witness. Additionally, the power attorney document should be notarized to ensure legal validity. If you want to grant comprehensive authority, it is wise to clearly outline the powers you are giving. A well-structured power attorney can safeguard your interests in various situations.

In Maryland, if there is no power of attorney in place, medical decisions fall to the closest relative, typically a spouse or adult child. These family members may have to make tough choices regarding treatment and care. Without a power attorney, it can lead to disputes among relatives, creating additional stress during difficult times. To ensure your preferences are respected, consider establishing a power attorney who can advocate for your health care wishes.

In South Carolina, the requirements for a POA include being at least 18 years old and having the mental capacity to understand the authority being granted. The document must be in writing and signed by the principal in front of a notary public. It's important to ensure that your POA complies with local laws, and platforms like USLegalForms can provide templates and guidance.

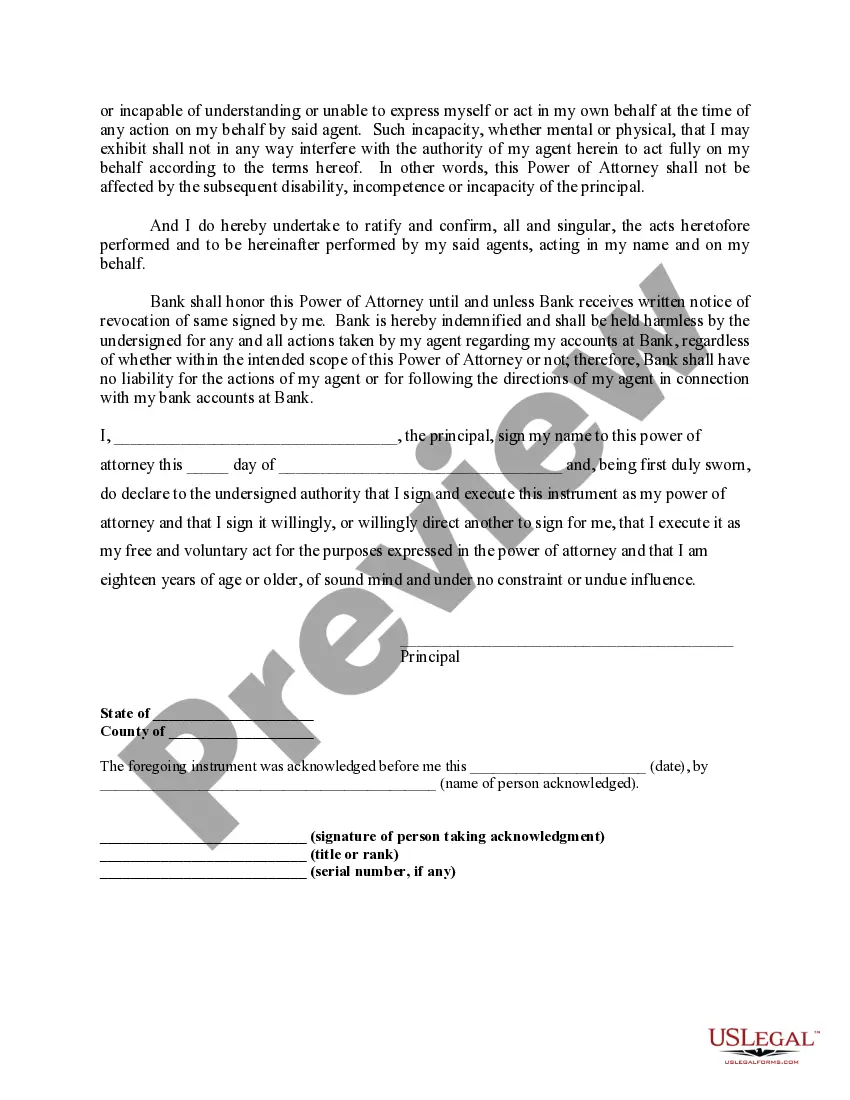

Filling out a POA form requires identifying the principal and the agent clearly. Ensure each section is completed, including powers granted, duration of authority, and any specific limitations. Once completed, both parties must sign the document in the presence of a notary or witness, depending on state requirements to ensure its validity.

An example of signing as power of attorney would be: If the principal's name is John Smith, you would write 'John Smith, by Your Name, Power of Attorney.' This format clearly communicates that you are signing on behalf of John Smith. Always remember to maintain consistency in your signature style.

Filling out a POA check involves writing the date, the name of the payee, and the amount clearly on the front of the check. In the signature line, sign your name followed by 'Power of Attorney for Principal's Name.' Ensure the information matches what is on the POA document to avoid any possible complications with the bank.